Small- and mid-cap schemes are likely to see lower inflows in March after the recent correction in the space and the regulatory diktat to conduct stress tests on such schemes, said industry officials.

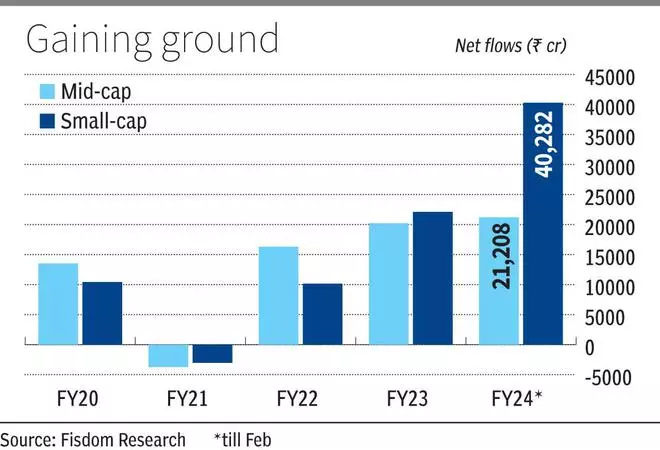

About two-fifths of equity flows in the past two years have gone to such schemes, said experts. Inflows into small cap funds in the first 10 months of this fiscal stood at ₹37,360 crore, 69 per cent higher than the amount collected in FY23. Flows in mid-cap schemes this fiscal have also surpassed the ₹20,205 crore garnered the previous year.

Distributors and advisors are now asking clients to park a larger share of their incremental money in flexi cap, large cap, large and mid-cap and multicap schemes instead of small and mid-cap funds.

“Investors have been chasing returns,” said Swarup Mohanty, chief executive of Mirae Asset Mutual Fund. “We have seen a build-up of froth in the small and mid-cap space and some of the incremental flows which could move to other equity categories and even hybrid funds.”

The Nifty Midcap 100 and Nifty Smallcap 100 have slid 3.7 per cent and 6.6 per cent respectively in the last one month. Market observers expect large caps to relatively outperform the broader market in the months ahead.

B Gopkumar, chief executive of Axis Mutual Fund said investors are preferring multicap funds over flexi caps as the former invests an equal portion in small, mid and largecap stocks whereas flexi caps are tilted towards large caps. “Multicap funds have built a three-year track record and may see greater investor interest going forward.”

According to Amol Joshi, a distributor, there won’t be a substantial reallocation from existing funds resulting in shifting of monies from small and mid-cap schemes to other equity categories. Fresh funds, however, may find its way into ‘large and mid-cap’, flexi cap or multicap schemes, driven more by intermediaries rather than investors themselves.

“Investors convinced about a sustained rally in mid and small cap schemes may gravitate towards multi-cap schemes. Lumpsum money could go to PMS schemes, especially for investors who have a lot of conviction in mid and smallcaps and a higher risk appetite,” said Joshi.

HSBC Global Research prefers largecaps but sees opportunities in the current mid-cap sell-off too. The research house remains constructive on the broader market and ruled out any deep sell-off in mid-caps from current levels.

It said that mid-cap valuations had come down to the five-year mean and that the mid-cap market breadth had declined to 73 per cent from 90 per cent and above at the beginning of the year (60 per cent being the normal cycle average breadth) -- signalling some potential but limited downside.

“After the recent correction, many quality companies have approached their key support. Investors should focus on accumulating quality stocks from a long-term perspective,” ICICI Securities said in a recent note.

Published on March 25, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.