India’s equity markets have been echoing the unyielding spirit of Sia’s hit song Unstoppable, with the Sensex scaling new peaks in the week gone by and closing past the 75K milestone last Friday.

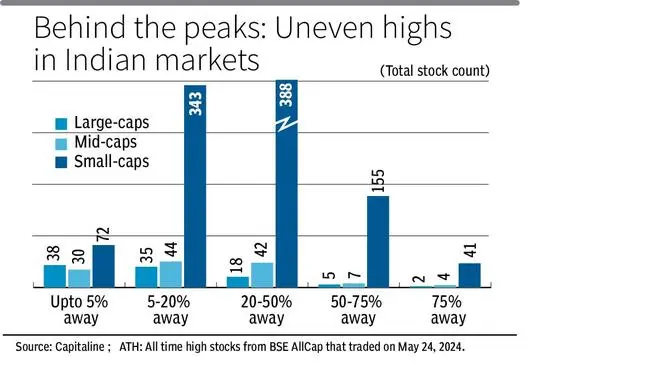

However, a deeper analysis shows that only about 11 per cent of the 1,224 stocks within the broad-based BSE All-Cap index are currently trading within 5 per cent of their lifetime highs. Close to 55 per cent of these constituents (662 stocks) are 20 per cent away from their peak levels, while nearly one-fifth (214 stocks) are over 50 per cent below their all-time highs. This underscores a relatively narrow market advance, indicating that the headline indices’ stellar performance is less broadly reflected across the stock universe.

Market capitalisation indices may present a picture of universal success, with the BSE MidCap and the BSE SmallCap indices rising alongside the BSE LargeCap index to new heights. However, beneath this apparent uniformity lies a tale of divergence.

While 39 per cent of large-cap stocks constituting the BSE AllCap index are near their lifetime highs, it is much lower in the case of small- and mid-cap stocks, with only 7 per cent and 24 per cent of these entities, respectively, near all-time highs. This disparity can partly be attributed to the market correction in these segments since March, driven by concerns over high valuations and SEBI’s stress-test mandate on mutual funds. Close to 60 per cent of small-cap stocks and 40 per cent of mid-caps are at least 20 per cent below their highest levels while one-fifth and one-tenth of small- and mid-cap scrips are at least 50 per cent away from their lifetime highs.

One in five large-cap stocks also remain 20-50 per cent shy of their all-time peaks. This group includes established names such as Asian Paints and Berger Paints, industry leaders with a combined market share of about 75 per cent, now facing increased competition from new players including Grasim Industries’ Birla Opus.

Additionally, around 7 per cent of large-cap stocks are trading more than 50 per cent below their all-time highs. This includes some Adani group companies such as Adani Energy Solutions, Adani Total Gas, and Adani Wilmar. These companies have struggled to regain the heights they achieved in 2022, prior to the US short-seller Hindenburg Research’s allegations.

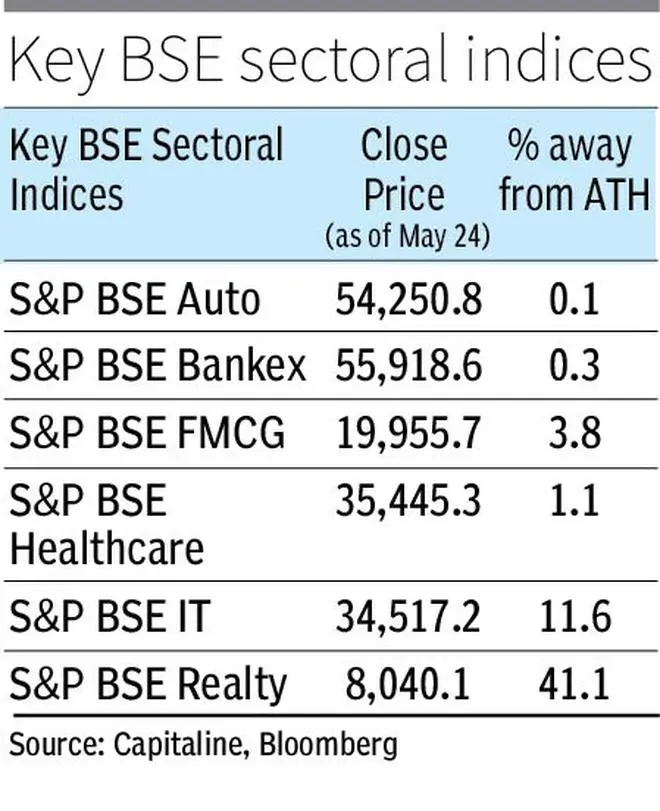

While most sectoral indices have surged to new highs this year, some, such as real estate and IT, are yet to reclaim their lifetime peaks. Although the BSE Realty index more than doubled in the last year on increased demand for housing and office space, it remains about 40 per cent below the peak it hit during the 2008 bull run. Similarly, the BSE IT index, which reached its zenith this February, has faced a sharp correction. This downturn can be attributed to high valuations, meek guidance, and an uncertain global macro-economic outlook, among others.

Many underlying constituents from the BFSI space in the BSE AllCap index, such as IndusInd Bank and Canara Bank, are still 20-50 per cent below their highs despite strong sector tailwinds, including robust credit growth.

While the BSE Automobile index has skyrocketed thanks to the cyclical upturn in auto sales, about 30 per cent of stocks in the auto ancillaries’ sector, which are part of the BSE AllCap index, remain 20 per cent below their lifetime highs.

The key to note here from these trends is that stock picking matters even when sentiment and economic fundamentals are robust.

Published on May 25, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.