With medical costs inching up every year, ₹1-crore health covers are gaining popularity. The new-age policyholder doesn’t seem to be shying away from taking large positions in health insurance, akin to his/her investment portfolios. But the allure of such large health covers should be analysed from the angles of need, affordability, and what you get for it.

Here’s a look at some factors that can help you decide whether you need a large cover.

The premiums for a ₹1-crore cover may tempt you to go for it. On an average, for a 30-year-old male with no pre-existing conditions, a ₹5 lakh/20 lakh/1 crore health cover will cost ₹7,791/12,775/20,100 per annum respectively (average of fifteen leading insurance providers). The bang for buck is clearly evident with only a 50-60 per cent increase in premiums across the categories for a 300-400 per cent increase in cover. On a normalised basis, across insurance providers, a ₹5-lakh cover would be available at ₹16 per ₹1,000 of cover, ₹6 per ₹1,000 of cover in ₹20-lakh category and ₹2 per ₹1,000 cover in the ₹1-crore category. The pricing implication suggests that the primary risk is that of being admitted for medical care. Beyond this, the rare risk of an outsized claim is a manageable event and hence not priced proportionally.

Policyholders may choose to focus on increasing their cover, but the over 50 per cent increase in annual premium (that comes with ₹5 lakh to ₹20 lakh or to ₹1 crore) should also be kept in mind. As costs are certain and health claims are sporadic, the likelihood of outsized health claims is rare, at least going by a normal distribution. Instead, personalised needs and affordability of premiums over the next twenty years should be factored into the purchase consideration. Also, premiums are inflationary over longer periods and increase further on change in health conditions. In such a case, starting off from an easily affordable coverage and adding appropriate riders along the way may be beneficial compared to beginning with a bang.

Before considering a higher cover, one should exhaustively look to stretch lower ranged covers. The options available can surprise policyholders. Existing covers are enhanced by 100-200 per cent through options such as restoration of cover and No Claim Bonus (NCB) at no additional cost (near-standard in the industry). Even higher increase can be achieved by purchasing top-up/super-top up riders. Restoration of cover refills the health cover in any given year if a prior claim had depleted it. The chances of meeting a second claim in a year (normally to the extent of original sum insured) for an unrelated illness (w.r.t to illness in first claim) are improved with this feature.

Niva Bupa, SBI General, Star Health, Chola MS and Manipal Cigna cover related illness as well. The NCB feature gradually increases bonus cover to match the original cover. The original cover is doubled in Manipal Cigna’s case and is moved up by 50 per cent with New India Assurance. The rate of doubling the cover with NCB can be gradual (over 10 years) or fast (within three years) but so will be the pace of retreat on making a claim in any year. In general, over five years, one can at least double one’s cover at no additional cost using restoration of cover and NCB.

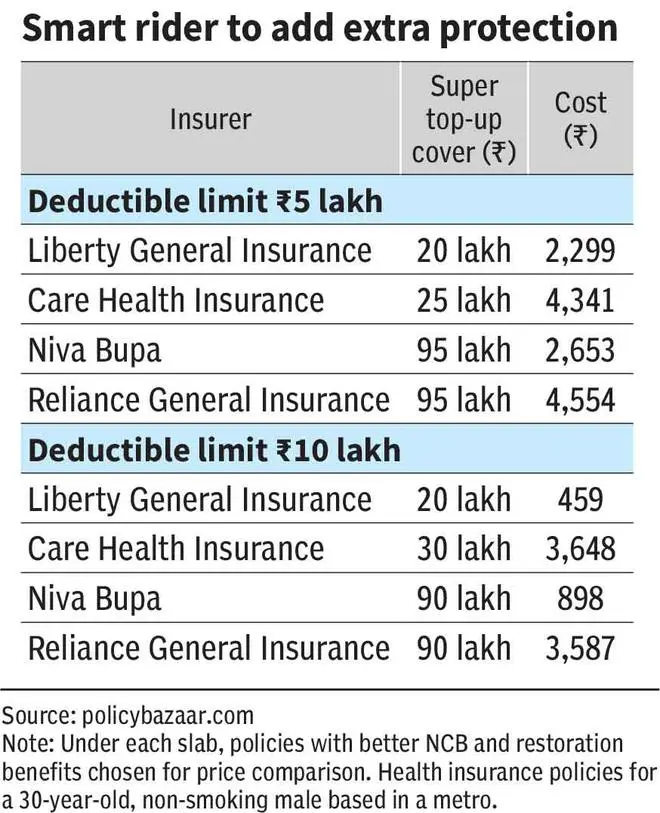

Top-up/super-top up riders purchased additionally over the base policy kick in when the pre-decided deductible limit (claim amount paid by the policyholder or base policy cover) is breached. In fact, some insurance providers are featuring this option (₹5/10 lakh in base policy + ₹90/95 lakh in super top-up as an alternative to their own ₹1-crore covers — Aditya Birla and Niva Bupa, for instance. Compared to an outright ₹1-crore purchase, which costs around ₹22,000 for a 30-year-old male, this option is cheaper at ₹9,500 at Aditya Birla. Alternatively, one could buy a ₹5-lakh cover for ₹8,500 and add a super-top-up of ₹95 lakh with a deductible limit of ₹5 lakh for a total premium of ₹10,500.

