The Reserve Bank of India (RBI) will infuse liquidity amounting to ₹2.50-lakh crore via a 15-day variable rate repo (VRR) auction on Thursday as the overall liquidity deficit in the banking system has widened to ₹3.34-lakh crore on January 23 as compared with ₹1.29-lakh crore as on January 1st.

This comes even as the huge cash balances built up by the Centre with RBI on account of inflows from GST and advance remain unspent, say market experts.

Overall liquidity in the banking system includes VRR auctions, liquidity drawn from the marginal standing facility, surplus funds parked at the standing deposit facility, and liquidity infused by the RBI via various long-term repo operations during the Covid-19 period (2021).

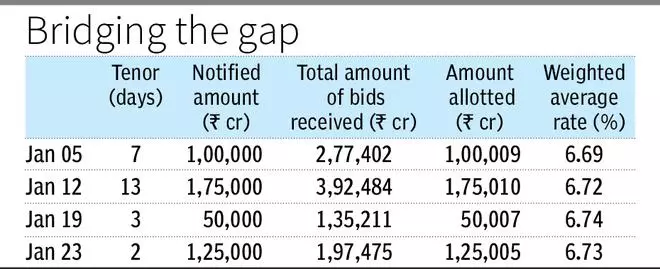

In the current month so far, the maximum liquidity that the central bank infused was ₹1.75-lakh crore via a 13-day VRR on January 12th.

Banks are facing pressure on the liquidity front as there were outflows last month on account of GST (goods and service tax) payments and advances tax outflows, and the central government has accumulated cash balances (estimated at about ₹2-lakh crore) with the RBI.

They are also up against stiff competition from non-banking finance companies for garnering resources. Non-convertible debentures floated by NBFCs are offering relatively higher returns (up to 10 per cent) against Bank term deposit rates of 6.50-7.25 for over a one year tenor.

Further, with equity markets in a bull phase, retail investors have been actively investing in initial public offers and mutual funds.

Gopal Tripathi, Head of Treasury and Capital Markets, Jana Small Finance, said the liquidity pressure could ease if the government starts spending the balances accumulated with the RBI.

He opined that if the RBI absorbs the dollars that foreign portfolio investors are bringing into the Indian equity market, it could result in an enhancement in liquidity.

RBI Governor Shaktikanta Das, in his December 2023 monetary policy statement, said: “The overall tightening of liquidity conditions is attributed mainly to higher currency leakage during the festive season, government cash balances, and the Reserve Bank’s market operations. Driven by these autonomous factors, system liquidity tightened significantly compared to what was envisaged in the October policy statement.

“Going forward, government spending is likely to further ease liquidity conditions. On our part, the Reserve Bank will remain nimble in liquidity management,” Das then said.

RBI asks banks to temporarily maintain incremental CRR

India Ratings and Research (Ind-Ra), in a report, observed that the RBI will necessarily have to infuse more durable liquidity into the banking system if the ongoing tight liquidity conditions persist.

On a net basis, the RBI has injected liquidity averaging ₹1.8-lakh crore between December 16, 2023, and January 14, 2024, it said.

“Sustained tightness in the banking system liquidity could prove to be onerous for borrowers and will worsen in case government spending does not accelerate in a meaningful way.

“Therefore, the infusion of durable liquidity is becoming necessary, and idealistically, the monetary policy stance should change to ‘neutral’ from ‘withdrawal of accommodation’ to maintain consistency of stance and action, opined Soumyajit Niyogi, Director, Core Analytical Group, Ind-Ra.

Published on January 24, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.