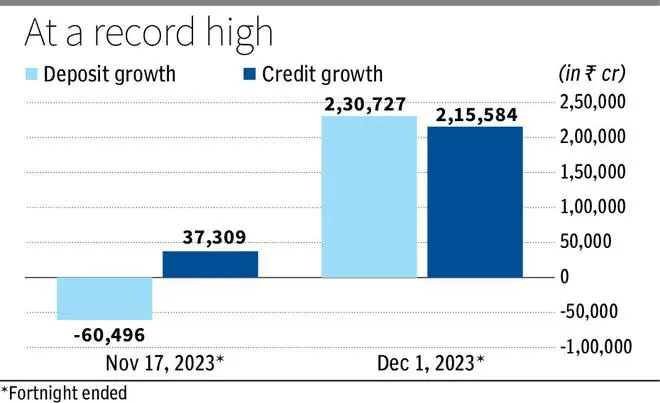

Deposits and advances of all scheduled banks soared by over ₹2-lakh crore each in the reporting fortnight ended December 1, 2023, per RBI’s Scheduled Banks’ Statement of Position in India.

Deposits and advances jumped by ₹2,30,727 crore and ₹2,15,584 crore, respectively. In the preceding fortnight ended November 17, 2023, while deposits declined by ₹60,496 crore, advances rose by ₹37,309 crore.

“Festival demand is ebullient. In urban areas, consumer appliances are in strong demand, especially in the mid-and premium segments. Consumer sentiment is upbeat. Close to 80 per cent of purchases of consumer durables are reported to be through consumer financing schemes spiced up with attractive equated monthly instalment (EMI) offers. Entry-level segment demand is relatively subdued as ‘premiumisation’ shows clear signs of developing into a consistent trend,” per a report in RBI’s November monthly bulletin.

Micro, small, and medium enterprises (MSMEs) supplying to in-demand segments are also experiencing a surge in orders, particularly from businesses selling through platforms and large format stores. In turn, bank loans to MSMEs is strong.

“In the affordable housing space, sales have declined, deterred by high interest rates, but surging growth is taking hold for houses in the ₹1-2 crore and ₹50 lakh-1 crore segments.

“Festival spending and consumer exuberance are also driving record loan disbursements by non-banking financial companies (NBFCs). Nearly half of the credit demand is originating from tier-3 cities,” per State of the Economy report.

The report noted that rural demand accounts for a third of the revenues of consumer goods companies. Overall rural volume growth is estimated to have risen by 6.4 per cent (versus 10.2 per cent in urban areas), it added.

Also read: Home buying now seen as a stable investment proposition: Manoj Gaur, Chairman, CREDAI

“Non-food companies are tracking better in terms of rural volumes than food companies. This is partly attributed to aggressive sales pitches by small and regional players, indicative of the rural consumer becoming increasingly price sensitive and switching to cheaper alternatives and smaller sized packs,” the report said.

CARE Ratings, in a report, said the outlook for credit offtake continues to remain positive for FY24, supported by factors such as economic expansion and a continued push for retail credit which has been supported by improving digitalisation.

The rating agency has estimated that credit growth is likely to be in the range of 13-13.5 per cent for FY24, excluding the impact of the merger of HDFC with HDFC Bank.

Also read: Early-stage delinquencies rising in affordable, low-ticket home loans

Furthermore, as the credit to deposit (CD) ratio remains elevated, growth in the liability franchise would play a significant role in sustaining loan growth. However, inflation, elevated interest rates and global uncertainties could potentially impinge on the credit growth in India.

“As the credit to deposit ratio remains elevated, growth in the liability franchise would play a significant role in sustaining loan growth. The competition for deposits is likely to intensify even further, resulting in a rise in funding costs in the coming periods as rates remain elevated and CASA share reduces,” CARE Ratings said.

Published on December 14, 2023

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.