An important contributor to the project cost sanctioned is the metals sector | Photo Credit: SHAILESH ANDRADE

The Reserve Bank of India’s latest release on private capex outlook concludes that there has been a material improvement in private capex outlook. This is on the basis of data from project approvals by banks, data on project funding through ECBs, and equity fund-raising by private companies (Private Corporate Investment: Performance and Near-term Outlook, August 2023).

The RBI note observes the following:

Sustained pick-up in bank credit, rising capacity utilisation, improved business outlook and demand conditions and various government policy initiatives to support investment activities provided a conducive environment for the private corporates to undertake fresh investments.

The envisaged total cost of the projects financed by banks/financial institutions reached a new peak during FY23 since FY15.

Of the total capital investment during FY23, about 40 per cent is expected to be spent in FY24.

Using the same data from the report we observed contrastingly opposite takeaways. We can look at it through the lending from banks and financial institutions, and from other sources.

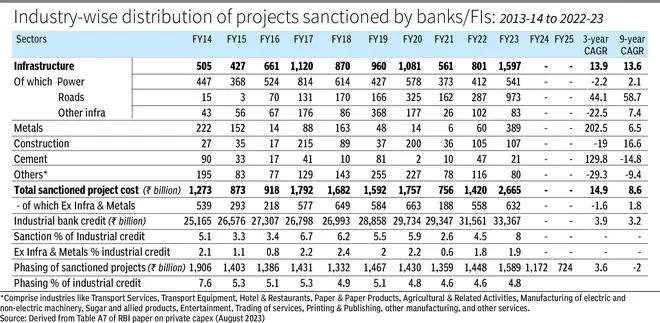

While the total cost of projects sanctioned by banks and financial institutions increased by 14.9 per cent on three-year CAGR till FY23 at ₹2.7 trillion, it is concentrated in the non-industrial sector, i.e. the infrastructure sector (₹1.6 trillion), which is mainly dependent on government capex.

Within the infra projects, major project cost sanction coming from roads (₹973 billion, or 61 per cent of infra project) saw the biggest rise (44.1 per cent, three-year CAGR). Power and other infra contracted by 2.2 per cent and 22.5 per cent, respectively, on three-year CAGR.

The other important contributor to the project cost sanctioned is the metals sector, ₹389 billion (202 per cent, three-year CAGR). This is mainly led by the episodic rise in EBITDA of metals (mainly steel) companies due to the disproportionate surge in global prices of metals on the back of short-term supply shortfall. With the global prices collapsing now and the emerging oversupply in China, EBITDA of the steel companies has collapsed. Hence, like the aftermath of the metal price collapse after FY14, the sanctioned projects run the risk of downsizing going forward.

Outside of the non-infra sector steel companies and road projects the sanctioned project cost has been modest.

In fact, total project cost excluding infra and metals at ₹632 billion has seen a contraction of 1.6 per cent on three-year CAGR. On a nine-year CAGR basis it is only 1.8 per cent!

The line item “others” aggregating a wide set of manufacturing and services sectors has seen a contraction of 29.3 per cent (3-year CAGR) at ₹80 billion in FY23. On a 9-year CAGR basis it is minus 9.4 per cent!

Also, what runs against RBI’s claim of gaining private capex is the weak industrial lending growth which grew by just 3.9 per cent and 3.2 per cent on 3-year and 9-year CAGR. Thus, adjusting for the WPI inflation of 8 per cent (three-year CAGR) the sanctioned projects excluding roads and metals and bank credit to industries have contracted on 3-year CAGR basis.

The latest banking sector results show a pervasive decline in interest rate spreads amid the rising cost of funds and weak corporate borrowings. Hence, the weakening pricing power of banks/lending institutions hardly makes the case for project funding by the industrial sectors. Intuitively, the spreads should be rising with improving private capex. The total cost of projects sanctioned by banks as percentage of industrial credit rose to 8 per cent in FY23 compared to 5.1 per cent in FY14. This is substantially on account of the infra and metals sector.

Project cost sanctioned as percentage of industrial credit excluding infra and metals at 1.9 per cent in FY23 is lower than 2.1 per cent in FY14.

Outside of the projects sanctioned by banks and financial institutions, i.e., those funded by ECB, FCCBs, RDBs, and equity fundraising, the aggregate project cost at ₹861 billion is a decline of 3.4 per cent on a three-year CAGR and is up by a modest 5 per cent on eight years CAGR.

The RBI also issues a caveat that the intended project data aggregated in this note does not match capital formation figures published in the National Income Accounts (i.e., expenditure GDP).

That RBI’s optimism on the revival in private capex is unrealistic given the narrow base of project intent, mainly coming from road projects and the highly cyclical metal sectors (together contributing 51 per cent), that is exposed to commodity price volatility.

The RBI’s project-level data also reinforce the view that the crowding-in effect of aggressive government capex on road projects on private capex is not visible.

A 360-degree framework capturing corporate performance, their operating matrix, analysis of balance sheet of NFCs and their cash flow deployment, long term data on projects under implementation from CMIE database, macro equation from falling household savings and high tax incidence and weak income points to a possibility of private-sector industrial capex continuing to show a sluggish trend.

The writer is Co-Head of Equities & Head of Research - Strategy & Economics, Systematix Group

Published on August 31, 2023

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.