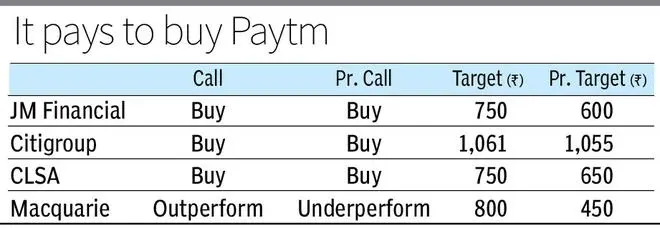

Shares of One 97 Communications (Paytm) got further fillip on Wednesday after global major Macquarie too joined other investment advisors/brokerages to upgrade the stock price post its better-than-expected Q3 numbers.

In fact, Macquarie Capital Securities, which had kept an underperform call on the stock since its listing, on Wednesday made a “double upgrade” to Overweight (from Underweight), and set target price of ₹800.

The stock of Paytm, after rising as much as 19 per cent to ₹697.90 on the BSE in early deal, closed the day at ₹677.60, paring some gains. The stock gained nearly 15 per cent over the previous day’s close.

The counter also witnessed a strong surge in trading volumes as against two-week average of 2.75 lakh shares; Paytm on Wednesday saw 24.38 lakh shares changing hands on the BSE. On the NSE, where the stock closed at ₹680, it witnessed a volume of 3.64 crore shares.

“Since our last downgrade, Paytm has positively surprised on the distribution of financial services revenues by a wide margin and has also managed to control overall expenses and charges,” said Macquarie.

“We were earlier expecting losses to continue, but at current rate of revenues and operating leverage kicking in, we expect accounting profits to be delivered by full-year 2026,” it added.

One97 Communications has achieved operating profitability in December quarter — three quarters ahead of its earlier guidance of achieving this target by September 2023. The company posted a reduced loss of ₹392 crore in the December 2022 quarter, as against net loss of ₹778 crore recorded in the same period last fiscal.

Citigroup said Paytm continues to leverage well its payments platform to drive lending distribution with significant headroom for growth ahead. With fixed costs reined in, margins can comfortably continue to expand, it added.

Another global major CLSA said revenue was largely in line as beats in other financial services and commerce revenue made up for a miss in payments.

Domestic brokerage JM Financial said: “We expect 42 per cent revenue CAGR over FY22-25 for Paytm, with contribution margins sustaining at 50 per cent+ incrementally and now expect Paytm to turn profitable by FY26.”

Published on February 8, 2023

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.