The number of funds launched were also down at 115 against 160 in last year | Photo Credit: ayo888

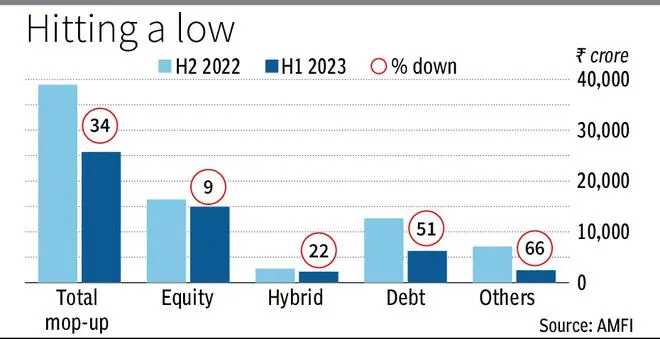

Funds raised by mutual funds through new fund offers (NFO) plunged 34 per cent in the first half of this year to ₹25,712 crore against ₹38,929 crore in the second half of last year on back of uncertainty in both equity and debt markets.

Moreover, large fund houses have no gap in product offerings to launch NFOs as SEBI regulation restricts launch multiple funds in same category.

The number of funds launched were also down at 115 against 160 in last year, according to the Association of Mutual Funds in India data.

Equity fund-raise through NFO was down 9 per cent at ₹14,917 crore against ₹16,370 crore as the number of funds launched dipped to 17 against 22 in last year.

According to industry experts, the steady rise in equity markets despite global uncertainties has forced many investors to book profit rather than investing in NFOs. Large fund houses have taken fancy to launching more riskier thematic funds to attract investors.

Similarly, mop-up by hybrid funds were also down 22 per cent at ₹2,141 crore (₹2,736 crore). Funds raised by new debt scheme launches was the worst hit and halved to ₹6,235 crore (₹12,649 crore) with number of NFOs slipping to 38 from 51.

Fund raised by other schemes, which include index funds, ETFs and fund of funds investing overseas, were down 66 per cent to ₹2,419 crore (₹7,115 crore) as the launch of target maturity funds dried up after the government removed the indexation benefit from debt funds.

Subsequently, passive liquid and gilt funds and target maturity schemes lost its sheen and led to lower NFO launches.

Saugata Chatterjee, Chief Business Officer, Nippon India Mutual Fund, said product offering basket of most fund houses, except for latest entrants, are complete and some of them are tapping the equity markets by launching thematic funds.

As a fund house, he said Nippon Mutual Fund has taken a conscious decision to launch NFO only if there is a unique proposition to offer to investors and in last two years, Nippon MF has launched just two schemes.

Before launching any NFO, Nippon MF builds a model portfolio and back test it to ascertain its effectiveness even before filing the papers with market regulator, he said.

Ramesh Pawar, CEO, Smart Wealth Advisors, said most investors think that they are getting to invest cheap in equity NFOs without understanding that the face value of ₹10 a unit are fixed by MFs, and its real value will be derived only after the money is invested in the asset.

Unlike large established fund houses, he said the responses for NFOs launched by latest entrants have been muted as investors in this booming market prefer to invest in initial public offers for quick returns.

Published on August 29, 2023

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.