The Sensex ended the day at 83,184, up 0.3 per cent and 589 points from the day’s high. | Photo Credit: FRANCIS MASCARENHAS

Indian capital and equity markets were largely unaffected on Thursday following a half-point rate cut by the US Federal Reserve, the first in over four years. Equities, gold and bond prices rose only marginally as investors had already priced in the rate cut. This is in contrast to the global financial markets which saw stocks and gold hitting new highs.

MSCI’s 47-country world stocks index closed to a record high while Europe’s main bourses were all more than 1 per cent stronger. In Asia overnight, the bulls drove Japan’s Nikkei up 2.1 per cent and stock markets in Australia and Indonesia to record highs.

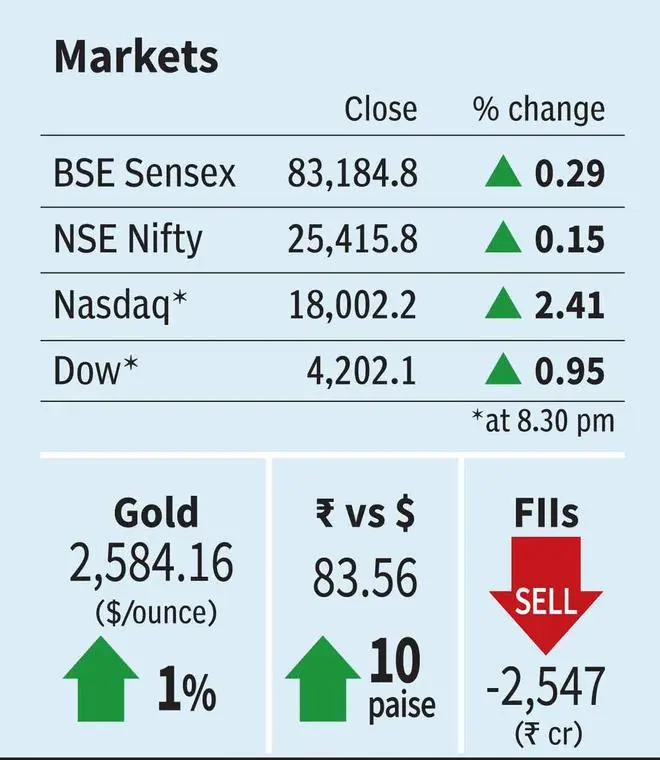

India’s benchmark equity indices retreated after making record highs in early trade. Yields of 10-year government securities softened and the rupee rose to a two-month high against the dollar in response to the cut. The Sensex ended the day at 83,184, up 0.3 per cent and 589 points from the day’s high. The Nifty settled at 25,415, up 0.2 per cent.

The rate cut by the US Fed would have a “relatively muted impact” on India even as it would be positive on the emerging economies, V Anantha Nageswaran, Chief Economic Advisor, said on Thursday. “For India, the stock markets are already attracting lot of investor interest, and it has been so for the last several years whether it is foreign or domestic or both. At the margin, impact will be relatively limited as it was not something that was being waited for this to happen,” Nageswaran said at an industry event.

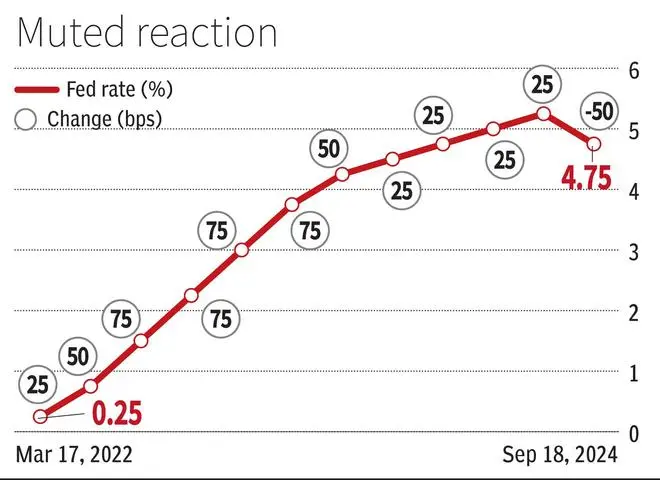

The Fed lowered the federal funds rate by 50 bps on Wednesday bringing it to a range of 4.75 per cent to 5 per cent, in a long-anticipated pivot, and paving the way for two additional 25 bps rate cuts this year. The US Fed Chairman Jerome Powell, however, cautioned that the Fed may not go back to the ultra-low interest rates of 2008-2022. The Bank of England held rates steady on Thursday, taking a more cautious approach.

According to experts, RBI may disassociate from the interest rate developments in the US and may take an independent view on the domestic rates based on evolving conditions. “RBI looks more set to depart from the ’Follow the Fed’ mentality for good, having created a robust and resilient Indian financial ecosystem, fueled largely by domestic demand-supply metrics,” said Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India.

Foreign portfolio investors sold shares worth ₹2,547 crore on Thursday, while domestic institutions bought shares worth Rs 2,013 crore.

Vinod Nair, Head of Research, Geojit Financial Services, said: “The substantial rate cut sparked concerns over a global slowdown, resulting in profit booking in mid and smallcap trading at premium valuation. Meanwhile, domestic heavyweight sectors like banking and FMCG saw buying interest, driven by foreign inflows and the RBI’s monetary easing expected in October.”

The yield of the benchmark 10-year G-Sec softened about 2 basis points to close at 6.76 per cent, with its price rising about 14 paise to close at ₹102.37. The rupee closed about 10 paise stronger at 83.66 versus the dollar against the previous close of 83.76.

Gold prices gained marginally to ₹73,485 per 10 grams on Thursday against ₹73,257 the previous day.

Colin Shah, MD, Kama Jewelry, said the US Fed rate cut has opened the doors for gold to scale new highs shortly, reinstating the might of the yellow metal as an investment haven.

"Domestically, while there may be some slowdown in demand for a brief period due to the shradh (inauspicious occasion to buy gold), the demand will remain upbeat for the remainder of the festive period with a 10-15 per cent rise in demand as compared to last year," he said.

Gold prices could scale to $2650 an ounce globally and hit ₹78,000 back home, he added.

Published on September 19, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.