It’s a growing tribe within the banking industry with two initial public offerings just this year and there may be more to come in 2024. Yet there is a cloud of doubt on this segment. The case in point is Small Finance Banks (SFBs). More often than not, critiques are quick to dismiss the model as a failure and in this background, is it possible for investors to take a long-term view on SFB stocks? Yes, we can, if one is willing to look at this segment with a different pair of lens.

The journey of large banks such as ICICI Bank, HDFC Bank, Kotak Mahindra Bank or even some of the old-generation private sector banks such as Federal Bank and City Union Bank is very different compared to SFBs. Created as a concept in 2014 and licensed a year later, the segment is barely even a decade old. It is still at the low quartile of the growth curve and to that extent it may be right to say that SFBs are still in the process of finding their feet in the system. Hence, investors may need to assess them using different parameters to judge whether they are suited for the long haul and have it in them to get to the next level of growth phase. Here’s a checklist that SFBs must tick and a few aspects that shouldn’t worry you unduly in the process of weighing them.

The banking sector average advances growth has been around 14 per cent, post pandemic. Going by their size and the fact that they are in an experimental mode, the default expectation is that SFBs should grow faster than the average. To be fair, since FY23, that has quite been the case, with growth secularly upwards of 27 per cent year-on-year across segments. Therefore, what becomes imperative is to scan into the quality of growth — namely, the ability of SFBs to broad-base the book, strike the balance between yield and diversification and yet keep pace with the broader return profile.

