For corporate and government debt combined, the interest payouts work out to around ₹35-36-lakh crore as interest besides redemptions that happen on a regular basis | Photo Credit: suman bhaumik

The issue of debt has come to the forefront today. Credit rating agencies point to debt levels when dealing with sovereign ratings while RBI is worried about increase in non-collateralised lending.

While these concerns deserve merit, it is also necessary to note that debt is a vital element of the growth process. A debt free-country or company will find it hard to grow. Companies can use their own funds, but governments cannot. How significant is debt in the Indian context?

For having accelerated growth one needs to have a financial system that allows for intermediation either through financial institutions or directly through other market instruments. Those who save and provide funds for investment are different from those who produce and invest, making intermediation necessary.

As financial institutions become more sophisticated more options are provided for borrowing to facilitate transfer of funds to productive sectors.

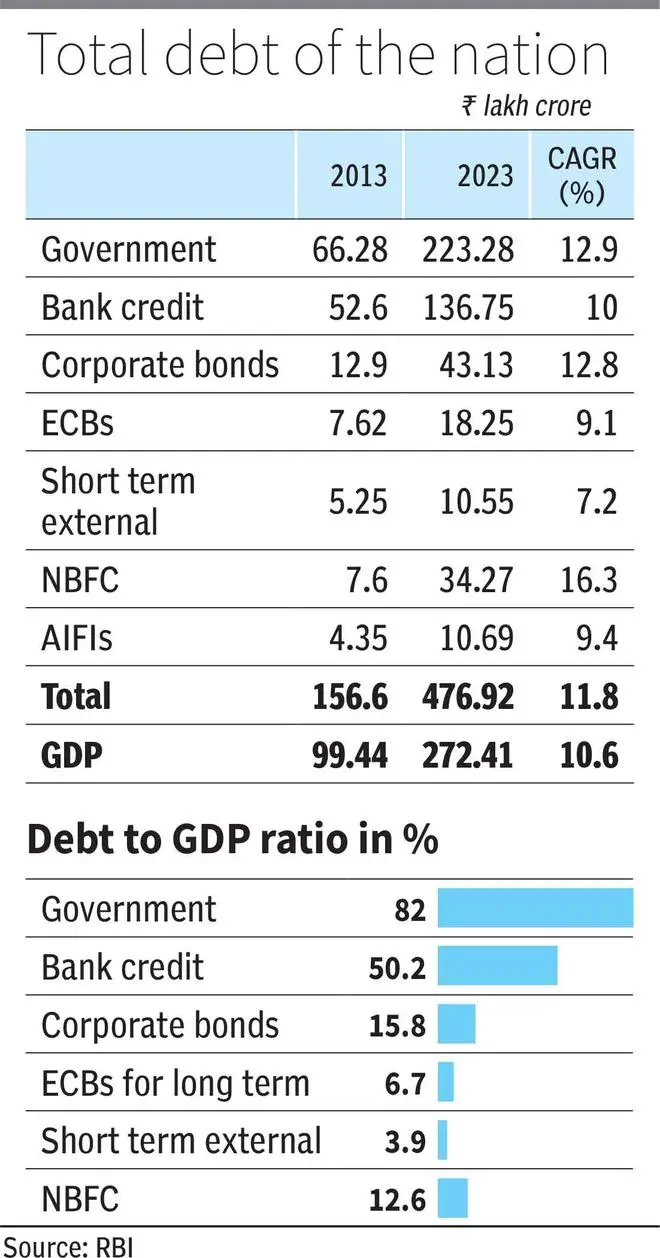

To look at the relation between growth and debt, the last 10 years are considered here. All possible debtors in the organised sector have been included.

The unorganised segment is excluded as there is no available data though it should remembered that the traditional moneylender plays an important role in financing consumption in India.

We take a look at government debt (Centre and States), bank credit (for farmers, individuals and firms), corporate bonds (corporates), NBFCs (same universe of borrowers as banks), external borrowings (corporates but excluding government), lending by institutions like Nabard etc. (direct lending and refinance).

The sum of these borrowings gives an idea of the indebtedness of the nation which can be juxtaposed against the GDP growth during this decade ending 2022-23.

The table shows that the CAGR of outstanding debt has risen at a faster rate than nominal GDP growth which means that debt has played a big role in financing GDP growth.

Incremental debt in 10 years has been ₹320-lakh crore, while GDP has increased by around ₹173-lakh crore.

This clearly shows that growth has been financed well by the system. The other significant aspect of our debt structure is that the largest debtor is the government with a share of 47 per cent.

It must be remembered that all borrowing is used for consumption or investment purposes and hence is productive.

While normally borrowing for investment is looked at favourably the same is not the case with consumption.

However, growth in consumption is a pre-requisite for investment and if entities borrow to buy goods and services, there are backward linkages created. As consumption improves and capacity utilisation increases, there is incentive to invest more.

Western countries have financed consumption which has in turn become an engine to growth through the use of credit cards. In India people borrowing for consumption or for acquiring assets such as vehicles houses or is a more recent phenomenon. Mortgages in particular have played an important role in US economic growth as the links with the construction sector and related industries are strengthened.

The table provides some interesting insights on where borrowing is concentrated. The government has the highest ratio of outstanding debt-to-GDP of 82 per cent with an compounded annual growth of 12.9 per cent over 10 years. Banks, in relative terms have been more conservative with credit CAGR of just 10 per cent, amounting to 50 per cent to GDP.

The corporate bond market has also grown at a faster rate of 12.8 per cent annually, which is a revelation considering that there is still a sense of the market not being well developed. Outstanding corporate bonds are now almost 16 per cent to GDP. Government, SEBI and RBI measures have brought about this growth in the market. The NBFC sector has a ratio of 12.6 per cent to GDP with CAGR of 16.3 per cent.

Debt needs to be serviced by the borrowers both in terms of repayment of principal as well as annual interest payouts. The average cost for the government would be around 7 per cent which involved ₹16-lakh crore as payouts. For the commercial side of borrowing the cost would vary between 8-9 per cent and hence have an outflow of almost ₹20-lakh crore (a lower cost for external borrowings). Hence there is an annual outflow of around ₹35-36-lakh crore as interest besides redemptions that happen on a regular basis.

An outflow of ₹35-lakh crore or 13 per cent of GDP, as interest on debt is a matter of concern. Extrapolating the past data, a CAGR even 10 per cent indicates that in future outstanding debt will be rising by a similar rate which is ₹48-lakh crore in the first year to begin with. Now the interest payout of ₹35-lakh crore would be a little over 70 per cent of net incremental debt reckoned. This is definitely quite high.

When it is the government there is less concern as it is paid from the Budget and the downside is some compromise on spending on projects.

For corporates, interest outflow is a part of ordinary business and at the lower end of the scale can impact profits. Unless there are losses made which leads to NPAs this amount can be absorbed by the firms.

The challenge is more for retail customers who borrow funds. In case it is for a house or vehicle there are assets being created which are used as collateral. However, if used for consumption it can lead to delinquencies in case the individual is not able to earn sufficient income to service the debt.

Hence, it can be seen that debt has been an integral part of the Indian growth story. It is however necessary to ensure that NPAs don’t build up and this is where regulation is important along with better underwriting skills of lenders. Presently there does not appear to be any major concern given the quality of assets across all segments. But one has to remain vigilant on all fronts as any segment can provide the shock.

The writer is Chief Economist, Bank of Baroda. Views expressed are personal

Published on January 16, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.