Kishore Narne, Head - Commodities and Currency, Motilal Oswal Financial Services

The commodities derivatives market in India has begun to gather momentum on the back of options contracts, particularly due to the success in crude oil and natural gas, says Kishore Narne, Head - Commodities and Currency, Motilal Oswal Financial Services (MOFS).

“The recent success in options contracts in crude oil and natural gas has led to a volume jump of close to 60 per cent year-on-year on the Multi Commodity Exchange (MCX),” he told businessline in an online interview.

The Indian derivatives market has established a national benchmark in the pricing of bullion metals on MCX, apart from creating a strong infrastructure for trading in industrial metals.

“There has been a significant speculative interest built up in energy commodities. But at the same time, the turnover in agricultural commodities, especially on NCDEX, has declined to an all-time low due to the ban in the trading of many prime commodities such as edible oils and pulses contracts,” he said.

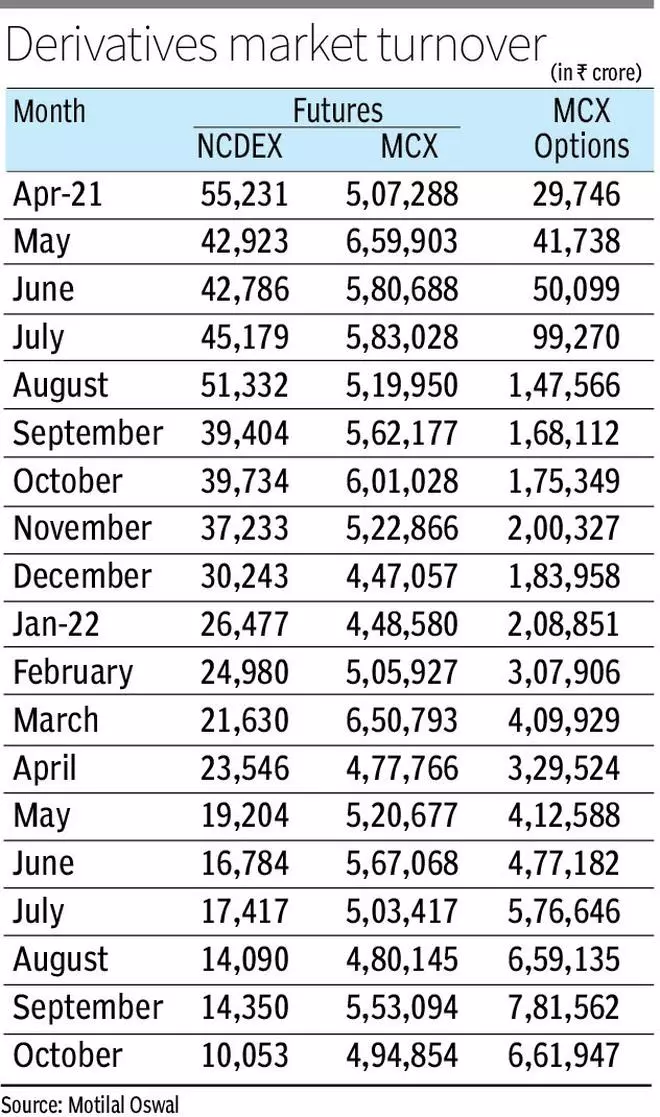

According to him, NCDEX’s monthly turnover declined to ₹10,053 crore in October from ₹55,321 crore in April 2021. MCX’s futures turnover has been swaying — it has dropped from the highs of ₹6.59-lakh crore witnessed in May 2021 to ₹4.47-lakh crore in December 2021 and ₹4.94-lakh crore in October. In between, it topped ₹6.5-lakh crore in May this year.

During the same period, options on MCX have surged from ₹29,746 crore in April 2021 to ₹7.81-lakh crore in September and ₹6.61-lakh crore in October this year. “MCX’s turnover jumped to ₹11.56-lakh crore in October 2022 from ₹5.37-lakh crore in April 2021 primarily driven by the rise in options,” the MOFS official said.

A vibrant commodity market aids the development of agricultural and industrial production, but the Centre is not recognising the importance of “these free market tools”, he regretted.

“Frequent policy intervention and high transaction costs have pushed the domestic agricultural futures volumes to the brink of shutting down,” Narne said.

The Government should encourage free-market pricing and give “policy stability” to these markets. “We are one of the most expensive markets in terms of transaction costs in commodity markets, which should be reduced. If not, at least the cost should be reduced for hedgers to encourage their participation,” the MOFS official said.

Policymakers should understand that a vibrant commodity market is essential for developing a strong manufacturing economy. This has been proved by the US in the 19th Century and recently by China.

“China launched commodity futures by launching Zhengzhou grain futures in 1990 and in the next 20 years the futures market has become one of the world’s largest by volume. Dalian Commodity exchange and Shanghai Futures Exchange are the backbones of the development of the manufacturing sector in China,” Narne said.

If India has to establish its presence in the manufacturing sector, the Centre must realise it cannot be achieved without a vibrant domestic commodity market. “I would suggest that Government must come out with a comprehensive plan for the development of these markets; it should encourage hedgers by reducing the costs and offer predictability in policy so that commodities trading will not be banned from time to time,” he said.

The Government itself, through its agencies and departments, should actively participate in derivatives markets to manage price volatility, ensuring payment of minimum support prices and hedging of stocks in its warehouses. “This will give them some control, while market participants will get comfort on liquidity and policy commitments,” Narne said.

The Indian industry has operated in an environment where there were no commodity derivative exchanges. Their business models and processes have evolved by either taking the commodity price risk or passing it on to suppliers or consumers.

“Hardly five per cent of our corporate companies, which are exposed to commodity price risk, have any risk management policy defined. Not even 10 per cent of them hedge on commodity markets,” the MOFS official said.

When the Indian industry is competing against China and other developing world nations, the policy of risk management and the cost advantages it can provide go a long way in securing margins. Without such a policy, companies will be exposed to significant price risk and lose out to the competition, he said.

“Many times, industry representative bodies and associations go to the Government and put up their side of the story and keep trying to get the government to act against the commodity futures for the mistake that they have not hedged. This needs to be changed,” Narne said.

Companies need not only to be educated but making special provisions to declare their commodity price risk in their results to shareholders should be made mandatory, he said on the user industry complaining to the Centre whenever their raw material prices surge.

On the outlook for metals, including bullion, he said though inflation, in general, drives gold prices as was witnessed during 2019-21, the yellow metal has lost its lustre due to rising interest rates.

“The rising cost of money discourages holding of non-yielding assets such as gold and at the same time makes the dollar stronger. This, in turn, leads to a fall in all the asset prices denominated in dollars,” Narne said.

With inflation expected to prolong, gold prices may rally in the second half of 2023. But for some time now, they will be under pressure. “The near-term outlook for gold in rupees is expected to be ranging between ₹49,500 and ₹53,500 per 10 gms, as we expect the rate cycle to peak out by the second half of 2023,” he said.

The strategy should be to accumulate gold on dips towards ₹49,000 in India. As far as silver is concerned, the price outlook remains as its production faces a primary deficit for the first time. This has turned the outlook bullish for the precious metal.

Published on November 24, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.