In recent times, stock market investors in India seem to be flocking to the options segment. The average daily turnover in options has been skyrocketing; the turnover of index options premium, particularly, hit a record high of ₹11.1 lakh crore in September on the National Stock Exchange (NSE), an increase of about 162 per cent compared to the turnover in September last year.

However, while entering this space is easy in the age of zero-brokerage mobile apps, making money is not. Apart from a very few, an overwhelming majority of participants struggle to make money consistently when it comes to options. The problem does not begin when traders book their first loss. It starts even before punching the first order, when they neglect to understand how options work.

It is imperative to know that the pricing of options is not straightforward, like futures. Futures are entirely correlated to the moment in stock/index prices and thus track the underlying at marginal discount or premium. Options, on the other hand, is a more complex product. It is a product where a mathematical model is at work and comprises several components. In India, the NSE uses the Black-Scholes-Merton model, often referred to as Black-Scholes or BSM model, to set the base price of an option.

Trading options without understanding how they are priced is multiple times riskier than investing in a company whose business you don’t understand. This is because the rate of change in options prices can also be at multiple times the rate of change in value of the underlying, and hence errors in decisions can have debilitating impact. While dwelling deep on the pricing model is beyond the scope of this article, given below is the formula to calculate a call option’s price. Here, we get to know the factors at play in determining the price:

Call option price = N(d1)*S – N(d2)*K*e^(-rt)

Here, S is the spot price of the underlying asset

K, the strike price of the option

r, the risk-free rate

t, the time to maturity

e, the mathematical constant i.e., 2.718

N(d1) is the normal distribution of the probability of how far in-the-money the option will be on expiry

N(d2) is the normal distribution of the probability that the option will expire in-the-money i.e., the price of underlying above the strike price

d1 and d2 contain the time and volatility components i.e., the time to expiry of that option and the standard deviation of that security

While this may appear complicated, it is not necessary for traders to become experts at solving equations. In fact, there are free option price calculators online wherein, once you provide the necessary inputs you will be given the expected price.

You will also not instantly become a successful trader once you know the equation, either. It just shows that the most important factors that traders should worry about are volatility and time component.

Option price has two components i.e., the intrinsic value and the time value. Intrinsic value is determined based on the security’s price in relation to the strike price. For example, you own a 100-strike call option of a security trading at ₹110. Suppose the market price of that option is ₹15. The intrinsic value of this option is ₹10 (₹110-100) and the remaining ₹5 is the time value.

But how is this time value determined? If you track options prices regularly you will notice the prices shooting up or crashing occasionally even when the underlying asset stays flat Similarly, there will be days when the option prices would have hardly moved or even declined despite the underlying moving in the direction of the strike price. Implied Volatility (IV), the significant factor in the time value component of an option, is the reason for this. Other factors that can influence the time value are the underlying’s price, strike price and interest rate but not to the extent of IV.

IV tells you how volatile the underlying is going to be over the life of that option i.e., it indicates the market expectation of how far the asset can move but not the direction. You can refer to India VIX, the volatility index, to know the broad market volatility. India VIX is calculated using Nifty 50 index options.

When expectations of volatility or a considerable move in the asset price rise, the demand for an option increases and thus, IV rises and vice versa. Sometimes, the demand for an option drops, resulting in implosion of IV, and this is the reason that traders sometimes lose money despite getting the direction correct.

That said, IV and HV (Historical Volatility) are not the same. While IV gives a hint about the future, HV shows how volatile the security has been in the past, in a particular period.

So, taking note of what the prevailing IV is and how much time is left for expiry can help you greatly. In general, monthly options are expected to witness most time decay during the week before the expiry i.e., in the third week of the month. Time decay is nothing but the decline in option price as time goes by, irrespective of the movement in the underlying. That is, even if the stock price and volatility stay flat, option price loses value as we approach expiry.

Apart from time and volatility, Greeks are other factors that can influence the price of options.

They can be remembered as sensitivity of options to various other factors. The five options Greeks are delta, gamma, theta, vega and rho.

