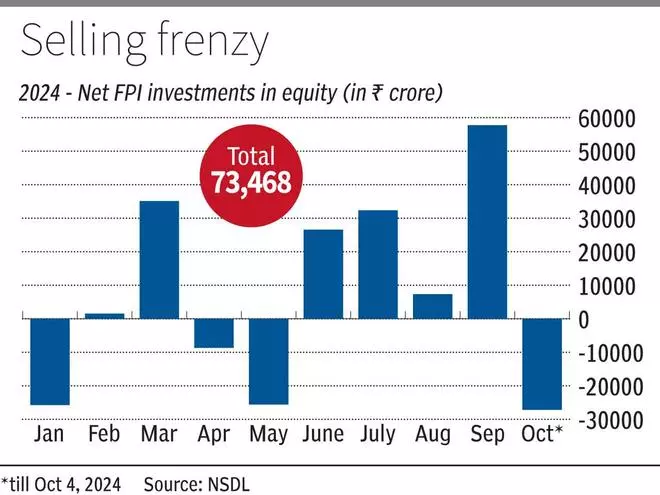

A sharp rally in Chinese equities last week has prompted Foreign Portfolio Investors (FPIs) to adopt a ‘Buy China, Sell India’ strategy in October, leading to the offloading of ₹30,718 crore in Indian equities over just three trading sessions. Data from depositories showed FPIs net sold ₹27,142 crore worth of Indian stocks between October 1-4, a stark contrast to the inflow of ₹57,724 crore in September 2024—the highest monthly inflows this year.

The recent sell-off has raised concerns about the sustainability of India’s stock market rally, as FPIs turn their focus to Chinese stocks, which have surged by 25 per cent due to government-led economic stimulus in China. Contributing to the selling frenzy are ongoing tensions in West Asia and SEBI’s recent revision of index derivatives norms, both of which have unsettled foreign investors.

However, market experts remain optimistic about India’s market resilience, citing robust retail investor participation. Despite China’s current rally, many foreign investors remain cautious about investing there, and much will depend on the long-term recovery of the Chinese economy, they noted.

Domestic mutual funds have pumped nearly $30 billion into Indian equities this year, far outpacing the $10 billion invested by FPIs, they pointed out.

Harsha Upadhyaya, Chief Investment Officer, Kotak Mahindra Asset Management Co Ltd, said that FPIs shift to China will not significantly unsettle the Indian side. “It may bring some jitters to the market. The long term structural money will still come to India despite current expensive valuations. India will continue to maintain its status as fastest growing large economy in the next few years”, Upadhyaya told businessline

“We should not focus too much on FPI flows into India. Now things have changed, Indian flows are better than foreign flows. Due to the change in market structure, FPIs are not as relevant as they were before”

V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services, said “In a sudden U-turn in their strategy, FPIs turned massive sellers in the Indian market in October. The selling has been mainly triggered by the outperformance of Chinese stocks”.

He highlighted that Hang Seng index shot up by 26 per cent in the last one month and this bullishness is expected to continue since valuations of Chinese stocks are very low and the Chinese economy is expected to do well in response to the monetary and fiscal stimulus being implemented by the Chinese authorities.

“If the momentum in Chinese stocks continues FIIs may continue to sell in India where valuations are elevated. It remains to be seen how long the optimism lasts”, Vijayakumar said.

Published on October 5, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.