I have 36 lots of Nifty 19250-strike call options expiring on June 29, bought at ₹15.05. Please advise whether I should wait till June 29 or book loss now?

Smruti Ranjan Panda

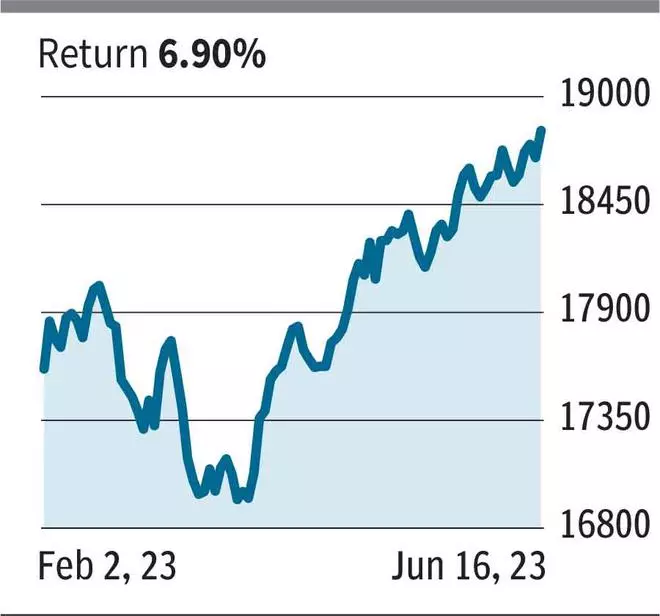

Nifty 50 (18,826): The index is bullish and the derivatives data suggests further upside from the current level. While the index will most likely hit the 19,000-19,200 region, how long it can rally above that level before the expiration of June contracts is uncertain. Because, before beginning the next leg of uptrend, there might be a corrective decline after the index touches the above-mentioned price region. Also, it’s worth to note that this week is the penultimate week before expiry, which means time value loss will be higher.

Given the above conditions, we suggest exiting the 19250-call (₹14.55) that you hold and trade in the July series. This will also buy you more time for the next leg of the rally to play out and also withstand the possible corrective decline from 19,000. Importantly, always prefer strikes with round numbers like 19,200 or 19,500. Our suggestion would be to go long on July (monthly expiry) 19200-strike call option if you intend to hold for next two or three weeks. This option closed at ₹96.3 on Friday. Exit this position whenever the underlying index touches 19,500.

I hold the June 20 expiry Fin Nifty 19500-strike call option. I bought this at around ₹75. Please advise

Kishore Babu

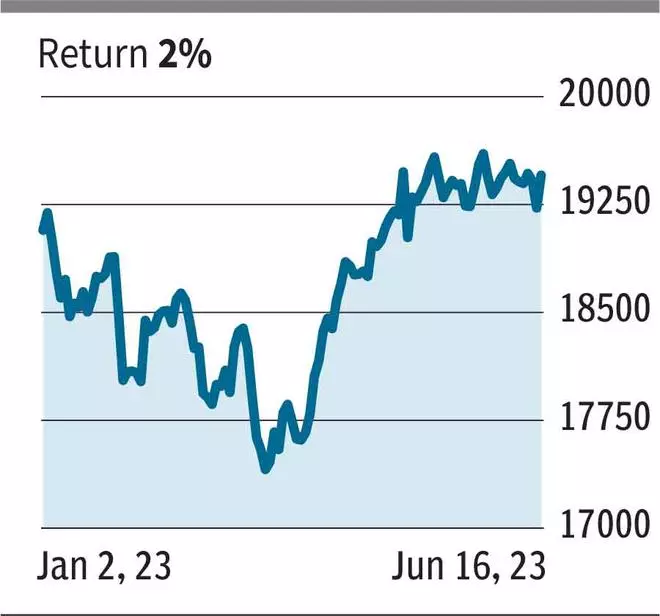

Nifty Financial Services (19,456.9): Even though this index closed last week with a gain, the price action on the daily chart shows that it has been oscillating within the 19,200-19,630 range for the past one month.

Technically, the next leg of trend can be confirmed only after the index moves out of this price band. As it stands, it is a make-or-break situation — there is a 50-50 chance that Nifty Financial Services will break out of 19,630. So, in our view, you have to take the hard call of liquidating the 19500-call option, which closed at ₹55 last week.

After liquidating, you can consider taking a position in Nifty 50, which is relatively more bullish than Nifty Bank and Nifty Financial Services.

Send your queries to derivatives@thehindu.co.in

Published on June 17, 2023

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.