Given that the recent interest rate hike was targetted at curbing inflation, investors should be mindful of a possible demand contraction and loss of operating leverage which has been shielding higher costs

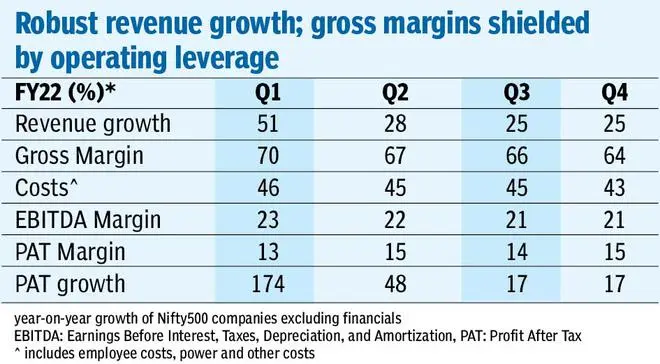

Nifty500 companies, excluding financials, posted a 25 per cent year-on-year (y-o-y) revenue growth and 17 per cent net profit growth in the gone-by March 2022 quarter (Q4).

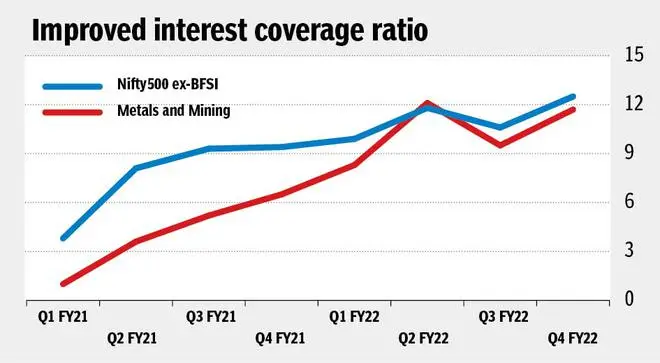

The surprise element here is that profit growth in Q4 has been holding up at the same levels as the previous quarter despite the unabated raw material cost pressures. Cost-saving efforts that companies have deployed since the start of the pandemic and the consequent operating leverage seems to have helped India Inc in Q4. Companies have taken advantage of the benign interest rate regime that lasted till the March quarter. But with interest coverage ratio for the universe of 344 stocks stood at 12.5x in Q4 as against 9.4 a year-ago, the impact of rate hike may not be detrimental.

Given that the recent interest rate hike was targetted at curbing inflation, investors should be mindful of a possible demand contraction and loss of operating leverage which has been shielding higher costs.

Overall gross margins continued their steady decline from 70 per cent in Q1 FY22 to 65 per cent in Q4 FY22 for the Nifty500 companies ex-BFSI. With oil prices scaling further 10 per cent higher from February 2022, more pain should be expected for industries dependent on oil or its by-products.

Chemicals, FMCG, cement and capital goods players spent an average 400 bps higher on raw materials on a year-on-year basis. Hindustan Unilever, which managed to pass on higher raw material costs till Q3 FY22, saw its gross margin decline by 310 bps q-o-q in Q4. Given that prices of oil, including edible oils, and logistics costs are expected to remain high in the near-term, investors should probably brace for a reduction in gross margins.

Auto companies managed to preserve their gross margins by passing on cost increases in Q3 primarily owing to good demand as indicated by the long wait periods. Maruti improved its gross margins by 180 bps q-o-q in Q4. Likewise, commodity players including, metals and mining have held on to the cyclically high margins in Q4.

Sectors such as metals, IT, and chemicals, saw their revenues grow by 20-40 per cent y-o-y in Q4FY22, and this to a large extent, shielded the operating margins. Led by higher capacity utilisation and higher prices of commodities, metals posted 1,400 bps increase in their operating margins. Likewise, even as raw material costs increased by 460 bps y-o-y in Q4, chemical companies held on to their margins, thanks to revenues increasing by 38 per cent y-o-y.

For these sectors, the question here on is whether they are well placed to preserve their margins in the coming quarters as well. While input costs continue to rally, central banks world over have taken on the fight against inflation by increasing their policy rates. This may curb the purchasing power of end-consumers and hence the demand enjoyed by these sectors may come under pressure from here on.

For instance, with steel prices trading at lower than peaks in Q1 FY22, Tata Steel reported a 490 bps q-o-q decline in operating margins in Q4. This implies that operating leverage which helped post strong earnings growth, may start reversing for these companies.

What will happen to the financial leverage which India Inc has extensively enjoyed since FY20? That advantage may wane in the coming quarters.

Low borrowing costs was an important component which fuelled demand and consequently, consumption in some pockets too may be hit going ahead. However, companies in the metals, cements, and chemicals which deleveraged their balance sheets reasonably in since FY20 may be less impacted by higher interest rates. Interest coverage ratio of these sectors (aggregate) improved from 12.4x, 11.4x, and 11.9x y-o-y to 28.3x, 11.8x, and 17.1x, respectively in Q4. However, companies in the textiles and power, sectors, where debt remains an issue, could be adversely impacted. Going ahead, one should watch out for how the lethal combination of higher raw material costs and interest rates would impact India Inc.

Published on May 7, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.