On BSE, the LIC scrip hit a 52-week low of ₹666.9 apiece on Monday | Photo Credit: NIHARIKA KULKARNI

As the 30-day lock-in period for anchor investors drew to a close, shares of Life Insurance Corporation of India (LIC) hit a fresh low and fell below ₹700-level.

On BSE, the LIC scrip hit a 52-week low of ₹666.9 apiece on Monday before closing 5.85 per cent lower than the previous close at ₹668.2 apiece. On NSE, the scrip ended the day 5.66 per cent lower at ₹669.5 apiece. This was the 10th consecutive day of losses for the stock.

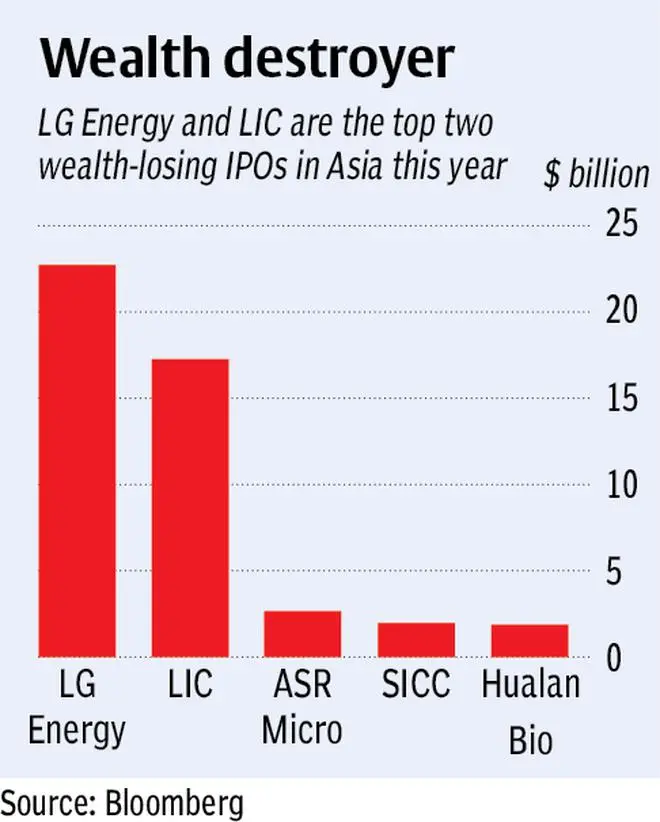

Its market capitalisation was also down at ₹4.22-lakh crore on the BSE on Monday as compared to ₹5.53 lakh crore on the day of its listing (May 17). The stock has fallen over 29 per cent from its issue price and has wiped off ₹1.11-lakh crore of investor value. It however, remains the seventh largest company it terms of market capitalisation.

Prasant Bhansaali, Director, Mehta Equities, said, “Anchor selling can be one of the reasons for today’s fall, followed by underperformance of equity markets as lower market yields will have adverse impact on embedded value which constitutes marked-to-market (MTM) of unrealised equity gains or loss. Lower market yields will have effects on first quarter earnings and hence markets are discounting the same in the price.”

For the time-being, conservative investors should stay cautious on LIC as well as on overall markets, he said, adding that it’s a wait-and-watch scenario until markets settle with all the upcoming events like FOMC policy meeting.

LIC had an issue price of ₹949 apiece and had listed at a discount of about 8 per cent. The government had allocated 5.92 crore shares of LIC to 123 anchor investors and had raised 5,627 crore shares ahead of the IPO.

Its anchor investors include Government of Singapore, Monetary Authority of Singapore, Government Pension Fund Global as well as a host of domestic pension funds including SBI Equity Hybrid Fund, ICICI Prudential Value Discovery Fund and SBI Balanced Advantage Fund.

Meanwhile, the BSE Sensex closed 1,456.74 points lower while the Nifty ended 427.4 points lower amidst a global sell-off.

Published on June 13, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.