The net profit/book value gives a perspective on what returns shareholder wealth in the company is generating

Return on equity (ROE) is sort of a buzzword in investing. Many a time on TV or otherwise in discussions on stocks you would have heard ‘it’s a good stock, the company has high ROE’ or ‘the company is doing a buyback, ROE will increase and this is a positive.’ Recently at bl.portfolio too we got a query asking, ‘since ROE for stock A is high, is it a good buy?’

However, have you actually wondered what significance ROE plays in stock returns? Does it really deserve the importance? The answer is, it depends! To understand how and where, let us first understand what ROE indicates.

The formula for ROE, as many may already be aware, is Net Profit/Book Value. Book Value or shareholder funds equals ‘total assets minus third party liabilities’ (primarily debt owed in most cases). Thus, it is an accounting estimate of what is the value that shareholders can get by liquidating the business as on the date of balance sheet (they get the value of assets that remain after paying debts), theoretically . Now, why is this block of shareholder funds or the number it represents important?

Shareholders have a choice; they can either liquidate their business, take their money back and invest it somewhere else, or they can keep their wealth (shareholder funds) in the company and benefit from the returns it generates. This is where ROE helps to get a perspective. The net profit/book value gives a perspective on what returns shareholder wealth in the company is generating.

Let’s say, for example, if ROE of company A is 30 per cent and the long-term government bonds are yielding 7 per cent , then it means, the business is highly profitable generating 30 per cent returns relative to fixed income, which is just generating 7 per cent returns. Thus ROE reflects efficiency in utilisation of capital. High ROE companies are very efficient utilisers of capital, that’s the primary inference you can make. Then there are derivative inferences like high ROE/efficient utilisation of capital means the company can fund its growth from internal accruals, can return to shareholders a higher percentage of its annual cash flow in the form of dividends or buybacks, it is less likely to dilute your stake via rights issues etc.

Is this enough to make a decision before investing?

One of the most important things to note in fundamental investing is that, no single financial or valuation metric can guide an investment decision. Basing decision on a single metric is like holding onto one end of a rope without checking whether the other end is tied strongly or neatly, or whether it is tied at all. A company’s PE can be low, but if you buy it just for that reason without checking whether its earnings are growing or declining, you may end up with a poor investment.

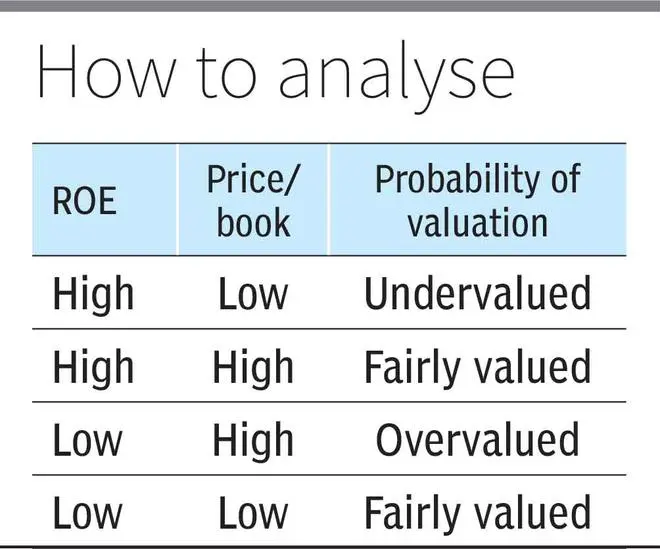

So what is the other end of the rope to check when it comes to ROE? It’s the price/book multiple. ROE reflects the efficiency with which the book value is utilised. The price/book multiple indicates how well or by how much this efficiency is factored by the markets. So if you want to buy high ROE companies, before finalising your decision, you must also check their price/book.

As Warren Buffett says, ‘Price is what you pay, and value is what you get’. Prices of stocks change every day, but the fundamental value changes only according to change in earnings or change in earnings prospects for a company. In the long run, you make wealth when you buy at a price below fair value of the business, and will lose money when you buy at a price above fair value. Thus if you buy a high ROE company at a high price/book multiple, you may be buying a company that is already priced by the markets for its efficiency, and thus may not derive much value.

However, it needs to be noted that the above table only represents a starting point. Other factors too need to be considered. For example, a company may be in investment phase and ROE may be low, with prospects for better earnings in coming years. In such case, if its price/book is low and it appears fairly valued, but there may be a good opportunity in wealth creation. Further price/book multiple needs to be assessed based on company’s historical average, as well as relative to peers in the industry.

The ROE of a company measured against its price/book represents your ROE. Net profit/book value divided by price/book, which equals net profit/price. This is nothing but the earnings yield of the stock or the inverse of PE (PE = price/net profit). Thus a company may have a very high ROE, what is relevant to you is your ROE or earnings yield.

For example, amongst Nifty 50 companies, Nestle India has the highest ROE at 105 per cent. At the same time it also trading at an extremely high P/B or 88 times. If you buy the stock today, your ROE (earnings yield) is a miniscule 1.2 per cent. You need to compare this ‘your ROE’ against returns you can get from other investments before taking a decision on high ROE stocks. The company ROE indicates efficiency, but beyond that the number is more relevant to original investors who may have bought into the company at face value or closer to book value levels. Your ROE depends on the level at which you enter.

So, next time, don’t just decide based on company ROE, make sure to also assess it against your ROE.

Published on February 4, 2023

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.