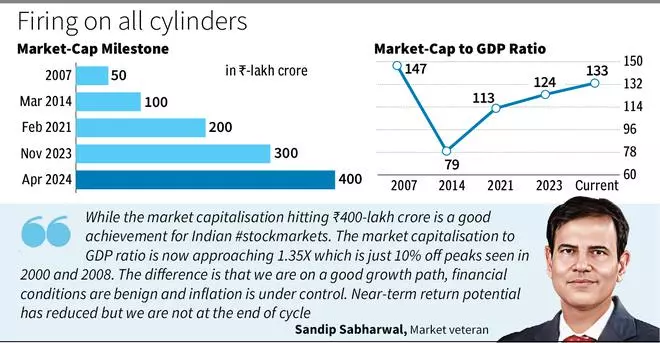

Benchmark indices touched fresh highs on Monday amid positive global cues, with the combined market capitalisation of shares listed on the BSE hitting ₹400-lakh crore for the first time.

The Sensex rose 494 points, or 0.67 per cent to 74,742, while the Nifty settled at 22,660, up 0.68 per cent, driven by strong domestic fund flow and healthy retail participation.

The market capitalisation of BSE-listed firms had hit the ₹300-lakh crore mark in July last year. Cumulative domestic equity inflows have amounted to $92.7 billion over the last five years. India Inc has raised $92.9 billion through the primary market over the same period.

Monday’s upmove was largely broad-based, with outperformance by auto, realty, oil & gas, and consumer discretionary. Eicher Motors, Maruti Suzuki and M&M were the top Nifty stocks, with gains of 4.3 per cent, 3.6 per cent and 3.2 per cent, respectively. Adani Ports was the top loser, down 1.96 per cent.

“Hopes of a favourable outcome from the ensuing general elections and the subsequent policy thrust are keeping sentiments upbeat. The announcements of encouraging monthly/yearly data and some operational/order announcements by companies are attracting stock-specific buying,” said Dhiraj Relli, MD & CEO at HDFC Securities.

He added that investors ought to be cautious while investing in small-/mid-caps, especially without adequate due diligence.

FPIs sold shares worth ₹684 crore on Monday, while domestic institutions bought shares worth ₹3,470 crore. Oil prices declined by over $1 per barrel, with Brent dipping below $90 as tensions in West Asia eased. Indian government bond yields hit a more than two-month high.

“India is currently enjoying the confluence of the best macro and micro tailwinds, such as moderating inflation, range-bound crude prices, easing of 10-year G-sec yield, stable currency, and resilient corporate earnings. India’s capital markets have witnessed vibrant participation from domestic retail investors, with demat accounts surging to 151 million in March this year,” said Ajay Menon, MD & CEO, Broking & Distribution, MOFSL.

India’s GDP is likely to exceed $4 trillion in FY25/26 and reach $8 trillion by FY34. Expectations of political continuity after the forthcoming Lok Sabha Elections should bolster the overall economic momentum further, with a focus on infrastructure, capex and manufacturing occupying the centre stage, said Menon.

Global equities posted modest gains on Monday as investors prepared for a busy week that includes US inflation data, the start of the first-quarter earnings season, and a European Central Bank interest rate decision.

Most of the Asian indices ended in the green, with Nikkei 225 the top performer with gains of 0.9 per cent. Shanghai Composite bucked the trend and ended lower by 0.7 per cent. European indices were trading in the green.

The short-term uptrend of the Nifty remains intact and the next upside levels to be watched are around 22800 levels, said analysts.

Published on April 8, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.