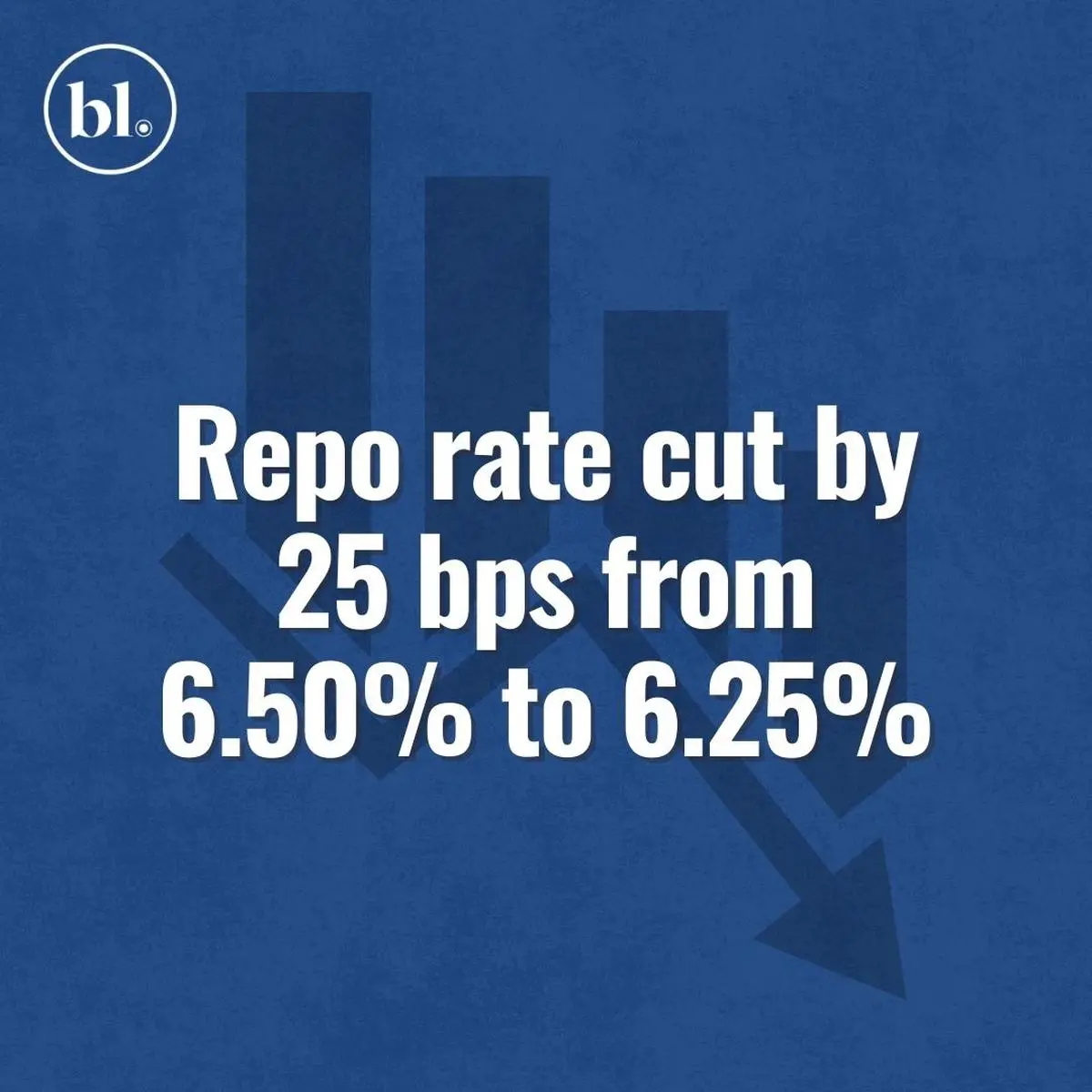

The six-member monetary policy committee (MPC) revised the repo rate for the first time in two years, voting unanimously to cut it by 25 basis points from 6.50 per cent to 6.25 per cent in view of easing retail inflation and slowing growth. The rate cut comes even as the Rupee continues to reel to under pressure from global tariff wars.

