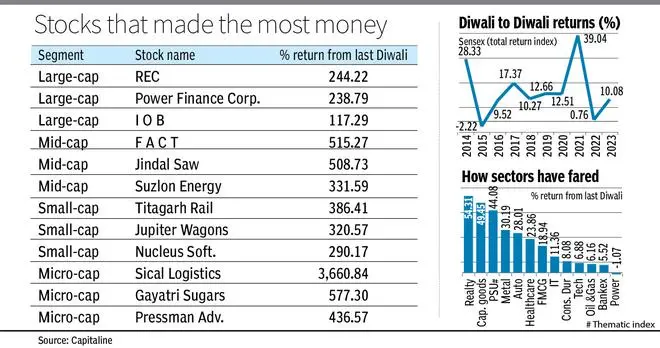

After a rather flattish Diwali year 2022, there were fireworks in the markets this Diwali year. From last Diwali until now, equities regained their mojo with Sensex hitting a new life-time peak during this period. It is still sitting pretty on 10 per cent gains. Overall, 65 per cent of BSE-listed scrips, led by real estate, capital goods, PSU, metal and automobile stocks, made money for investors since last Diwali. Mid and small caps stole the limelight.

The rally from last Diwali was led by over 30 per cent gains each in small- and mid-cap indices. This is in contrast to 2022 when they took a pause. However, investors in large caps (top 100 stocks) will be relatively better off since last Diwali with 86 per cent winners. This is versus the 77-80 per cent hit ratio in mid-caps (next 150 stocks) and small-caps (subsequent 250 stocks).

Not surprisingly though, since last Diwali the biggest gainers in large-caps such as REC (244 per cent), IOB (117 per cent) or Supreme Industries (107 per cent) are dwarfed by best performers in mid-caps (FACT and Jindal Saw up 500+ per cent) and small caps (over 300 per cent rise in Titagarh Rail and Jupiter Wagons). Notably, nearly 75 per cent of mid-caps and small caps beat Sensex return.

Interestingly, micro-caps (beyond first 500 stocks) were home to the most alluring gains in the market viz. Sical Logistics up 3,660 per cent and Gayatri Sugars up 578 per cent! At the same time, micro-caps, share the ignominy of being home to the worst performers such as SEL Manufacturing, Cerebra, Yaari Digital and PC Jeweller who have lost 70-85 per cent since last Diwali.

Real estate stocks, including the likes of DLF, Godrej Properties and Prestige Estate, emerged the best, with the corresponding index advancing 54 per cent in contrast to a decline the previous Diwali.

Capital goods stocks were a close second, with nearly 50 per cent index gain as L&T, HAL, BEL, ABB, Suzlon etc. again clicked, spurred by pick-up of capex. This is the third straight Diwali year in which the sector clocked a double-digit rise.

PSU sector also worked well since last Diwali. Ahead of national polls next year, PSU stocks saw demand from investors. The BSE PSU index clocked 44 per cent gain, led by a good show from BFSI, energy, railway stocks, industrials, etc.

On the other hand, sectors such as Power, Oil & Gas, Technology, Banking and Consumer Durables haven’t been able to outperform markets since last Diwali. These sectors hadn’t done that well in Diwali 2022 year as well.

During this time of the year, brokers release Samvat/Diwali stock picks for ‘Shubh Labh’. A quick glance of the performance of Diwali 2022 picks of brokers reveal a decent show in a generally rising market, albeit some disappointment in few frontline stocks.

Diwali/Samvat picks of 2022 such as Britannia, Hero Moto., UltraTech, DLF, ITC, Sundaram Finance, Oracle and M&M have clocked 20-65 per cent gains for investors holding on. However, Muhurat trading favourites such as ICICI Bank, RIL, Infosys and HDFC Bank have under-performed Sensex.

Mid- and small-cap picks of last year such as Ajanta Pharma, CCL Products, JK Lakshmi Cements, etc performed well, but Page Industries, NOCIL, La Opala, Inox Leisure and Bata failed to cause any fireworks.

Published on November 11, 2023

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.