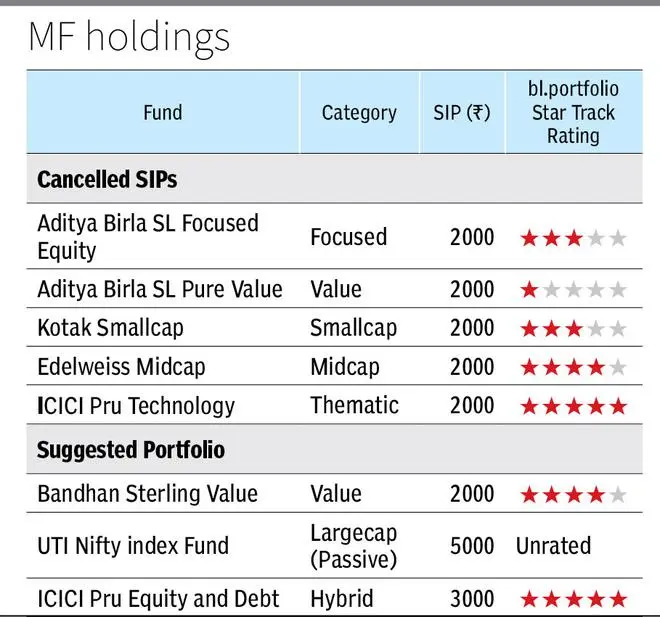

I am 52 and am a voluntarily-retired Central Government employee. I was doing SIP of ₹2,000 each in Aditya Birla SL Focused Equity, ABSL SL Pure Value, Kotak Small Cap, Edelweiss Midcap and ICICI Prudential Technology. I have currently cancelled all the SIPs and have a corpus of ₹5 lakh. I am planning to invest further in mutual fund SIPs for ₹10,000. Could you please assist me in allocating the funds ?

Ananda Kumar

It is unclear as to why and how long you have been investing in these funds, what your return experience has been and why you have cancelled the SIPs. Barring Aditya Birla SL Pure Value which is rated 1-star by us, other funds are rated 3 -5 star, implying that if you have ongoing investments in them, you can continue for the time being. We recommend a stop/switch only if ratings fall below 3-star for any fund in our half-yearly revisions done every January and July.

You can move the corpus out of ABSL Pure Value to Bandhan Sterling Value and start SIPs of ₹2,000 in this fund. For the remaining funds, assuming you don’t need the money in the near-to-medium term, you can let the sums invested so far, stay with the fund house for the time being. Out of the ₹8,000 left with you every month, you can invest ₹5,000 in UTI Nifty Index fund and ₹3,000 in ICICI Pru Equity and Debt.

You have taken early voluntary retirement and we assume that this may have been one of the reasons for cancelling SIPs in actively managed equity funds, which are a high-risk category. Hence, we have suggested greater exposure to a large-cap index fund and a hybrid fund as they carry relatively lower risk. Ideally your time horizon when investing in equity and related categories should be 7-10 years.

In suggesting mutual fund SIPs, we have assumed you have enough pension and other investments to take care of your monthly post-retirement expenses, as well as health insurance.

Published on April 8, 2023

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.