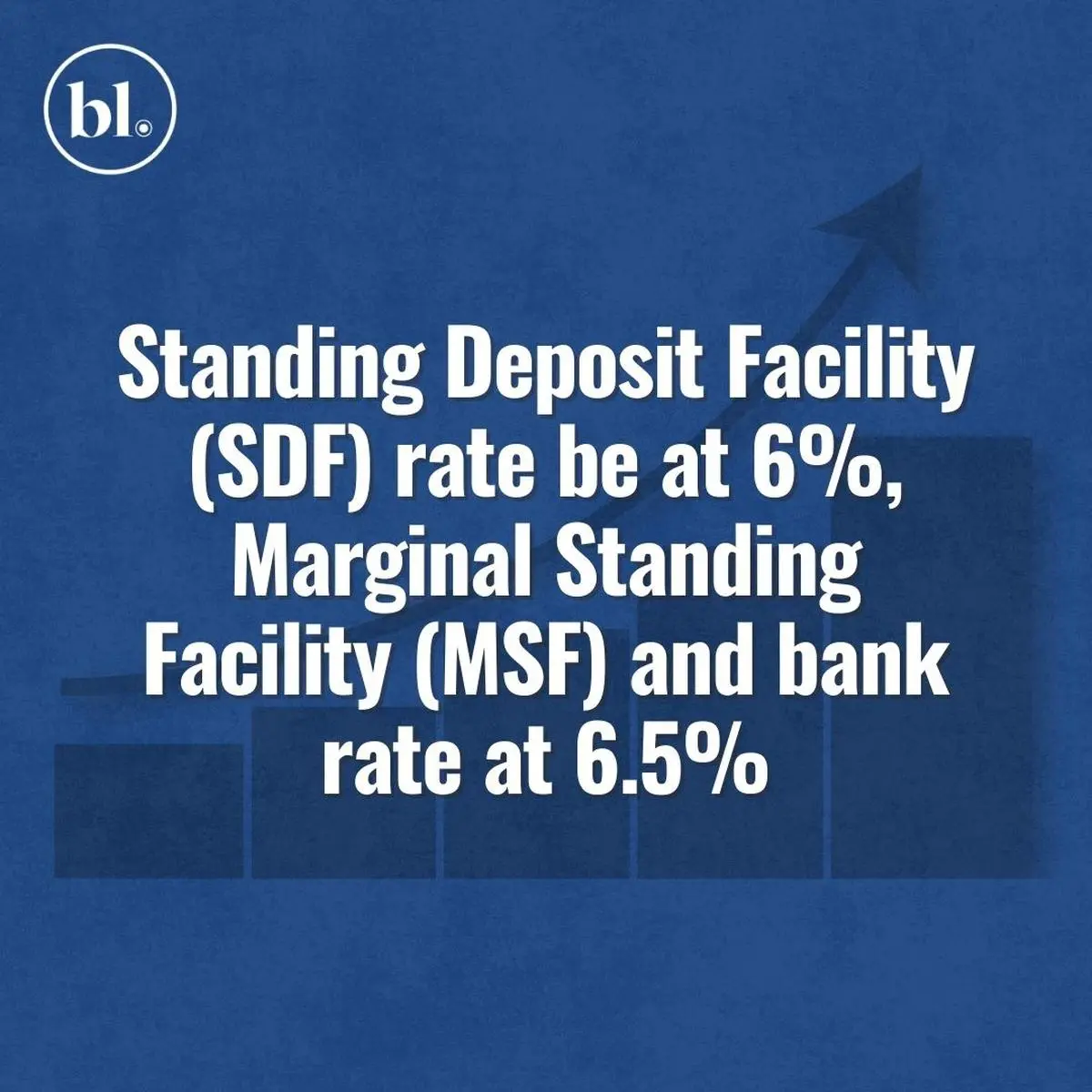

The MPC decided unanimously to reduce the policy repo rate to 6.25 per cent at its meeting, which is the committee’s last one for FY25 and new Governor Sanjay Malhotra’s first after he assumed charge of RBI on December 11, 2024, held from February 5th to 7th. The MPC also decided unanimously to continue with the ‘neutral’ stance and to remain unambiguously focused on a durable alignment of inflation with the target, while supporting growth.

