All that glitters has literally been gold, of late, with the precious metal touching record highs recently. But silver too has been performing well alongside. Silver, which has been in an upward trajectory for nearly two months, hit a three-year high of $29.8 per ounce in early April.

Expectations that the US Fed would begin to cut interest rates lifted the prices of both gold and silver until recently. This conviction though has faded a bit in recent weeks as inflation in the US is not showing signs of cooling down, pushing Fed to take a ‘wait and watch’ approach. Nevertheless, gold and silver sport double digit returns on a YTD (year to date) basis, as they have gained a little over 10 per cent each.

Although silver is considered a precious metal like gold, the peculiarity with respect to silver is its dual nature. Since nearly 60 per cent of the total demand for silver comes from industrial applications, its performance can be linked to the economic cycle. As a precious metal it can be impacted by the monetary cycle, too.

Now that silver prices have rallied, is there more fuel left? Where is silver headed? Here’s our analysis.

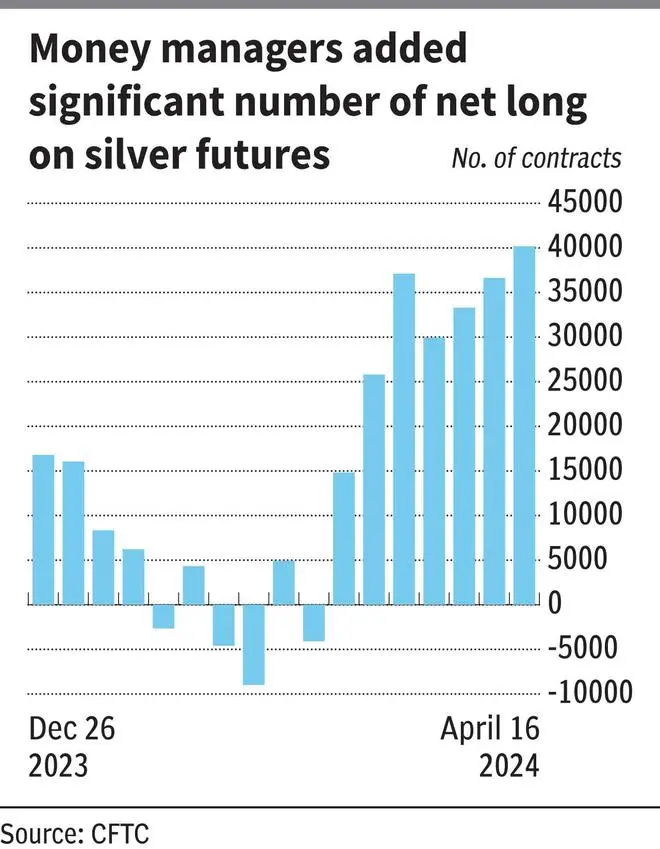

The recent upswing in price has coincided with an increased interest in silver from managed money. The COT (Commitment of Traders) data, released by CFTC (Commodity Futures Trading Commission), shows that investors bought a considerable amount of silver futures. Managed money was net short on silver futures by 4,083 contracts on February 27. They overturned the position and on April 16, their net long stood at 40,190 contracts. This indicates that the capital inflows to futures played a significant role in the recent upmove in price.

However, one should be wary, given that such a speculation-powered rally comes with higher risk. If the consensus outlook of these investors turns negative, they can offload their positions, possibly leading to a quick downward reversal in price.

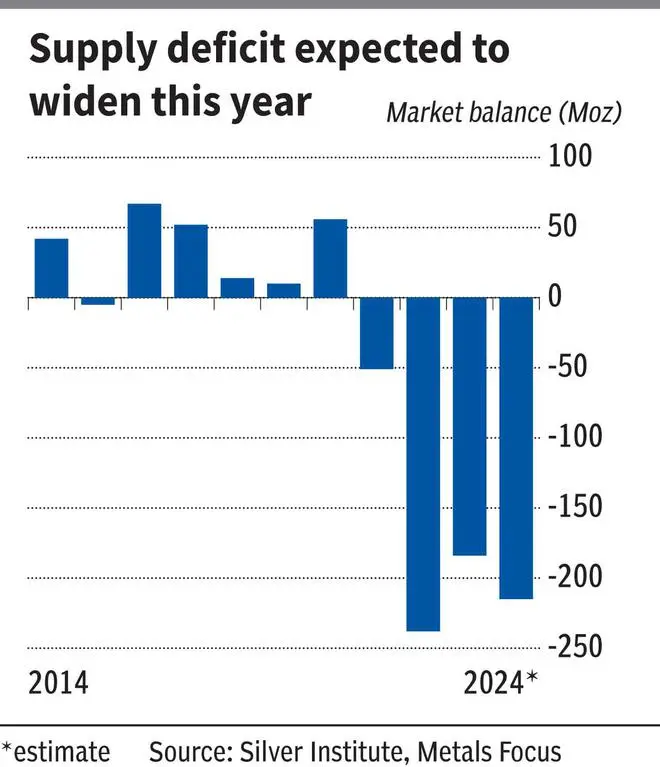

That said, positive factors include a projected increase in industrial demand and an increasing supply deficit for 2024.

