The current volatility in broader markets may be on account of many reasons ranging from inflation, developed market recession, or a plain year-end phenomenon. This renews the focus on defensive sectors including pharma, which do not list any of the above as a major headwind to performance. In fact, resurgence of the Covid threat could be a tailwind to pharma at the cost of everything else.

But what gets overlooked in the usual turn to pharma is the healthcare segment within the cluster, that includes hospitals, diagnostics and even pharmacy retailers. Accounting for an average 15-20 per cent across funds’ investments, this sub-cluster is hard to overlook and small to emphasise while tracking funds. We analyse the indices and funds from healthcare perspective and evaluate the differences.

The diversification benefit is clear; even though serving the primary end-market of healthcare, the pricing, volume and opportunities facing each sub-cluster is different, providing the diversification. Pharma is equally driven by Indian market, which is secularly strong and US markets which can be highly volatile, the remaining two sectors, Europe and Emerging markets, exhibit similar fluctuations. Healthcare, on the other hand, is primarily Indian consumer-facing industry as around 50 per cent of the expense is borne out of pocket and privately-bought insurance accounting for another 10-20 per cent. More than the 5-6 per cent pricing growth that hospitals reap over a given peirod, volume growth starting from high single-digits is aiding the industry as capacity building is now spreading to tier-II clusters and beyond, having made a mark in urban centres.

BSE Healthcare index comprises stocks from healthcare (currently around 15 per cent by weight) compared to Nifty Pharma which is solely focused on pharma. In the last 10 years, the healthcare index has outperformed pharma index by a sizeable 3.25 per cent CAGR, which may in part be ascribed to healthcare involvement which has re-rated and provided strong returns, albeit limited by low sector weights.

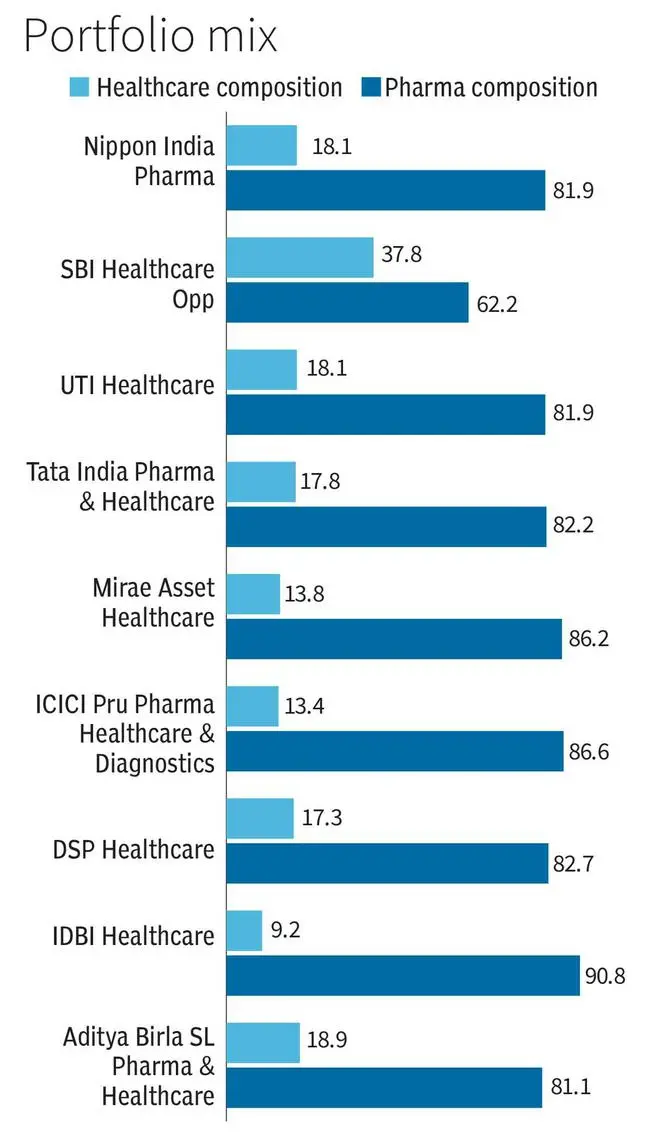

Amongst healthcare funds (nine with more than three years of operations), healthcare accounts for an average of 18 per cent exposure by weight as on November 30, 2022. SBI Healthcare Opp Fund has the highest exposure at more than 37 per cent, while IDBI Healthcare Fund has the lowest at 9 per cent. In the healthcare space, hospitals has highest allocation across all the nine funds with an average 16 per cent allocation across funds. This implies that actively-managed healthcare funds allocate an average 82 per cent towards pharma, 16 per cent towards hospitals and only 2 per cent towards diagnostics and retail chains.

