The opinion on whether the market gains and FPI flows will continue is divided. | Photo Credit: SARINYAPINNGAM

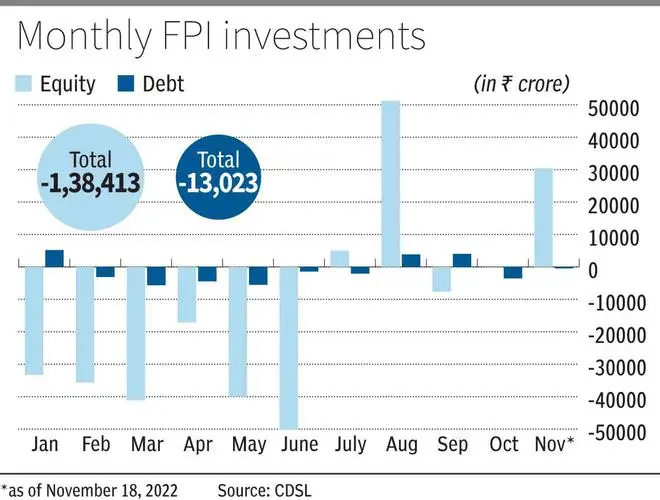

Foreign money is flowing back into India’s stock markets. In November so far, the foreign portfolio investors (FPIs) have pumped in ₹30,385 crore in equity and debt markets. This is the second-highest monthly inflow since January this year.

Telecom, information technology and auto stocks witnessed huge inflows, analysts said. There is a view that the past two quarters of reported quarterly earnings and range-bound share prices have actually lowered the price-to-earnings ratio, the most watched investment parameter, that has made India’s equity markets attractive, experts said.

Supported mainly by FPI buying, India’s key benchmark equity index Sensex recently hit a new all-time closing high. The Nifty index is around 1.5 per cent away from touching the new peak.

Data show FPIs net purchased stocks worth ₹12,839 crore in the cash segment. They were net buyers worth ₹1,760 crore in the index futures, which indicated long positions. But in the stock futures, FPIs were net sellers to the tune of ₹2,011 crore. Prior to November, FPIs were net sellers for two consecutive months in September and October in the cash segment, worth ₹18,303 crore and ₹489 crore, respectively.

The opinion on whether the market gains and FPI flows will continue is divided. “We must see $20 billion flowing into India’s markets in the next 6-12 months as earnings remain strong. Aggressive FPI selling that we saw since September 2021 has now passed us,” said Kishor Ostwal, founder promoter, CNI Global Research.

“FPIs have unusual behaviour. Recently, it is seen that they have invested heavily when markets are near their short-term top. But still, since India’s macro environment is stable, FPI flows will continue for the next few quarters unless some drastic global event happens,” said Kranthi Bathini, Equity Strategist, Wealth Mills Securities.

But those looking at global trends and charts are not yet convinced that markets could keep going up one way. “Derivatives data show that FPIs are now holding 50,000 contracts net long positions in index futures. This is not all time high but their bullish bets are moving into caution zone, especially since global risks are still on the table due to liquidity tightening and markets too are near their highs,” said Rohit Srivastava, chief strategist, Indiacharts.com.

Published on November 20, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.