Shares of Suzlon Energy cracked by seven per cent to ₹7.10 as the company's rights issue to raise ₹1,200 crore opened for subscription on Tuesday. Suzlon Energy rights entitlement (RE) shares or partly-paid shares too plunged into deep discount of 30.19 per cent at ₹1.85 against the rights offer price of ₹2.50 on the NSE. While rights issue will end on October 20, trading on partly-paid shares will end on October 14.

The company is offering 240 crore shares on rights basis for ₹5 per equity share. A bidder has to pay ₹2.5 per share at the time of application and ₹2.5 a share on a subsequent call. The issue will be in the ratio of 5 rights equity shares for every 21 fully paid-up equity shares on the record date of October 4.

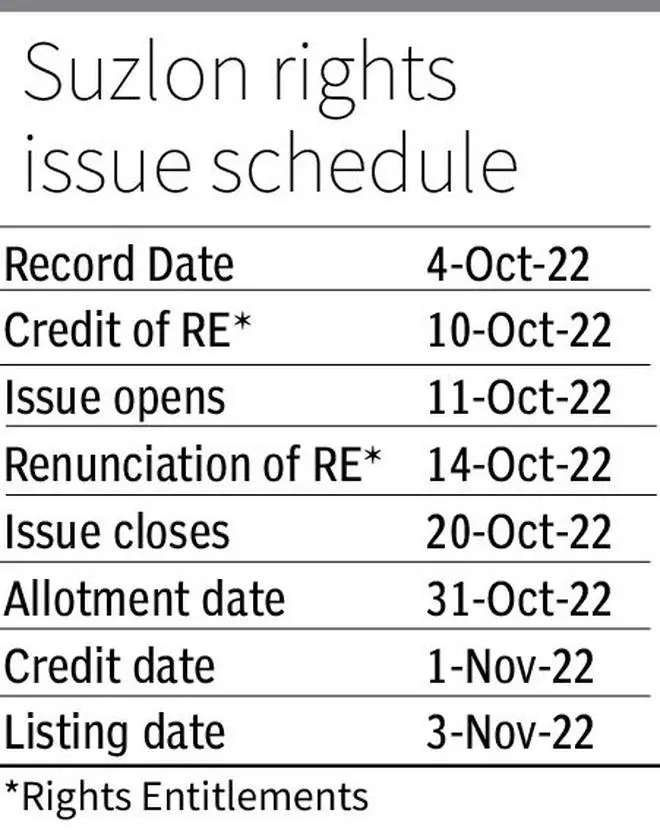

The tentative date for the rights issue allotment is October 31.

Suzlon plans to repay ₹1,000 crore to the State-run REC from the rights issue proceeds. Of the ₹2,800 crore 20-year REC loan, only ₹800 crore is working capital facility and is priced at 19 per cent.

Last Monday, the promoters of Suzlon, the Tanti family, re-confirmes their participation in the proposed rights issue. This came after the demise of CMD Tulsi Tanti on October 1 following a cardiac arrest.

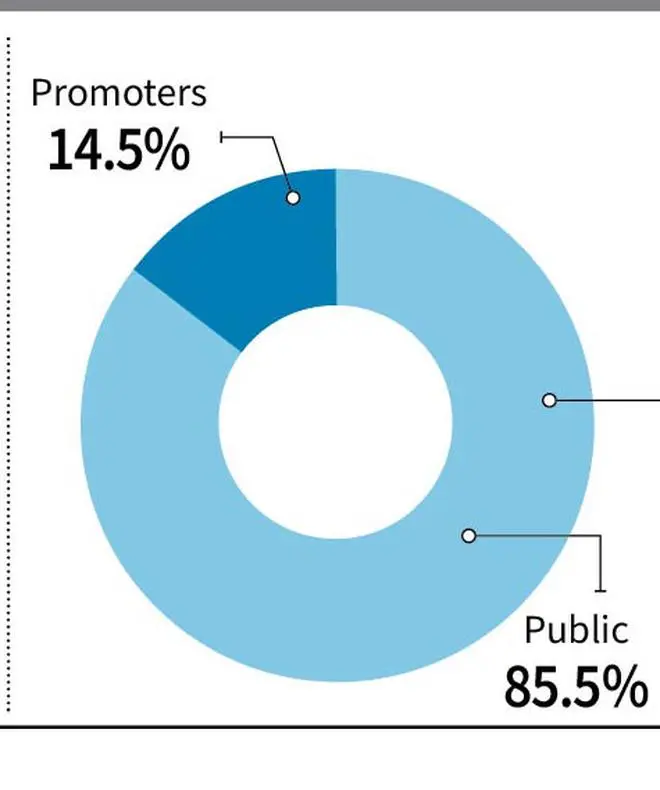

The promoter group, which includes the Tantis, collectively hold 14.5 per cent in the company after lenders, as part of a debt restructuring plan, converted part of the loans into equity holding.

"In continuation to the announcement dated October 2, the promoters and the promoter group have reconfirmed their participation in the proposed rights issue and have expressed their intention to subscribe to the full extent of their rights entitlement," said Suzlon Energy in a regulatory filing.

Published on October 11, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.