An analysis of returns of Nifty 100 stocks in the last five years indicates that stocks ranked higher based on their ROE five years back (FY19 ROE), under-performed those ranked lower

In the world of investing, Return on Equity, or ROE, is a buzzword for fund managers, analysts, managements, et al. A high ROE is used to build a favourable investment case for a stock. Have you wondered how and why it matters, and is it really a defining metric to pick winners in the stock market?

Here is some food for thought. An analysis of returns of Nifty 100 stocks in the last five years indicates that stocks ranked higher based on their ROE five years back (FY19 ROE), under-performed those ranked lower.

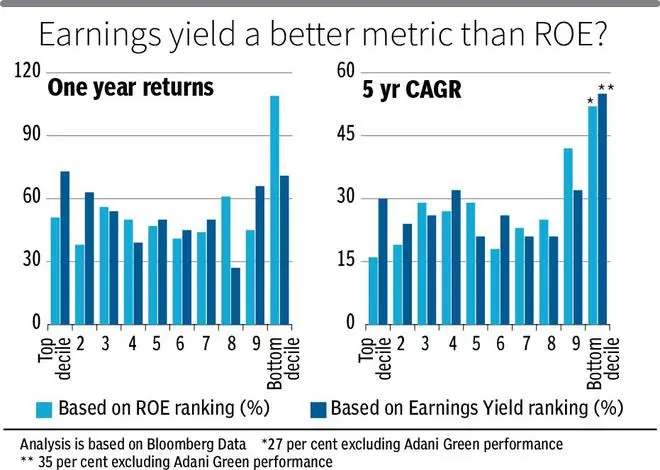

The average return of the bottom 10 stocks (in terms of ROE) in the last five years at a CAGR of 52 per cent, significantly outperformed the top 10 stocks that gave average returns of a mere 16 per cent CAGR.

On a one-year basis too, ROE failed as a metric to pick better performing stocks. While top decile ROE (FY23 ROE) stocks, returned 51 per cent, the bottom decile returned more than double that at 109 per cent. The top 50 per cent of the stocks returned 48 per cent, lower than the bottom 50 that gave total returns of 59 per cent.

Basing decisions by giving high weightage to a single metric is like holding onto one end of a rope without checking whether the other end is tied strongly or neatly, or whether it is tied at all.

The other end of the rope here is Price/ Book. ROE is nothing but net profits/ book value. It indicates the annual returns generated on the book value of a company. So, if a high ROE stock trades at a high price to book, then it is already priced into the stock and there may not be much value left for investors to capture.

This has played out in some of the high ROE stocks of 5 years ago. For example, stocks like Hindustan Unilever, P&G, Godrej Consumers Products, Marico and Britannia which were in the top decile, have under-performed Nifty 100 in the last five years. They were trading at high price to book in 2019, implying the high ROE was largely already priced into the stock. The key thing to note here is that, if you buy a stock with a high ROE of say 50 per cent, at 10 times Price/Book, your ROE (that is, the return on price you paid) comes down to a mere 5 per cent.

Thus assessing ROE against Price/Book (that is, ROE/(P/B)) or in other words, assessing the stocks based on the earnings yield (which is nothing but the inverse of PE) has turned out to be a relatively better metric to pick stocks. For example, close competitors in the IT space – Infosys and HCLTech had the same ROE in 2019, but HCLTech with earnings yield of 7 per cent then as against Infosys’ 5 per cent, has outperformed by a wide margin.

When the Nifty 100 stocks were ranked according to their earnings yield, the top decile stocks fared better with 5-year CAGR returns of 30 per cent as against 16 per cent when picked based on ROE. Of course, here too the bottom decile outperformed, but not by as much a margin as when picked purely on ROE. Nearly all high earnings yield stocks in the top decile which includes Tata Steel, Tata Power, Hindalco, Coal India, Hindustan Aeronautics have outperformed Nifty 100 by a wide margin.

When ranked based on earnings yield, the divergence in performance in stocks across deciles was lower too (see charts).

The other point to note is that the presence of stocks such as Adani Green in the bottom decile of rankings both on ROE and earnings yield makes the data look better. Excluding Adani Green, results in ROE ranked returns of just 27 per cent CAGR for the bottom decile, but still much better than the top decile.

ROE is a useful metric that helps screen for businesses with high capital efficiency. However, on needs to check how strongly the other end of the rope is tied. Successful investing covers multiple factors and ROE may be a factor, but overstressing on it may yield sub-optimal returns.

Beyond this, investors also need to factor for accounting related impacts to book value and ROE. For example, the ROE of HUL has crashed from 80 per cent in FY19 to 27 per cent in FY23. Accounting adjustments to its book value due to acquisition of GSK Consumer has increased its book value and reduced ROE although its profits have continued to compound in the last five years.

Published on March 23, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.