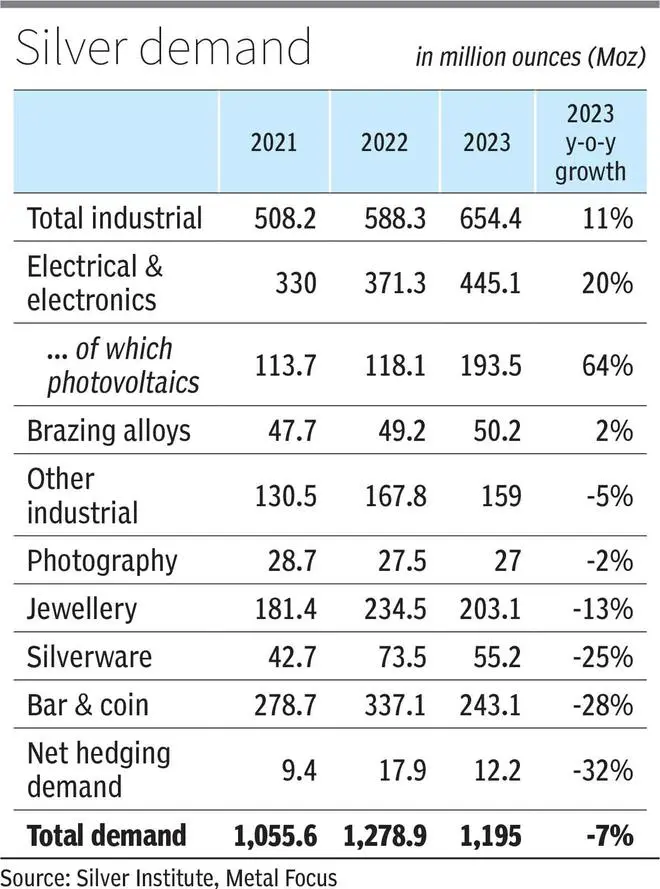

In 2023, the total demand for silver dropped by 7 per cent to 1,195 million ounces (Moz), according to the data by the Silver Institute and Metals Focus. However, industrial consumption, the major contributor to the overall demand for this metal, expanded by 11 per cent to 654 Moz.

The E&E (Electrical and Electronics) consumption hit a record high of 445 Moz, underpinned by a surge in PV (photovoltaics) demand. PVs are nothing but solar cells used to construct solar panels.

While more countries have been installing PVs in recent years, huge capacity additions in China led to massive demand for solar cells in 2023, which translated to considerable increase in silver demand.

On the other hand, the physical investment demand dropped 28 per cent to a three-year low to 243 Moz last year. Jewellery demand, too, shrank by 13 per cent to 203 Moz. Together, the physical investment and jewellery demand contributed to 37 per cent of the total last year.

For 2024, the Silver Institute and Metals Focus project the total demand to grow 2 per cent to 1,219 Moz. The industrial consumption is expected to grow 9 per cent to 711 Moz as China is anticipated to further boost the solar capacity, leading to demand for PV. However, the pace of addition could drop, going ahead, which can dent the incremental demand.

The supply, on the other hand, can slightly drop to 1,004 Moz in 2024, compared to 1,011 Moz in 2023. This can lead to a higher supply deficit of 215 Moz this year compared to 184 Moz last year. In fact, supply has been falling short of demand since 2020. Against this backdrop, apart from 48 per cent return in 2020, silver prices did not respond to the supply deficit between 2021 and 2023.