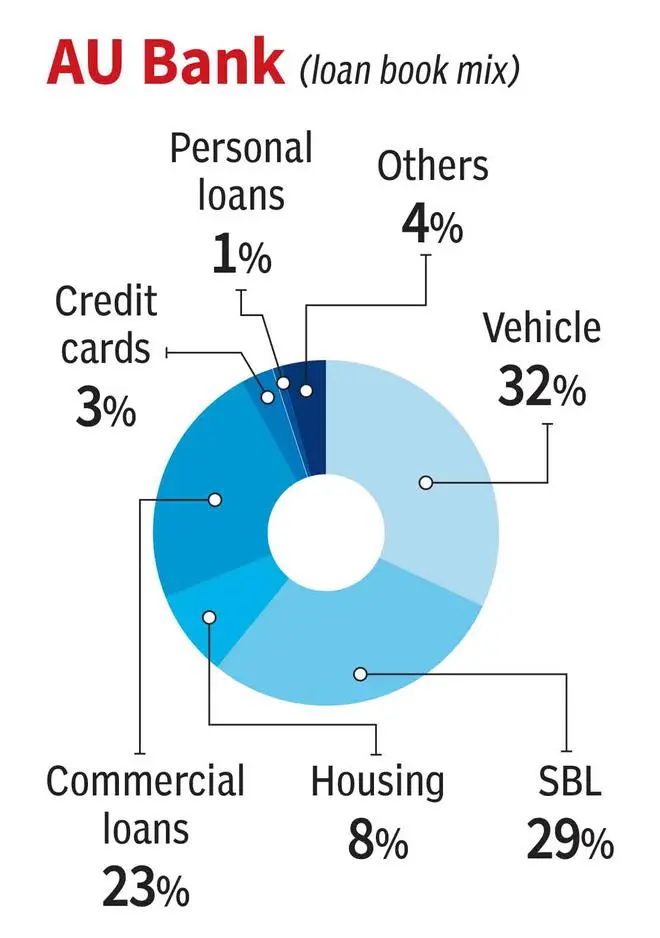

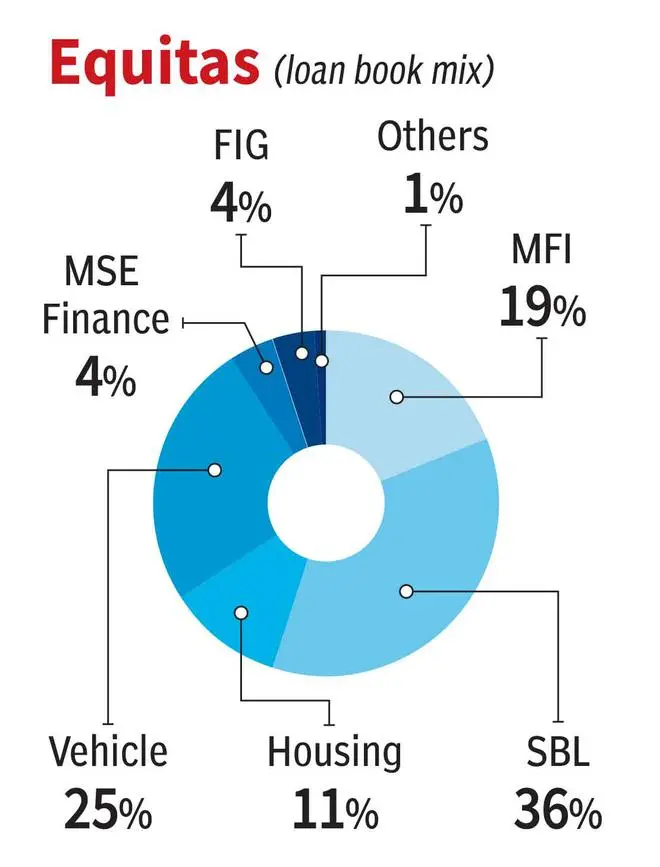

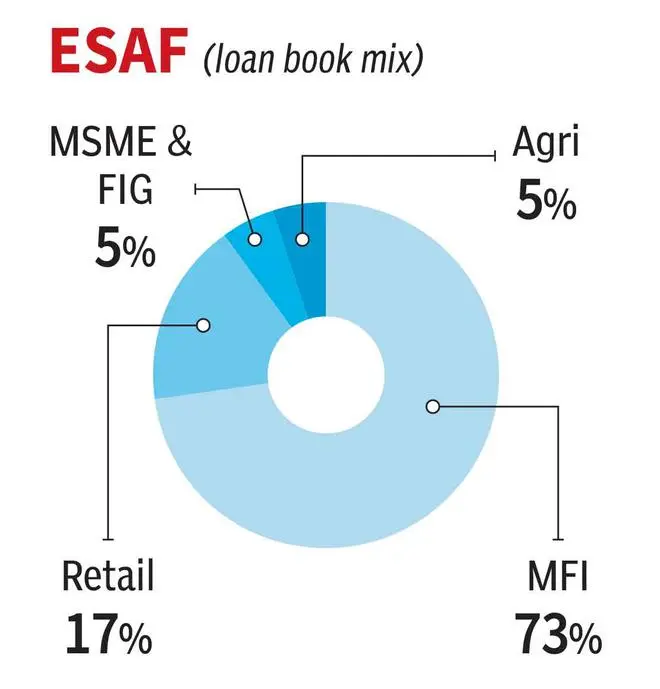

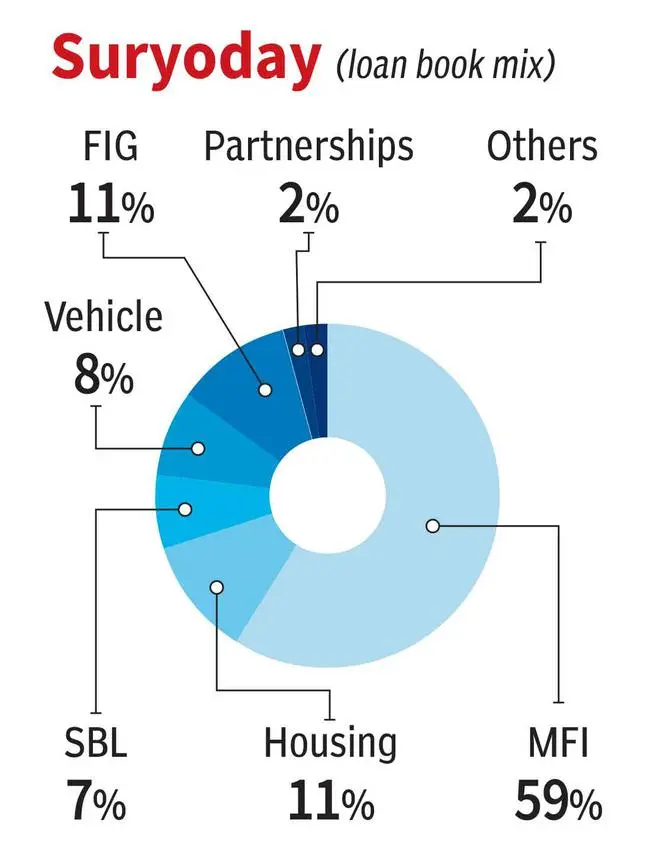

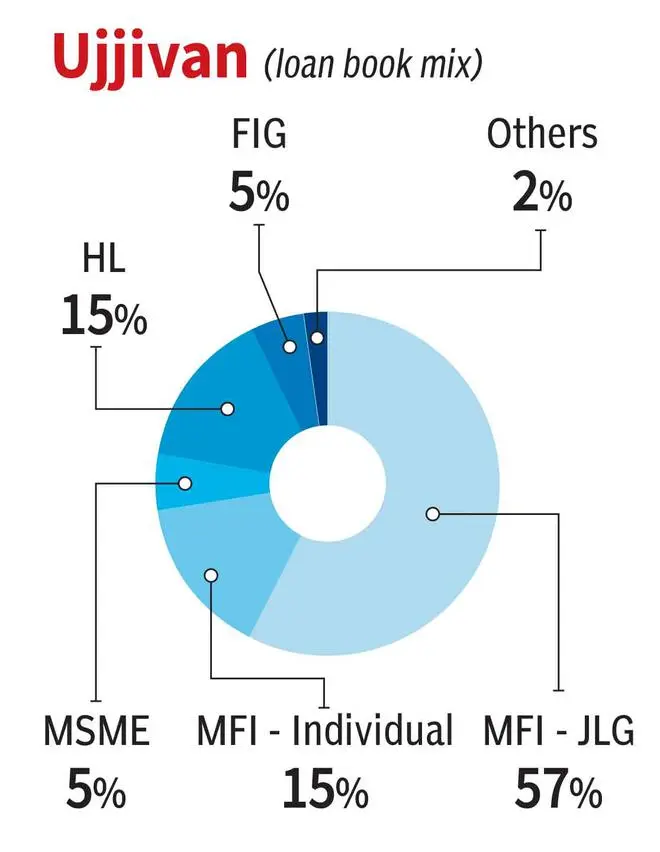

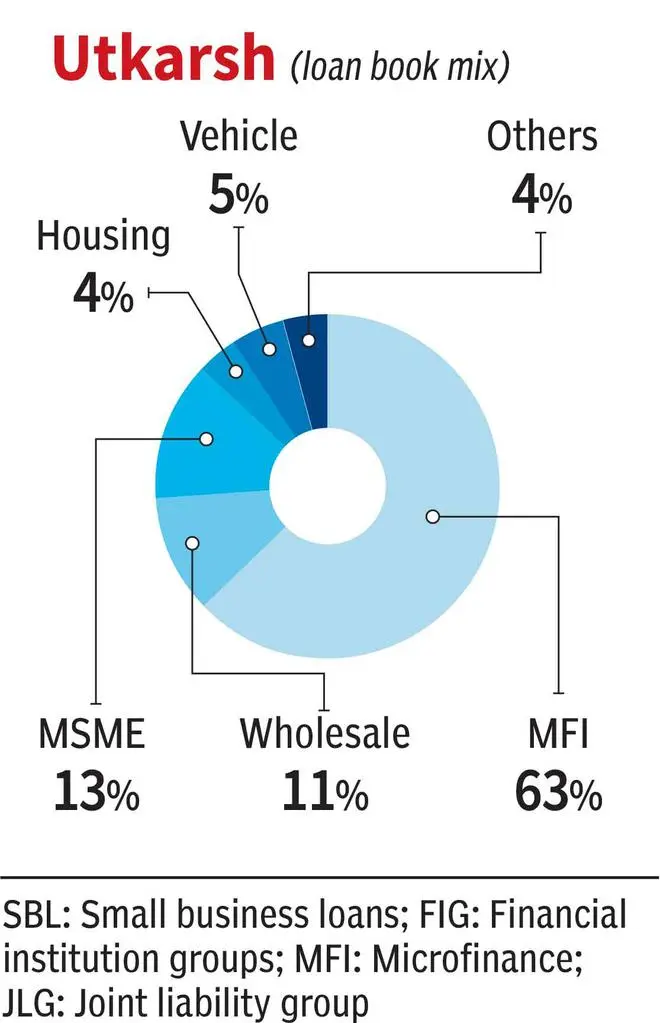

Barring AU and the unlisted Capital SFB, others licensed in 2015 carry microfinance pedigree. There again, while Equitas commenced its SFB journey with lower proportion of MFI loans compared to peers, loan book diversification efforts have been quite patchy so far in this segment. Other than Suryoday, which is getting closer to the management guidance of a 50:50 split in MFI and non-MFI portfolio, the rest of the listed players remain dependent on MFI loans. This is one aspect that might work against them till the efforts to have a broad-based loan book yield fruit.

