‘What comes down, must go up’ is very true of cyclical sectors such as auto.

After a hiatus which started well before the pandemic, the auto cycle is looking up now with utility vehicle (UV) and commercial vehicle (CV) sales leading the pack. A projection based on new vehicle sales volumes achieved in the first quarter of this fiscal (April-June 2022) shows that while sale of new cars including UVs can grow 18.6 per cent year-on-year in 2022-23, CVs (light, medium and heavy) volumes are expected to grow 25 -26 per cent this fiscal; Two- and three-wheelers volumes, about 10 per cent. After peaking out in 2018-19, the new vehicles sales volumes have been in contraction mode in the last three fiscals.

With the Nifty Auto index being among the best performers so far this year vis-à-vis a flat Nifty, the market has already recognised the turn in fortunes. Stock prices in the sector have moved up as well, with over 50 of the 171 listed entities in the segment touching all-time highs since the October 2021 market peak. Valuations have expanded too. Over 41 stocks sport a trailing PE greater than 25 times now, vis-à-vis only 14 of them three years ago.

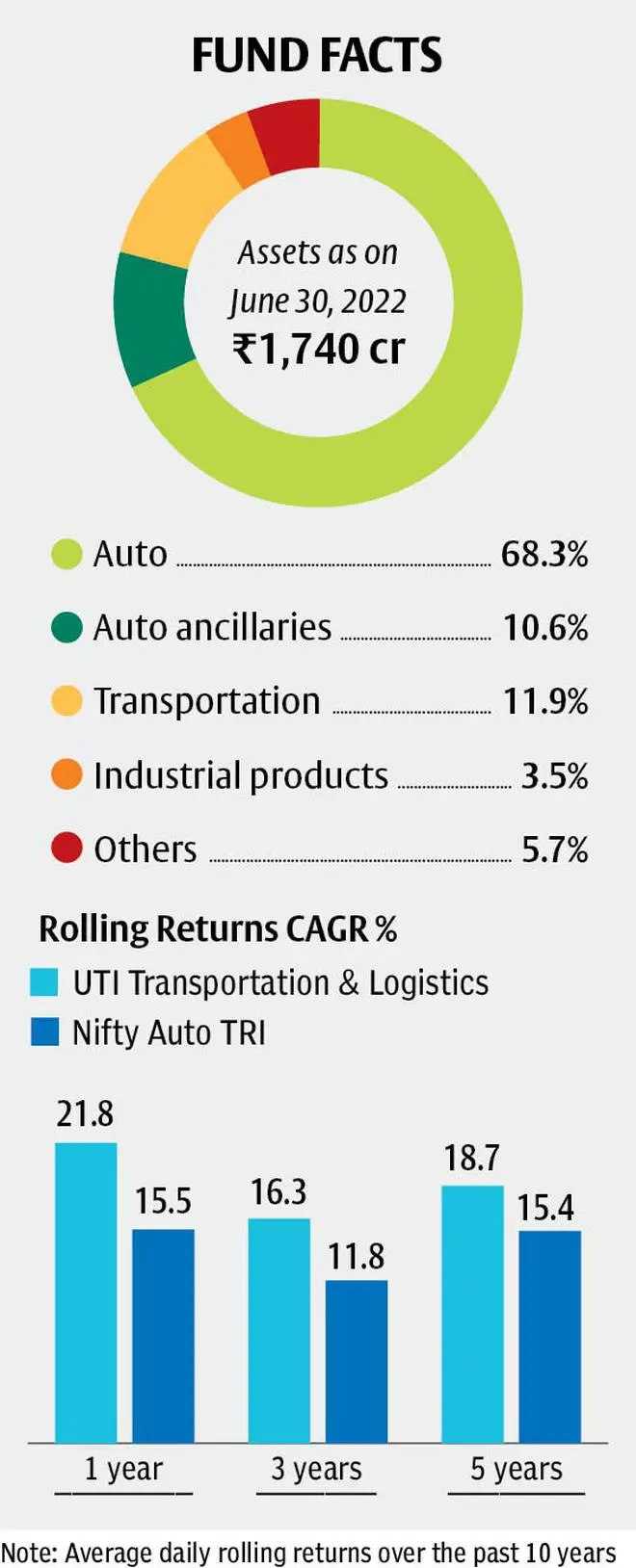

However, given the auto cycle typically holds for about two-three years, today there is still a case for tactical investment in funds focused on the auto sector. Those who have a high appetite for risk can consider investing in the UTI Transportation and Logistics (UTI T&L) fund as part of their satellite portfolio. This is the only active fund focused on the sector currently. While we have presented Nifty Auto ETFs too as good investment option based on technical analysis in our Big Story titled What charts say about 6 key sectors and how to play them, this fund is for those willing to walk the extra mile for additional returns. A daily rolling-return analysis of the average returns for one, three and five years over the past 10 years show that the fund has comprehensively been able to beat the bellwether Nifty TRI, the broader Nifty 500 TRI as well as the Nifty Auto TRI across these periods. Lump-sum investments in two or three tranches can be considered, to take advantage of intermittent corrections due to broader market volatility.

Data from Capitaline shows that while price increases and recovery in demand to an extent have brought back aggregate revenues for listed auto and auto component players close to 2018/19 levels in the year ended March 2022, profits are still far away from what was achieved then. This indicates stress at the operating level from lack of leverage as well as high input prices. Being a highly raw-material intensive industry (RM to sales ratio of about 65 per cent roughly), the cooling-off in prices of base metals such as aluminum, copper, lead, zinc as well as steel is a tailwind for the sector now. Normal monsoons (+6 % departure from LPA for the country as a whole currently), increase in crop and agri-commodity prices as well as the government’s focus on infrastructure through the PM Gati Shakti initiative spells well for personal vehicles as well as CVs. Freight rates for road transport — a proxy for economic activity — as measured by the CRISIL Pan India Freight Index, is also indicating strong demand for goods carriage. Given the government’s focus on improving EV penetration, most vehicle makers and suppliers are gearing up for the change too, with mid- and small-cap suppliers focused on EVs, in the limelight in the market rally since March 2020.

Of the 171 stocks listed in the auto space, large-caps are only eight in number, while there are about 149 small-cap stocks. The fund has been able to outperform the Nifty Auto index on a consistent basis because of its diversified portfolio including mid- and small-cap stocks. It currently holds about 27 per cent in these segments. Prominent auto small-caps in the latest portfolio include Minda Corporation, Sandhar Technologies and Jamna Auto.

UTI T&L typically holds a total 30-35 stocks. Usually, Maruti Suzuki, M&M, Bajaj Auto, Tata Motors and Eicher Motors are its top bets with 8-18 per cent stake in each of them. The rest of the holdings are well-spread. The fund has rightly added to its holdings in Ashok Leyland since 2021, to benefit from the recovery in CVs. With two-wheelers seeing the slowest recovery so far, its stake in Hero MotoCorp has come down to 2.4 per cent now, from about 8-9 per cent levels in mid- and late-2020. Tough competition from electric bikes when fuel prices shot through the roof as well as a rural slowdown in 2021 took the glamour off this stock. The stock has marginally declined in the last year. Endurance Technologies is a recent entrant. Timken and Balkrishna Industries have been exits in the last year, probably due to high valuations.

While 78 per cent of the holdings is in auto and auto components, about 12 per cent is from logistics which are also a play on economic activity picking up. Adani Ports, VRL, Mahindra Logistics are some of the prominent stocks held.

The fund has usually been taking over 95 per cent exposure in equities over the last few years.

Published on August 6, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.