Equity markets have faced near-term volatility triggered by geopolitical risks, higher oil prices and the start of interest rate hikes by central banks. In such a scenario, conventional equity investing has not worked well. For instance, 90 per cent of actively-managed large-cap funds have underperformed their respective benchmark in the last year.

Has contrarian investing worked during this period for the three funds that exclusively carry the mandate of going against consensus? While SBI Contra Fund has performed well, Kotak India EQ Contra and Invesco India Contra have fared in line with their benchmarks. Here is a detailed look at how funds went against the tide, deployed different strategies and have positioned them for the future.

In the contrarian style of investing, the fund manager deliberately attempts to invest in a way that is against the prevailing market trends. Due to greed and fear emotions in human psychology, markets, which are ultimately driven by investor actions, tend to throw up mispricing opportunities across stocks, sectors etc.

Contra funds have the mandate to exploit these situations in un-loved equities of the day, which have the potential to deliver robust returns later.

SBI Contra, launched in 1999, is the oldest in the category, followed by Kotak India EQ Contra (2005) and Invesco India Contra (2007). Considering the size, Invesco India Contra is the largest with an asset size of ₹8,536 crore, followed by SBI Contra and Kotak India EQ Contra with ₹4,584 crore and ₹1,228 crore respectively.

One may think contrarian investing and value investing are the same. Actually, value investing is just one part of contrarian investing. Value investing focuses more on the bottom-up approach, wherein the focus is on selecting stocks as per valuation multiples such as P/E, P/B, etc. Contrarian investing considers a bottom-up as well as a top-down approach. While stock fundamentals are important, bets are made taking into account business cycles.

Kotak India EQ Contra focuses on a value investing approach — portfolio construction is based on fundamentally-sound companies available at cheap valuations. SBI Contra and Invesco India Contra consider both top-down and bottom-up strategies. The Invesco fund also uses a technical analysis approach for stock picking.

In the last 12-month period ended May 2022, Kotak India EQ Contra has operated in a tight P/E multiple range in contrast to SBI Contra Fund and Invesco India Contra Fund whose individual portfolio PE range have been broader.

Contra funds are known for taking unconventional bets. A good way to understand their positioning is by looking at overweight/underweight status vis-a-vis the benchmark. As per the latest portfolio, Invesco India Contra is overweight mainly on automobiles, construction and pharmaceutical sectors, while it is underweight on energy, software and communications. The change in sectoral weights is in the 2-5 per cent range

Currently, Kotak India EQ Contra is overweight on capital goods and industrials, pharmaceutical, realty, private sector banks and select PSU banks. At the same time, it is underweight on software and energy space. The change in sectoral weights is in the 2-6 per cent range

At present, SBI Contra is overweight mainly on industrial and hospitality space, while it has remained significantly underweight on BFSI and software sectors. The change in sectoral weights is in the 2-6 per cent range.

Do note the sectoral positioning of contra funds, as per the latest portfolios, is not unique to only this category. The funds also play contrarian with the market capitalisation of stocks vis-a-vis their benchmark.

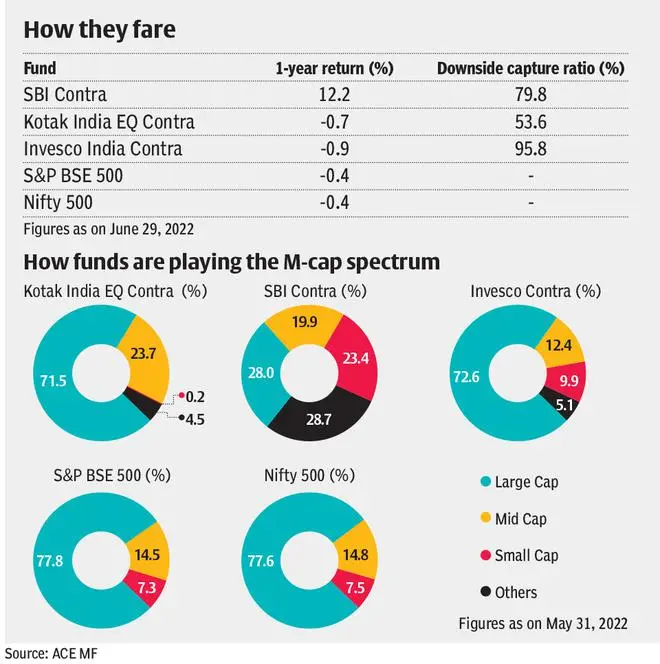

While Invesco India Contra and Kotak India EQ Contra hold around 72 per cent (similar to benchmark) in large-cap stocks, SBI Contra has cast the net wide to diversify across large-cap, mid-cap and small-cap spaces by investing nearly equally in each of them. While Kotak India EQ Contra goes overweight on mid-caps, it has almost zero exposure to small-caps. Invesco India Contra has weights similar to that of benchmark across each capitalisation.

In the last one-year period ended June 29, 2022, Invesco India Contra Fund and Kotak India EQ Contra have generated -0.94 per cent and -0.73 per cent respectively, which have been in line with their BSE 500 TRI and NSE 500 TRI benchmarks.

The standout is SBI Contra, with a gain of 12.22 per cent, which has significantly outperformed the benchmark (BSE 500 TRI). Sector wise, industrial space has been the alpha generator for the fund, while investments made on stocks such as Indian Hotels, Neogen Chemicals, Phoenix Mills and Ingersol proved to be successful contrarian bets.

Cash calls also help performance. SBI Contra, which has cushioned the impact of falling markets in the last few months, has been holding more than 15 per cent of the corpus in cash and cash equivalents (including derivatives) since December 2021, ACE MF data shows. Other contra funds hold 2-4 per cent cash.

Do contra funds help contain downsides? Kotak India EQ Contra is a winner when it comes to portfolio downside protection, which is measured by downside capture ratio.

While Invesco India Contra and SBI Contra have downside capture of 95 and 79 respectively, Kotak India EQ Contra has a downside capture of 53 which means that when the benchmark falls by 10 per cent, this fund falls only by 5 per cent.

The fund’s insignificant investment in small-caps could be a driving factor in arresting market decline impact at portfolio level. Peers SBI Contra and Invesco India Contra’s small-cap exposure have been around 23 per cent and 10 per cent respectively.

Though contrarian investing can be rewarding, going against the consensus makes it a riskier strategy and so the accuracy of bets has to be high. It’s challenging to find underperforming/undervalued stocks on a sustainable basis. The gestation period for this strategy could be quite high as gains may follow only after a certain period of underperformance.

Hence, patience and high risk-tolerance is must for those investing in contra funds. Like thematic funds, the investment horizon in contra funds should not be less than five years and exposure should be capped at 5-10 per cent. One can consider investing in contra funds as a portfolio diversification exercise.

Published on July 2, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.