If Covid comes back into investor focus, the short-term gains by healthcare heavy funds should be immediate. Even otherwise, backed by double-digit revenue growth potential and white spaces in tier-II towns for expansion, healthcare focus can add a high growth lever to funds. This is despite the high valuation (average 50 times trailing earnings).

Another high valuation sector which seems to have lost funds’ attention is diagnostics sector with an average 2.4 per cent allocation amongst only six funds. The unorganised-to-organised narrative may not be offsetting lack of pricing power from intense competition in the industry leading to lower interest in the segment. But again, if Covid and the accompanying drills make a comeback, the funds’ lack of positioning in this sector may hurt return potential.

Pharmacy retail may have been represented by Medplus Healthservices alone, but Apollo Hospitals and its aggressive expansion with Apollo Pharmacy accounts for this division as well.

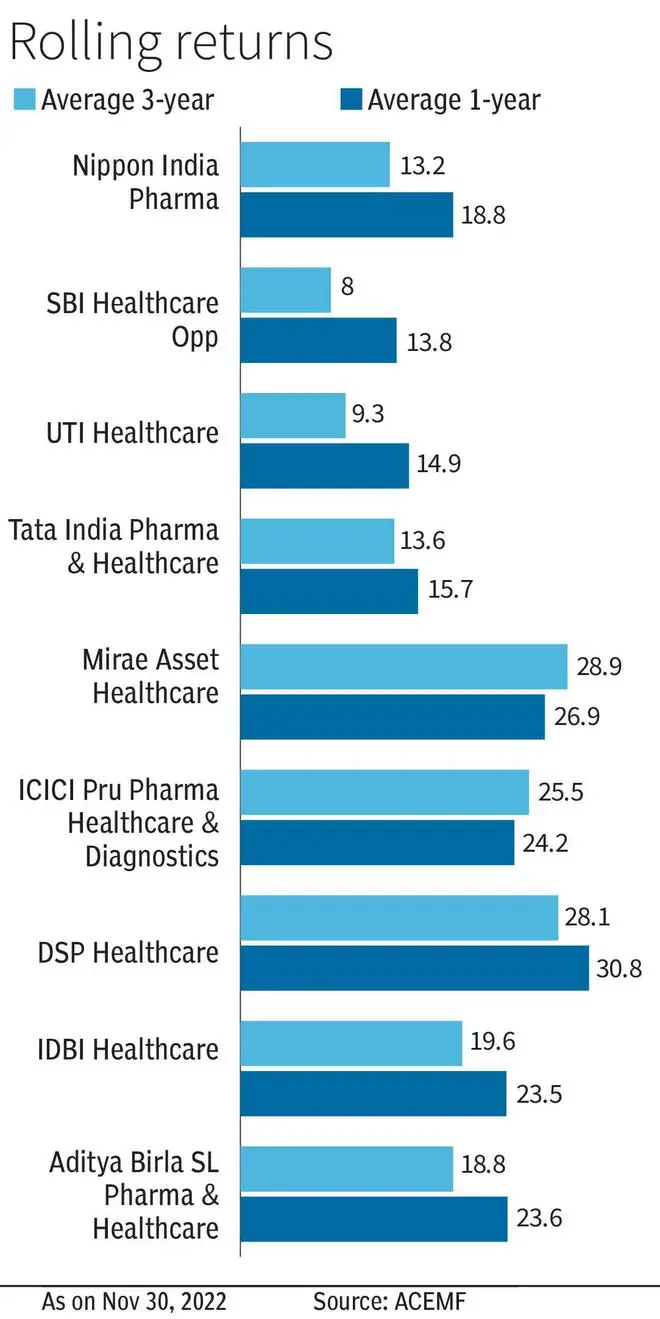

In the last three years, on an absolute CAGR basis, DSP Healthcare Fund and Mirae Asset Healthcare Fund have outperformed the cluster of funds with 28 and 26 per cent CAGR respectively. Incidentally, IDBI Healthcare Fund with lowest healthcare allocation has the lowest return CAGR at 18 per cent for the last three years. For investors focused on holding period performance, the same two lead the pack with 28 per cent average three-year holding period return in the last five years. But SBI Healthcare returned 8 per cent average CAGR in this parameter. But with 37 per cent healthcare allocation, SBI Healthcare fund, with or without another healthcare crisis looming ahead, should deliver better returns, measured from the healthcare perspective.

Published on December 31, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.