Delta is the rate of change of option price for one rupee change in the underlying asset.

Gamma represents the rate at which delta of an option changes given a one rupee move in the underlying.

Theta shows the rate at which the price of an option decreases with respect to time, all else equal.

Vega tells us how far the option price can change for a 1 per cent change in volatility.

Rho indicates how much the option price will change for a 1 per cent change in the interest rate.

There are online portals where you can find the Greek values of the option that you want to trade.

Understanding the above factors can make you a better trader as they can aid in deciding whether buying or selling is better at any given time.

One can form a multitude of strategies with options. But whether buying or selling is right has much to do with your expectation of the market.

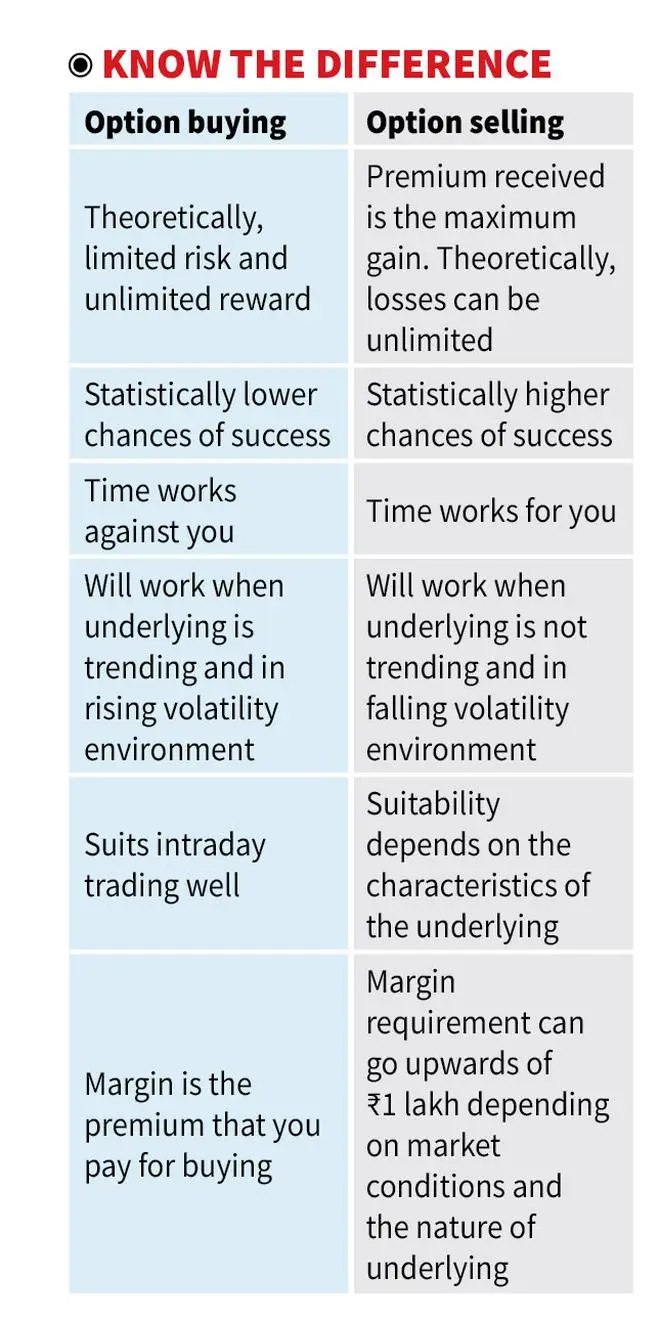

Theoretically, buying options means limited risk and unlimited reward. But the trick is the probability of success is very low as time will work against you.

Options buying will work when the underlying security is trending with good momentum (either up or down) and when volatility goes up (usually triggered by an event). It can be a good tool to monetise on intraday price movements where the exposure to time is just one day.

On the other hand, for sellers, the premium received on selling is the maximum gain whereas, theoretically, the losses can be unlimited if one gets the direction wrong. That said, the probability of success is higher because of the time decay. However, selling requires more margin which, at first, can be unappealing.

