After having plunged over 30 per cent since hitting a new high on March 4, copper prices are expected to rule lower for the rest of the year though supply woes are likely to prevent any sharp fall.

“...persistent supply issues in Latin America will prevent prices falling much further, and we expect copper to remain elevated by historical standards, averaging around $7,500/tonne over Q422 (fourth quarter),” said research agency Fitch Solutions Country Risk and Industry Research, a unit of the Fitch Group.

ING Think, the economic and financial analysis wing of Dutch multinational financial services firm ING, however, said Chinese copper smelters are reported to have increased the floor price for treatment charges to $$93/tonne for copper refining in the fourth quarter compared with around$80/t for the current quarter.

It reflected higher demand for Chinese smelting capacity as power shortages in Western markets impact smelting and refining capacity in these regions, said Warren Patterson, Head of Commodities Strategy, ING Think and Ewa Manthey, its commodity strategist.

Copper prices had soared to a record 10,674 a tonne in March, soon after the Ukraine war broke out. Since then, it has been on a southward journey closing at $7,400 a tonne for the three-month contract on the London Metal Exchange (LME).

Copper for cash on the LME is quoted at $7,475. The price of the red metal is down 22 per cent year-on-year and over 9 per cent month-on-month.

According to analysts, aggressive monetary tightening around the world has stoked fears of a global recession and dampened the demand for metals, in general.

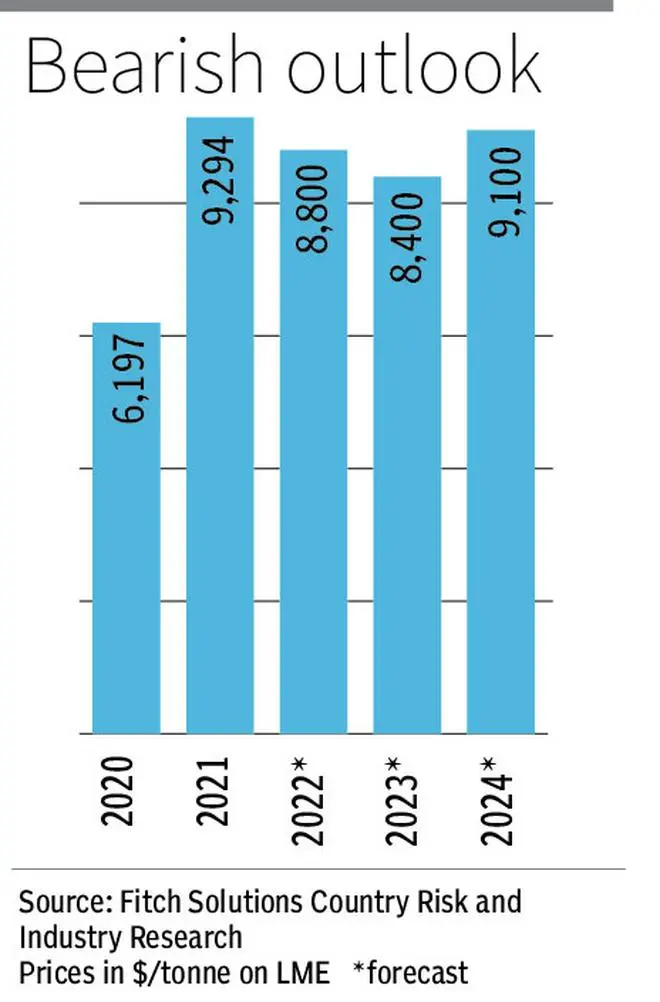

Fitch Solutions said it was lowering its copper price forecast for 2022 to $8,800 a tonne from its earlier projection of $9,470 due to weakening investor sentiment and falling demand (in light of slower global growth) putting “downward pressure” on prices.

The research agency said it was forecasting a slight production surplus in 2022, though the market will tip back into deficit in 2023 with demand increasing. “The deficit will grow out towards the middle of the decade as demand accelerates, mainly driven by consumption related to the green transition,” it said.

For 2023, Fitch Solutions projected copper price at $8,400, down from its earlier prediction of $9,580.

ING Think pointed to China taking advantage of the situation with its copper concentrate imports increasing by 9 per cent so far this year, while imports in August hit a new monthly high of 2.3 million tonnes, up 20 per cent year-on-year.

Jayanta Roy, Senior Vice-President and Group Head, Corporate Sector Ratings, ICRA, said copper supply was hit in the second quarter this year due to prolonged protests in large mines of Peru. “Therefore, we expect metal prices to remain range-bound in the coming quarters,” he said, adding heightened fears of weakening global demand will limit upward movement in the near term.

Commodity Participants Association of India (CPAI) national president Narinder Wadhwa said more than the recession, “it is the fear of recession that lowers the sentiments and also prices of commodities”.

“The fear is at elevated levels. This may depress the new investment and demand in many parts of the globe,” he said.

Fitch Solutions said competing supply and demand factors have caused considerable volatility in 2022 so far. “After being driven to an all-time high of $10,674/tonne on March 4 2022 by concerns about supply disruptions after Russia’s invasion of Ukraine, copper prices began to fall sharply in late-April 2022 as the global macroeconomic picture worsened and concerns grew about future demand from Mainland China, in particular,” it said.

In addition, a stronger dollar has capped demand for the commodity which is traded in the currency internationally.

“While the demand outlook continues to be bleak, prices have since stabilised to some extent from early August 2022. Greater supply disruptions, mainly in Latin America, have provided support to prices. We expect this dynamic to play out broadly over Q422, with prices largely trading sideways,” the research agency said.

Prices would average around $7,500 as some supply issues are expected to ease, Fitch Solutions said.

It forecast global copper consumption growth to fall a tad by 0.7 per cent in 2022, “amid a worsening macroeconomic outlook, lower industrial production in China and high levels of global inflation”.

Referring to the Indian situation, Wadhwa said though metals are expected to be volatile with a bias towards softening, India being on the cusp of an infrastructure revolution will support demand for commodities, mainly metals.

He said India is looking to improve its infrastructure through the Gati Shakti National plan and schemes such as Bharatmala, Sagarmala, inland water transport, dry/ land ports and UDAN.

Published on September 28, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.