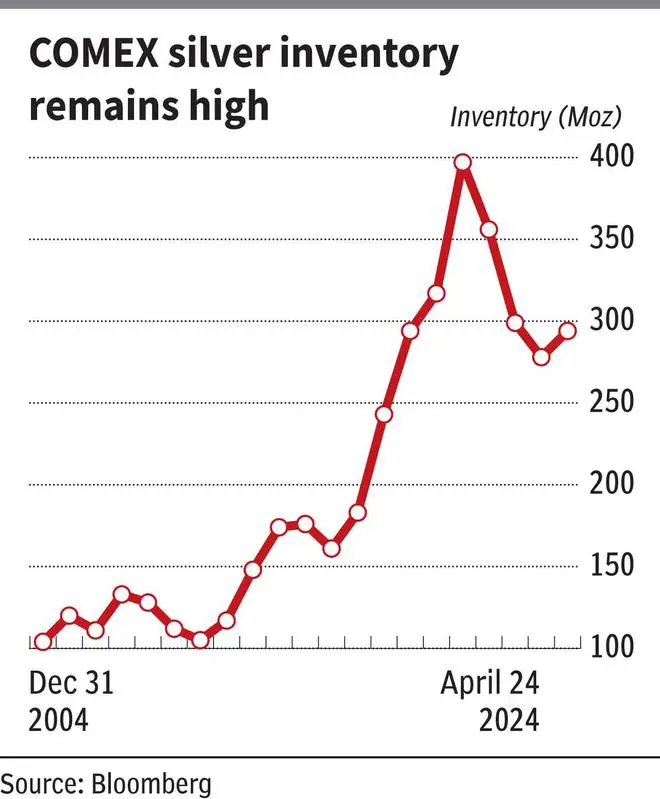

The ‘above-ground stocks’ i.e., the available inventory of silver, have been more than covering the gap between the demand and supply. The COMEX inventory data shows that although there has been a drawdown in recent years, the stock remains high (see chart). So far in 2024, we can see a slight increase in the stockpiles. As on April 24, 2024, the silver inventory in COMEX stood at 294 Moz.

Considering the above, the industrial tag of silver is unlikely to help in lifting the prices. So, going forward, the driver could be its precious metal tag. This will largely boil down to market sentiment and the central banks’ actions, especially by the US Federal Reserve.

When it comes to safety, precious metals and treasuries are the assets that investors prefer to park their money in. As bonds are interest-yielding assets and precious metals are not, in a high interest rate environment, it is natural for participants to invest in the former. But when the interest rate falls, the appeal for precious metals increases, potentially leading to some asset reallocation.

This is exactly what the market has been expecting for quite some time. The Fed is expected to start its rate cutting cycle in 2024. Anticipating this, money started chasing gold and silver recently.

However, the timing of the first cut is still very uncertain, especially considering that inflation in the US has been on a rise so far this year. It increased from 3.1 per cent in January to 3.5 per cent in March, the highest since September last year. In addition, the advance estimate of US GDP for the first quarter of 2024 was at a lower rate of 1.6 per cent against the expected 2.4 per cent. These factors would mean that the Fed will not be in a hurry to embark on a rate cut cycle.

Now that the recent rally in precious metals has been more due to the speculative money trying to get ahead of the curve, a delay in rate cut can lead to exit of these positions. So, there is a good chance for the price to see a blip before the actual rate-cut powered rally begins.

So, what should investors do now? Is it beneficial to buy silver? Below is our take.

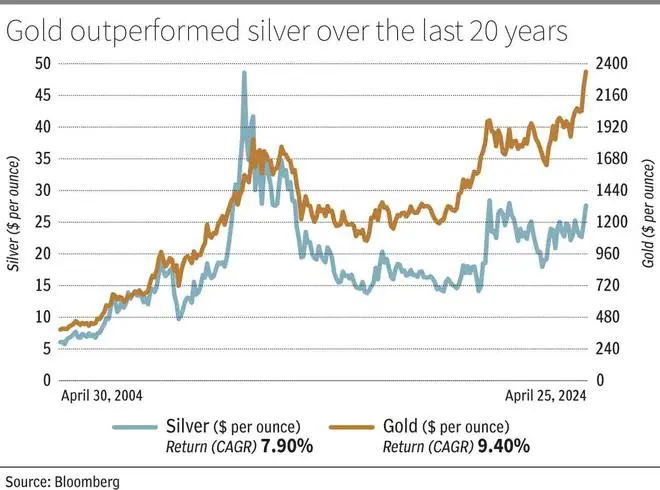

Investment objective is the key here. In our Big Story published on May 8, 2022, (First lessons in silver investing) we discussed the difference between gold and silver. The yellow metal produced better long-term returns than silver. The last 20-year return of gold and silver is 9.4 and 7.9 per cent CAGR (compounded annual growth rate). Also, it has very low correlation to other assets. So, for participants eyeing long-term opportunities and those who are looking to diversify to reduce portfolio-level risk, gold can be ideal. And any time is the right time to invest in gold for these objectives.