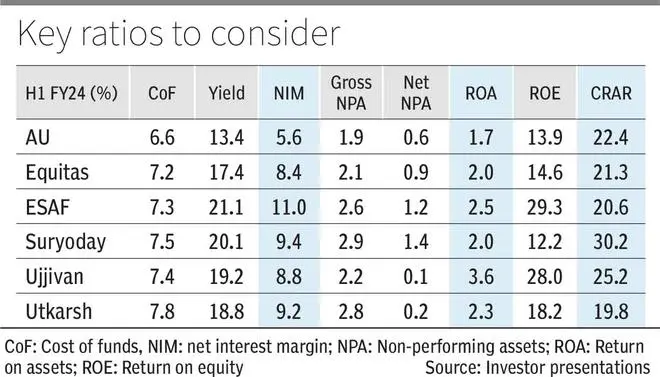

Net interest margin or NIM, which gauges profitability of banks, reflects the loan book composition of SFBs. AU followed by Equitas have relatively lower NIMs compared to peers and this is largely owing to a greater portion of secured loans that the two banks have. Secured loans earn lower yield compared to unsecured loans. The pricing advantage is also more pronounced in the latter. That said, AU is expected to get a bump up on NIMs post the merger with Fincare SFB.

For the MFI-dependent SFBs, what’s encouraging to note is a near 100 bps easing in NIMs from the peak FY20 level, which supports their diversification efforts and as the share of non-MFI loans decreases, the 9 per cent plus NIM maintained by the MFI-led SFBs may shrink by at least 200 bps as the other portfolios increase and season. This shouldn’t deter investors as it indicates the willingness of banks to let go of profitability for the sake of a diverse loan book. That said, an advantage SFBs have over their larger peers is their pricing ability since they cater to borrower segment (whether urban or rural) where they can exercise their pricing dominance. This, to some extent, has kept their overall yield intact and yield earned by SFBs may stay 150–200 bps higher than the private bank average. This is why their NIMs may remain superior to private banks’ average of 4.25 per cent for the foreseeable future.

Owing to their pricing power, SFBs comfortably earn 2 per cent plus return on assets and as the asset quality pressures ease and the quality of earnings improves, return on equity is also poised for an improvement. This should provide investors comfort while considering SFBs.

SFBs listed have 6–7 years of operational history. While they may have entered into businesses such as housing or vehicle loans, the book may be barely seasoned as the loans have not have seen a full cycle yet. While some SFBs give the year when loan products were introduced or product-wise NPA on a quarterly basis which would help investors gauge the maturity of the book, such level of granular information isn’t uniformly available. It needs to be sought on investor call or otherwise. But this is an important data to track. Whether the SFB is able to grow a product segment within its risk management framework and keeping a check on the product-level NPA is important to understand in the process of diversification.

As barely a decade old segment, costs will be steep for SFBs. Keep a tab on costs, but don’t judge them for that. Cost to income ratio, cost of deposits and share of low-cost current account – savings account (CASA) deposits may be very different for SFBs vis-à-vis established banks. For instance, CASA (a business that gets built over years) for SFBs tends to be lower than 30 per cent but the share of retail deposits to fixed deposits is around 80 per cent, and this is a good testimony for their ability to attract deposits. Likewise, with yield and NIM in the upper quartile, cost to income ratio of 60 per cent plus shouldn’t be perceived badly because till year 10–15 of their operations as SFBs, banks may still be in a heavy capex deployment mode and costs will look upwards.

The aspect that works most against them is their high interest rate payout on fixed deposits. Is this a safe bank to invest in if it should shell out such high FD rates is a question that strikes every depositor and equity investor, especially after the recent bank failures. While one should rely on the financials of the bank to take a call on the ‘safety’ aspect, with SFBs still in the phase of establishing themselves in the market, elevated FD rates may be the norm for the industry for the foreseeable future, especially given the overall high repo rate environment.

Having passed two major survival tests — demonetisation and Covid — the good news is that barring North East SFB which failed for different reasons, the nine that bagged SFB licence in 2015 have survived. Two more candidates got added to the list and that is a testimony of the model’s ability to eventually find success. What is, however, debatable is whether all the SFBs are equity market worthy just yet. Given that they have gone through crises caused by external factors, the model of each SFB needs more time to evolve in a manner that investors may appreciate better.

Therefore, those looking at the SFB space must have a long-term horizon (5–7 years as against 3–5 years for established banks) while investing in this segment. The real growth phase for SFBs may start in FY24 as a major part of their asset quality issues are behind them and with overall environment structurally in favour of the banking sector, SFBs will also gain. Therefore, as a model they have the ability to survive.

The question is whether there is space for all in the listed universe, especially in the backdrop of consolidation triggered by AU and Fincare. Also, given how capital has been consumed in the last three years across most SFBs, sooner than later they may be faced with the need to raise money from the market. Will patient money once again chase this sector to support its growth phase like it did about a decade back when large investors bailed out NBFC-MFIs from the 2010 crisis? That would be the true test.

Published on December 16, 2023

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.