With over 60 per cent of retail loans and advances and over 70 per cent of deposits mobilised through digital channels, the number of grievances at Reserve Bank of India Ombudsman in these categories have risen exponentially, reveals the Trend and Progress report published by the central bank a week back.

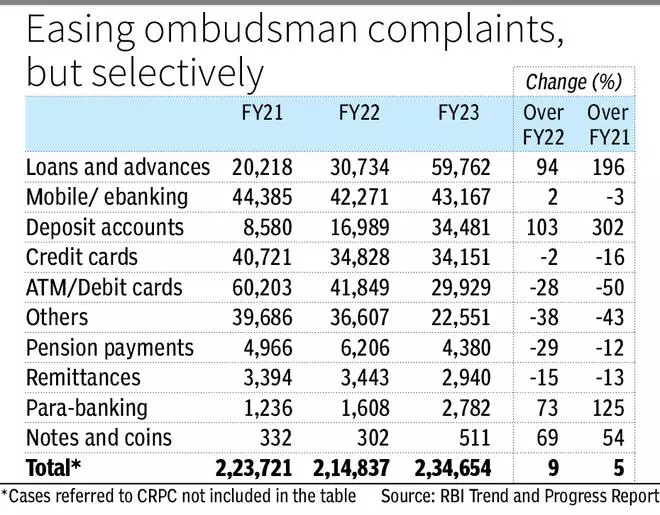

Data indicate that the case load for loans and advances has increased from 30,734 cases in FY22 to 59,762 cases in FY23; a jump of 94 per cent year-on-year, while the ombudsman data for deposit accounts reveals 103 per cent jump year-on-year from 16,989 cases in FY22 to 34,481 cases in FY23. When seen against the number of cases referred to RBI Ombudsman in FY21, the two categories have seen about 2-3 fold increase in the last two years.

Data further suggests that 43.5 per cent complaints received in FY23 were related to public sector banks, while private banks stood second with 31.4 per cent share of total complaints to the ombudsman.

Interestingly, grievances for mobile/ electronic banking rose by only two per cent year-on-year in FY23 and in fact dipped by three per cent compared to FY21 case load (see table). Likewise, grievances for credit cards and ATM/ debit card declined significantly in the gone by fiscal, when seen against FY22 and FY21 numbers. It is pertinent to note that para-banking (insurance, asset management etc) related complaints have increased 73 per cent year-on-year in FY23 and by 1.3x from FY21 level.

“To a large extent, digital products sold or provided directly by banks such as mobile/ electronic banking, cards and ATM are well established products now and there is a good awareness among customers on how to use these products and resolve issues directly with banks. Banks have also reasonably upped their back-end phone banking and online resolution mechanisms to handle these issues,” said a retail banking head of a State-owned bank.

However, with respect to deposits and loans and advances, banks say digital adoption, whether directly from banks’ website or through third party apps have gained ground only in the last two years. “These products are in early stages of evolution and we are working on how best to resolve these issues,” said a senior executive with a private bank. With respect to para-banking related cases which are on the rise, experts attribute the spike to mis-selling of products. “

Data from the Trend and Progress report suggests good progress for the recently introduced Reserve Bank – Integrated Ombudsman Scheme (RB-IOS). With nearly 4,68,854 cases handled by CRPC or Centralised Receipt and Processing Centre in FY23, it helped reduce the overall case load at RBIO. Cases pertaining to non-observance of Fair Practice Code, levy of charges without prior notice, direct selling agents and recovery agents, failure to meet commitments and non-adherence to BCSBI (Banking Codes and Standards Board of India) codes are now handled by CRPC.

Published on December 28, 2023

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.