-573.38

-169.60

+ 352.00

+ 1,855.00

+ 362.00

-573.38

-169.60

-169.60

+ 352.00

+ 352.00

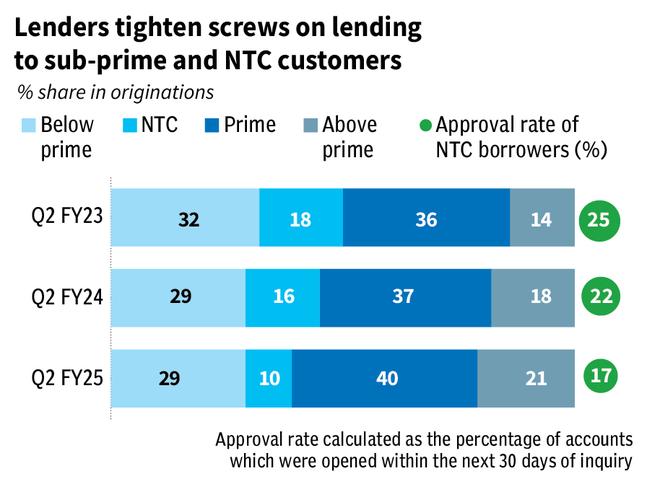

+ 1,855.00

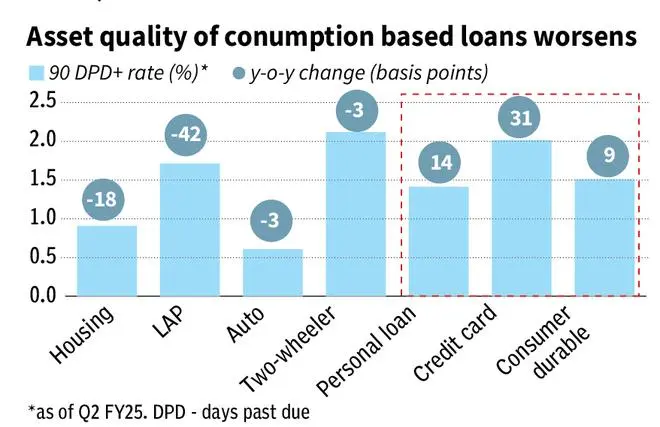

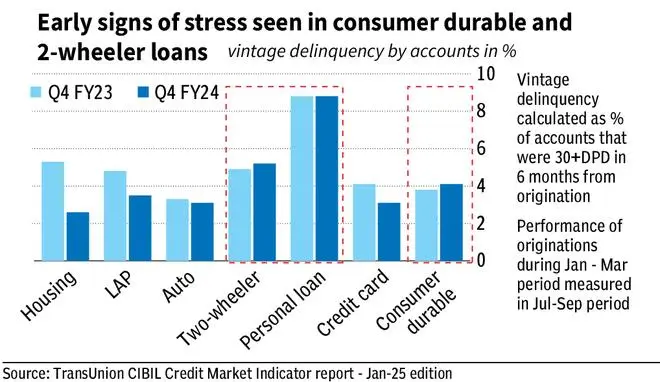

A recent TransUnion CIBIL report lucidly visualises the ongoing pain in the financial sector. Delinquencies worsen in consumption-based loan products, namely, personal loans, credit cards and consumer durable loans. While vintage delinquencies have largely improved, it is not so in the case of consumer durable loans and two-wheeler loans, signalling stress emerging there. As a result, financial institutions scaled back on origination of these loans. Originations to new-to-credit (NTC) and sub-prime borrowers too have dropped.

Published on February 4, 2025

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.