istock/Tinnakorn Jorruang | Photo Credit: Tinnakorn Jorruang

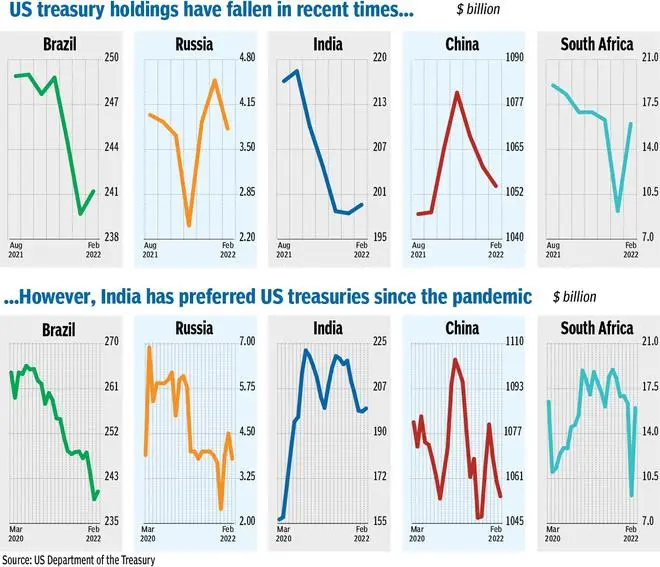

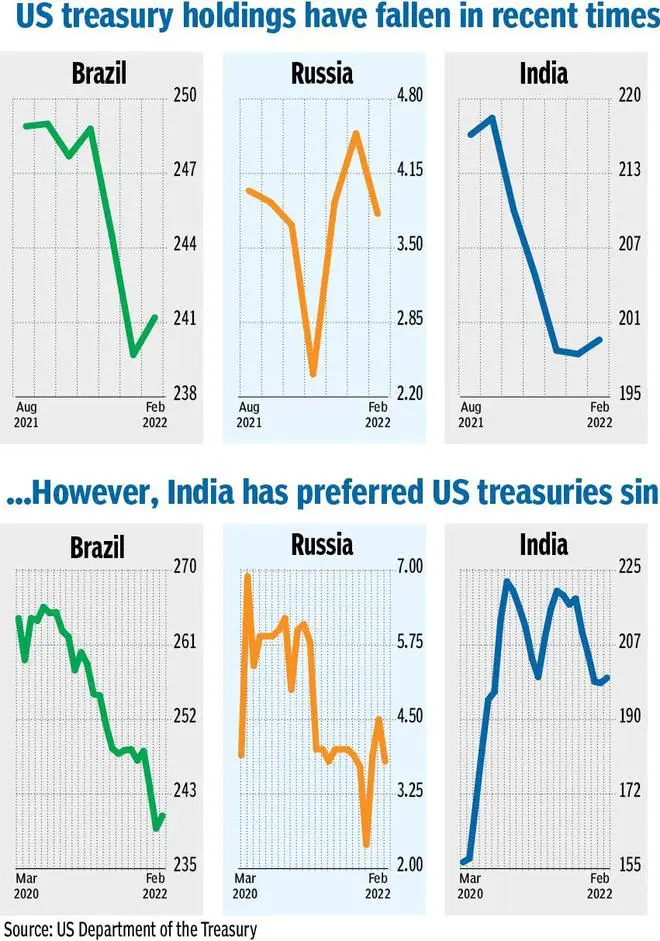

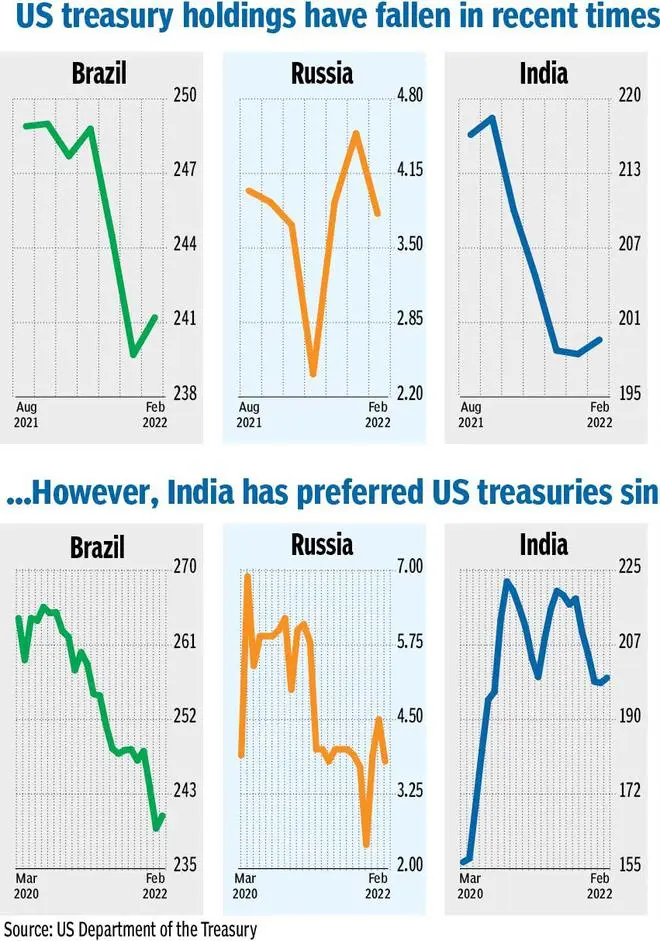

BRICS (Brazil, Russia, India, China and South Africa) countries have been reducing their exposure to the US Treasuries over the last six months. Data available from the US Treasury Department shows that South Africa has pared its exposure the most, followed by India. The US Treasury holding of India has declined from $217 billion to $199.8 billion over the same period — down by 7.93 per cent.

Among the foreign holders of the US Treasuries, Japan is the largest holder with an exposure of $1.3 trillion. China comes next with $1.05 billion. India stands at the 14 th position as of February 2022.

India and Brazil have shifted their affinity towards gold during this period. Foreign Currency Assets (FCA) and gold form a major part of any country’s forex reserves. The US Treasury is one of the components of FCA . For India, the FCA forms 90 per cent of its reserves. Within that, the US Treasury holding accounts for an average of 38 per cent.

Data till December 2021 from the World Gold Council (WGC ) shows that India and Brazil have increased their gold holding by seven7 per cent each in the second half of 2021.

Surging inflation, high prospects for an aggressive rate hike from the US Federal Reserve have made the countries trim their US Treasuries position.