Selling works best when the underlying is not trending and when volatility is expected to decline. So, rather than restricting yourself to being any one — i.e., buyer or seller for eternity, be a little flexible and execute strategies based on where you expect the market to move. Make sure to ascertain the scope and extent of potential gains and losses in an unbiased manner before executing any trade.

Possibilities are numerous as there are option trading strategies that one can adopt. Each will work in a different scenario, and one needs to find the best fit for the existing market conditions to increase the odds of success. But for that, you should form a view not only on direction but on volatility as well.

For instance, you might expect the volatility to remain largely the same and the underlying security to appreciate in the short run. Here, a plain vanilla call option can be an apt strategy.

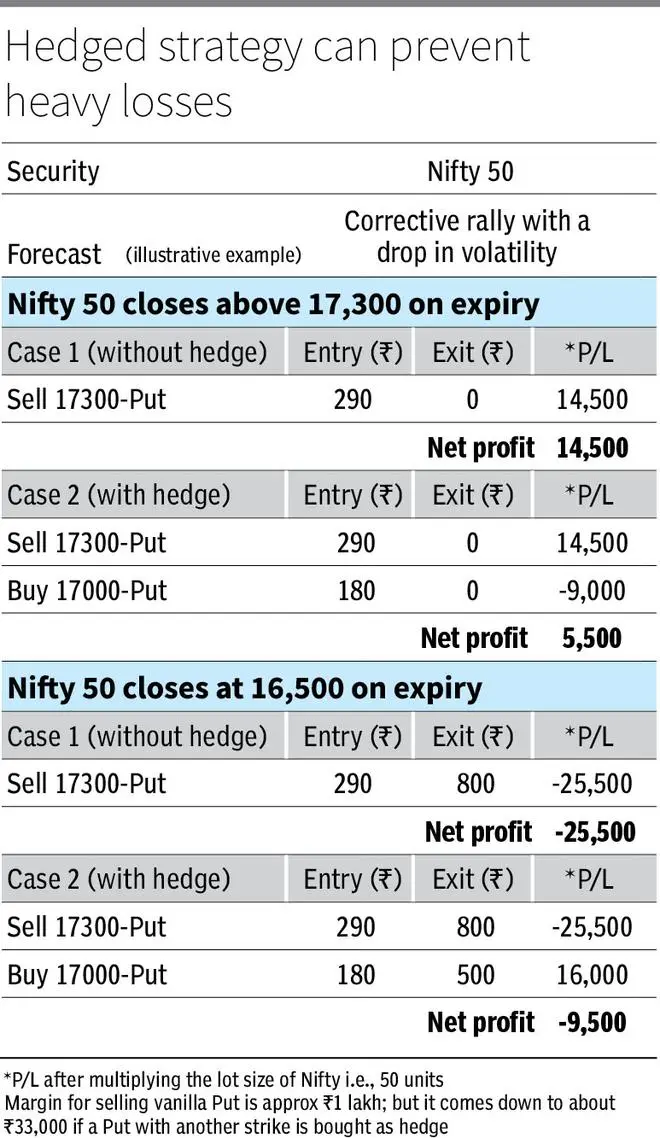

What about a situation where you conclude that a security has fallen beyond explanation and volatility shot up too much and believe the time is ripe for at least a corrective rally? Normally, in such cases, the volatility will also decline as price goes up. Meaning, one should look for a strategy to short volatility and capture the upward movement in price as well. One can sell put options here.

Selling an option requires a higher margin which can be equivalent to that of trading a futures contract. Apart from the fear of theoretically unlimited loss, this is another factor that puts off retail traders when it comes to selling. But one can bring down the margin requirement.

Take the above scenario of selling a put option. In addition to selling a put contract, one can buy a put option with lower strike simultaneously. Yes, it will eat into your profits to the extent of the premium that you pay for the long put, but it can also be a hedge giving you a valuable safety net should you go wrong with your prediction. Refer table for illustration.

So, rather than always opting to take long positions, executing a combination of both is a good way to sustain and have a chance of making money over the long term.

Published on October 8, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.