Chandra Shekhar Ghosh

Days after announcing his resignation from Bandhan Bank as MD & CEO effective from July 9, 2024, Chandra Shekhar Ghosh is said to be exploring various possibilities with his shareholding in Bandhan Financial Services, including selling a part of stake held by the promoter group.

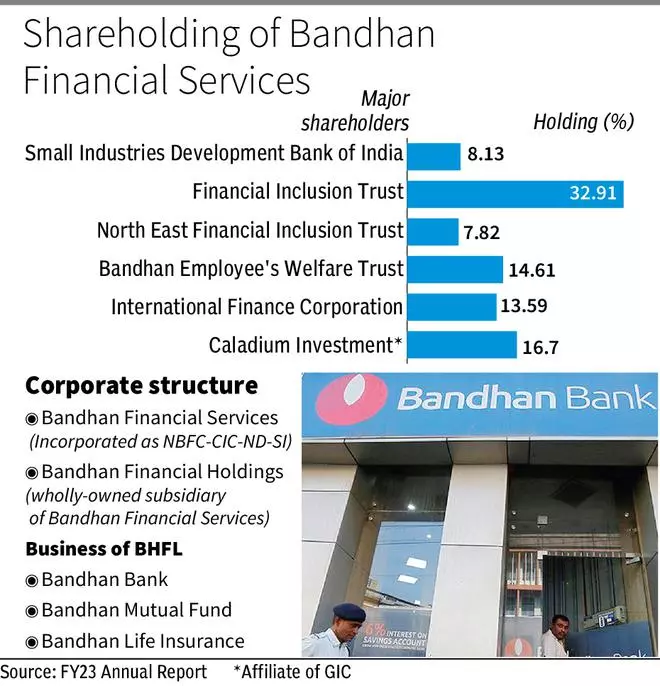

Bandhan Financial Services is the non-bank core investment company (CIC) which holds the shares of Bandhan Bank though Bandhan Financial Holdings Limited. Financial Inclusion Trust, North East Financial Inclusion Trust and Bandhan Employee’s Welfare Trust collectively hold 55.34 per cent stake in the company, according to the FY23 annual report of Bandhan Financial Services.

These are said to be the entities through which Ghosh and/or his family members along with some employees of Bandhan group hold shares in Bandhan Bank. Other shareholders of Bandhan Financial Services include SIDBI, International Finance Corporation and Singapore based sovereign wealth fund, GIC held through Caladium Investments Pte Limited (see table).

According to highly placed sources aware of the matter, Ghosh is exploring possibilities to monetise his holding in Bandhan Financial Services. “He has initiated some early talks with a few banks to consider buying out his stake in the holding company but hasn’t received encouraging feedback yet. A few private equity investors have also been approached and talks are at early stages,” said two bankers aware of the matter. It is gathered that Ghosh may not be seeking a full exit from the holding company and could continue to hold about 10 per cent stake in the company.

Email sent to Bandhan Bank remained unanswered till press time. However, when contacted over a phone call, CS Ghosh termed the possibility of a stake sale as speculative. “I would like to hold a strategic role in the holding company,” he replied.

Bandhan group through Bandhan Financial Holdings has recently expanded its interest to life insurance business by acquiring controlling stake in Ageon Life Insurance. Last year, the Bandhan Financial Holdings along with GIC and ChrysCapital acquired IDFC Mutual Funds for Rs 4,500 crore. On April 5, 2024, Ghosh announced his decision to step down from the post of MD & CEO of Bandhan Bank once his term ends on July 9, 2024. In February, businessline reported that a forensic audit is currently underway at the bank.

Published on April 28, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.