However, experts believe that this is a short-term phenomenon and the demand for the US Treasuries will rebound. Gaurang Somaiya, Forex & Bullion Analyst, Motilal Oswal Financial Services, said: “Countries like India have just trimmed their position and not dumped the US Treasuries. When the US Yields settle down in the 3-3.5 per cent levels, the demand for Treasuries could come back. Everyone will start buying again at higher yields.”

For India, the US Treasuries have remained as the safe bet, especially at times of uncertainty. Thus, despite the recent trimming, India has been the largest buyer of the US Treasuries during the pandemic among the BRICS nations (Brazil, Russia, India, China and South Africa) since March 2020. India’s holding of the US Treasuries has gone up from $156.5 billion in March 2020 to $199.8 billion as of February 2022, as per data from the US Department of the Treasury. This is a strong 28 per cent surge. Over the same period, all other BRICS nations reduced their holdings.

What are the implications of this holding in today’s scenario for India?

“Returns from the US Treasury holdings will get impacted on the back of the rising yields. But the topmost priority is the safety of holding the Treasuries rather than the returns obtained from it,” said Rajani Sinha , Chief Economist, CareEdge Ratings (CARE Ratings).

Aditi Nayar , Chief Economist, ICRA, said, “The forex earnings of the Reserve Bank of India (RBI) are likely to rise given the larger holdings of the US Treasuries.

“However, at the current scenario of possible interest rate hikes, the pay-out from the RBI in the form of reverse repo and Standing Deposit Facility (SDF) might absorb a part of the higher forex earnings.”

Published on April 23, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.