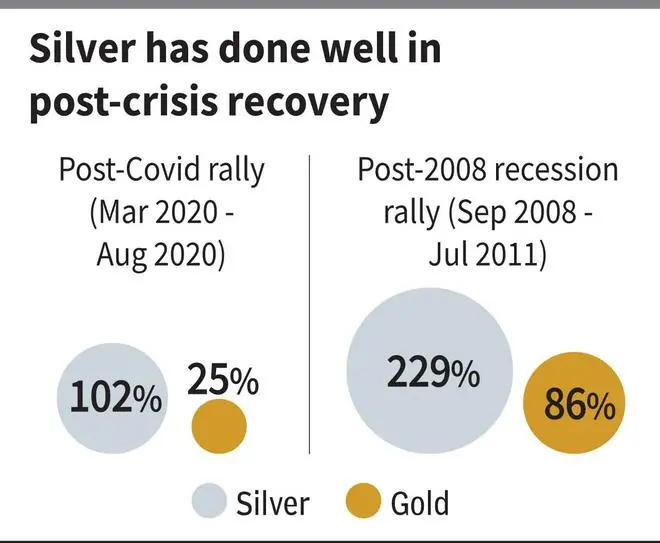

However, there were times when silver outperformed gold in the past. These were during economic expansion and during the recovery phase post a crisis. Note that silver is 1.5 times more volatile than gold. So, depending on the composition of your existing portfolio, it might increase the total portfolio risk. Hence, silver should be viewed as more of a tactical investment rather than buy and hold forever.

The yellow metal, in its response to monetary policy changes and crises such as war, has proved to be a better choice for investors in recent times. In the last three years, gold has gained 6 per cent CAGR while silver, only 1 per cent CAGR, in the backdrop of events such as Fed tightening cycle, Russia-Ukraine war and the recent Israel-Palestine and Israel-Iran conflicts. Also, in the previous instances of the Fed cutting rates, gold has outperformed silver. Therefore, going by history, given the prevailing conditions, gold could better silver in terms of returns, going ahead.

That said, there are certain factors that are in favour of silver. If the global economy avoids a recession, the risk-on sentiment will prevail, which is good for the white metal. In addition, the gold-silver ratio hints that silver has the potential to outperform.

Gold-silver ratio, also known as mint ratio, denotes the number of ounces of silver required to buy one ounce of gold. It is obtained by dividing the price of one ounce of gold by the price of one ounce of silver. The ratio goes up if gold outperforms silver and vice-versa. It can be used as one of the tools in finding the relative valuation between gold and silver, thus helping us evaluate the relative performance of gold and silver in the future.

Currently standing at 86, the ratio has predominantly stayed within 75 and 90 since early 2022. Now, it is near the upper limit of this range, meaning the ratio is likely to fall. That can be taken as a sign of potential outperformance by silver compared to gold. That is, if both metals rally, silver’s can be at a faster rate. In case the prices of both precious metals fall, silver’s decline might be at a lower rate. Nevertheless, investors should note that this cannot be taken as the holy grail of indicators and conclude that silver is up for a rally. Consider this as an additional tool along with other factors — such as changes in monetary policy, fundamental aspects of precious metals, etc.

Broadly, although there could be some correction in price from the current levels, both precious metals are expected to post gains over the next one-two years. So, investors, based on their objective, can decide between the two.

Those who look for portfolio-risk-mitigation can opt for gold through the ETF/SGB route whereas investors with higher risk appetite can take exposure to silver through silver ETFs.

Silver, since early 2023, has been oscillating in the range of $21-26. But in the first week of this month, it broke out of the barrier at $26. It then marked a three-year high of $29.80. Last week, it closed at $27.2.

The chart shows that the $30 price region is a considerable supply zone, thus acting as a substantial resistance since August 2020. So, there is a good chance of a price correction from here.

Henceforth, $26 will act as a support. Below this, silver can find a rising trendline support at around $24. So, the price correction is likely to be limited to the $24-26 price band. Eventually, silver is expected to recover and break out of $30. In such a case, the price can surge to $35, its nearest potential resistance. Subsequent resistance is at $42. The life-time high for this metal is $49.60 made in April 2011.

In case the downswing extends beyond $24, silver has a good base at $21. The broader trend will be bullish as long as the price stays above $21. However, a drop to this level might mean that the breakout of $30 will take longer.

Published on April 27, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.