Critical illness rider is also another form of covering high-cost procedures. The rider can be purchased to provide a lump sum amount (ranging from ₹10 lakh to ₹1 crore) on the diagnosis of a critical illness (20 to 60 ailments covered). This provides an alternative to buying a large health cover if the primary concern is to cover these indications.

The difference between a ₹5-lakh and a ₹1-crore health cover is essentially in the inpatient cost cover. One cannot expect lower waiting periods for pre-existing diseases or higher sub-limits with a higher cover. The basic product and the critical features (day care procedure list, NCB and restoration of cover) are common across higher or lower ranges of covers. In fact, when it comes to room limits, even a ₹5-lakh cover offers single private AC room in most policies. Only New India Assurance has a room rent limit of ₹5,000 with its r ₹5-lakh health cover.

However, a ₹1-crore policy can help in some ways. For instance, cataract surgery sub-limit is placed at 20 per cent (upper limit of ₹1 lakh) in Bajaj Allianz, which might lead to some out-of-pocket costs when claimed with a ₹5-lakh cover. Similarly, accidental death benefit matches sum insured at Star Health, implying a higher accidental death benefit can only be met with a higher cover. While single private AC room is the limit in HDFC’s health insurance, the limit for covers above ₹50 lakh is removed. With some other high-value policies, OPD covers, dental benefits, free check-ups might improve for higher covers.

Considering the cost of treatments abroad, global coverage makes better sense when health cover is higher. In this regard, TATA AIG Medicare plan allows for reimbursement of inpatient treatment cost abroad if the diagnosis is made in India (compared to only worldwide emergency treatment cover across other policies).

So, given the factors discussed above, how much cover is ideal? While medical treatment costs and the inflation in the same, year after year, can be an indicator, the right health cover is ultimately a personalised decision. Factors that nudge the policyholder to take the required cover higher or lower include medical histories as well as existing insurance back-up with employers, for instance. After weighing these factors, the health cover and how much you spend on the premiums should not chase extreme outlier risks at the cost of affordability and hence, continuity of the policy.

While health risks are common for all, risks flagged in family medical histories, specifically those being tackled by modern science or the latest technologies, call for a higher cover. Amongst these are immunological and oncological conditions. Breast, lung or ovarian cancer may have been a death knell in the past but with medical advances, they now carry a recovery prognosis. But they come at a high cost of treatment and so do liver or kidney transplant procedures at ₹10-25 lakh compared to chronic conditions of cardiac, asthma, dialysis or even diabetes that carry a bill of ₹3-10 lakh at the higher end. Compare this with the average hospital bill of ₹2 lakh per admission (Average revenue per operating bed * Average length of stay) at leading hospitals.

The existing insurance provided by employers or State/Central organisations can temper the need for higher covers. But it is also a trade-off between your choosing to move out to an organisation where health cover may be lower or not provided or, say, becoming an entrepreneur where you will not have the safety net of a group health cover.

Family floater policy covers family members under one sum insured with a unified premium payment. There is scope to carve the health cover for each individual in a family plan but leaving it open for all may be beneficial. While opting for a family floater, a higher sum insured seems to be an automatic choice for many, the reason being that many individuals are covered. However, multiple family members needing medical care simultaneously in one year is still a low probability event. But for peace of mind, a higher cover is generally chosen in family floaters.

On a cost basis, a family floater is obviously cheaper than three or four individual policies and the paperwork involved will be much lighter. Comparing individual and family floater policies, for a ₹20-lakh cover from ten insurance providers, the average family floater premium comes at ₹25,000 per annum (Parents aged 35-30 and children aged 4 and 6). This is double the premium of an individual plan for each of them. For the same family, a ₹1-crore policy will be at an average ₹41,000 among the 10 insurers.

A lower, ₹5-lakh cover for the family is priced at ₹15,000. NCB and restoration of covers are similar to individual plans, allowing for near doubling of cover on claim-free first few years. The super top-up plans to enhance this cover are available from ₹6,000 to ₹11,500 for a ₹95-lakh cover and ₹5-lakh deductible limit.

Family floaters for the elderly (children and parents above 60 years) continue to remain expensive (starting from ₹45,000 for a ₹5-lakh cover). They may also need higher underwriting standards, including medical evaluation for policy initiation. Also, considering a higher medical care requirement for elders, it may be prudent to choose individual plans for the elderly.

Published on October 15, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.