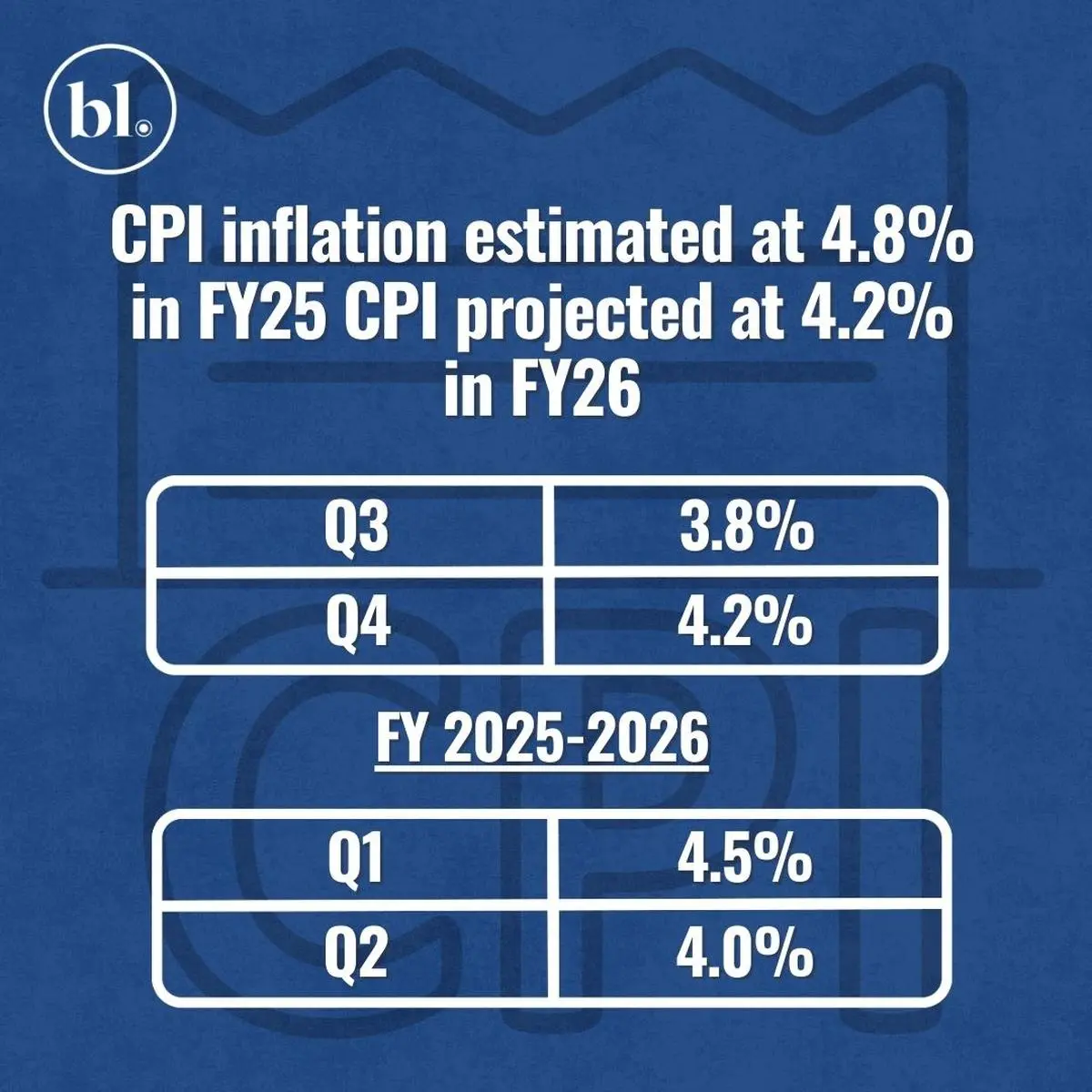

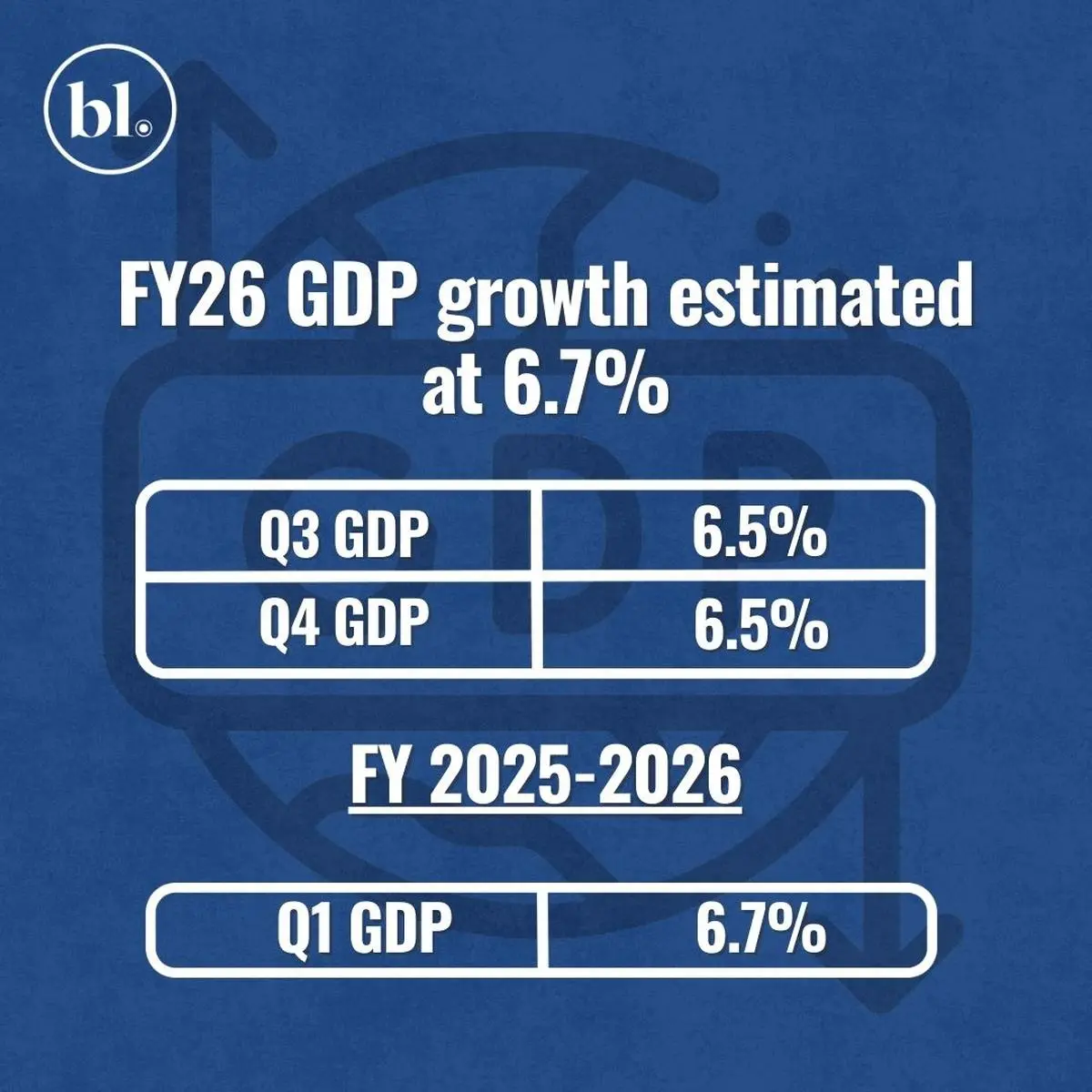

Retail inflation eased to 5.22 per cent in December 2024, a four-month low, from 5.5 per cent in November. GDP growth in Q2 FY25 slowed to 5.4 per cent, a seven-quarter low, from 6.7 per cent in the previous quarter.

Published on February 7, 2025

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.