Remember the rush to get into small-cap funds last year as indices soared? Turns out, by-end 2023, arbitrage funds became the most purchased category seeing gross sales of over ₹1.59-lakh crore.

And if you assumed raging benchmark indices would make investors take to active investing than passives, see this: Non-gold ETFs (₹1.44-lakh crore) and index funds (₹85,408 crore) were in the second and third positions in terms of gross sales made from January to December 2023.

Curiously, investors chose sector and thematic funds to play the rally in several key segments during 2023 as the category notched up ₹77,525 crore in gross sales. Small caps came fifth in the list with ₹68,395 crore in purchases during the past year.

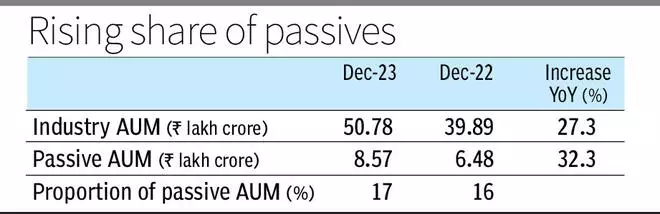

Passive assets under management rose faster than the overall industry’s assets in 2023, indicating the increasing interest around the space.

Here is more on these key trends in investor choices during 2023.

Opportunities aplenty. After a steady outflow, arbitrage funds turning attractive

Arbitrage funds found favour with the markets as they give debt-like returns but enjoy equity taxation.

With cash-futures arbitrage being the main strategy used by these funds, the risks are quite low. The top 5-7 funds in the arbitrage category gave more than 8 per cent returns over the past one year, much higher than most debt schemes.

And with tax on gains made on holding period of more than one year being 10 per cent for profits beyond ₹1 lakh, the proposition was quite attractive amidst rising and often volatile markets, giving rise to arbitrage opportunities.

Investors once again reiterated their interest in passive funds with index schemes figuring prominently in gross purchases. Given the lower costs and limited fund manager risks, many investors seem to prefer these schemes. In fact, index funds had the among the highest net sales as well.

Now, in another direction, with sectors such as infrastructure, power, realty, construction, rallying 50-100 per cent in 2023, investors gravitated towards underlying funds in these categories to take advantage.

The preference for small-cap funds was not a flash in the pan though. With the index seeing a robust 50 per cent plus rally, this space, too, had higher net sales compared to most other categories.

In 2023, passive funds outpaced the industry. With ₹8.57-lakh crore in asset under management as of December 2023, their size increased 32.3 per cent over December 2022. This was a good 5 percentage points higher than the overall mutual fund industry’s AUM. The proportion of passive funds to the total AUM has also increased from 16 per cent to 17 per cent over the above period.

Investors get variety from passive funds, too, with factor, sector and theme-based schemes available aplenty. For investors, the preferred categories for their core portfolios would generally be flexi-caps, multi-caps, large-caps, large- & mid-caps and a sprinkling of small- and mid-caps. Any other specialised funds would be suitable as diversifiers outside the main portfolio. It may not be a great idea to jump into to invest in specific categories of funds just based on the gross sales figures.

Adequate due diligence in conjunction with investors’ risk appetite and asset allocation pattern are critical for making the most suitable choices.

Published on January 27, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.