Srivatsan’s family consists of 6 members, his wife, aged 40 and two sons aged 12 and 7. His parents also stay with him and found to be financially independent. They live in a two-bedroom flat in Chennai and wanted to move to a 3 BHK in the same locality. Based on the growing family needs it was very much essential for him to move to a larger apartment. He wanted to know how his financial goals such as children’s education and retirement get affected because of this purchase.

He got a buyer for his old house for a sum of ₹70 lakh. The new apartment will cost him ₹ 1.6 crore inclusive of all registration and interior costs. His father provided help by way of a contribution of ₹20 lakh from his own savings. Srivatsan had already saved ₹10 lakh towards new house purchase. Hence, it was sufficient to look at ₹60 lakh as loan from bank/housing finance company.

It seemed logical for them to opt for a housing loan based on low interest rates that is prevailing. The EMI also looked affordable. After this, a kind of stress test was performed on his finances to understand the impact of the decision.

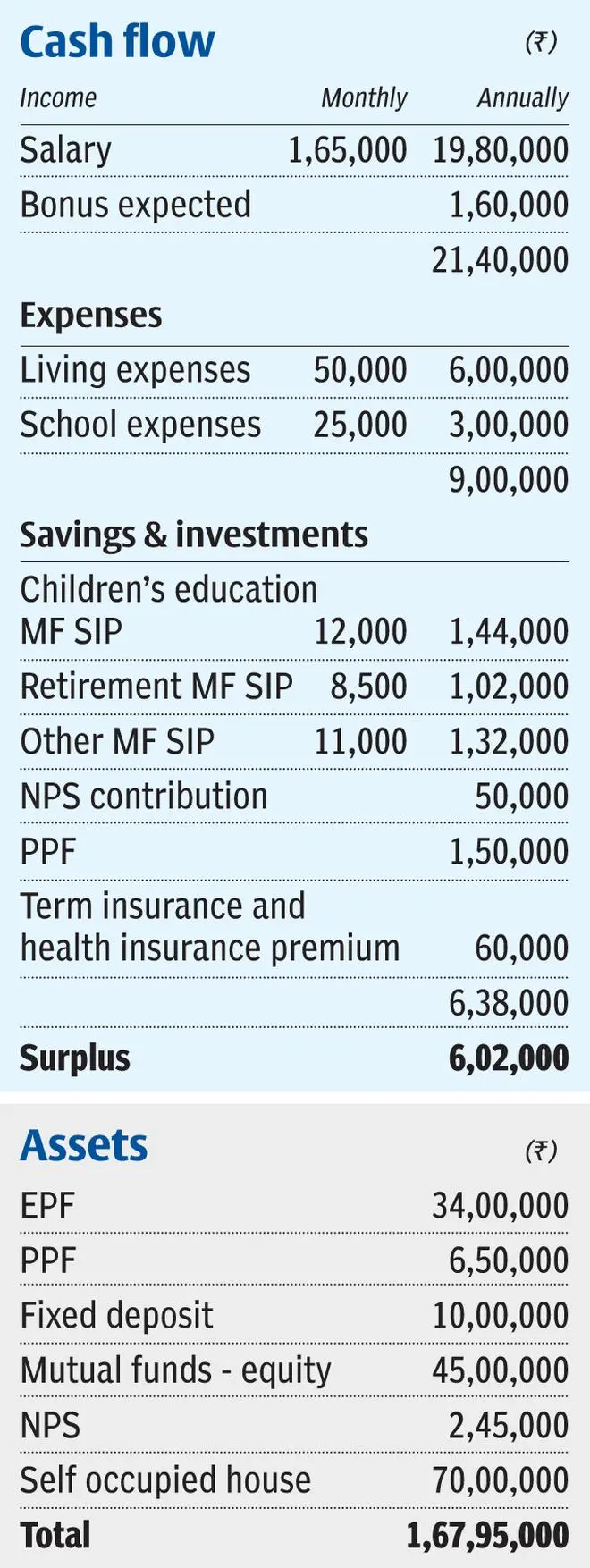

He was investing ₹4,500 per month in large cap equity mutual funds since his first son’s birth and accumulated ₹15 lakh. If the current cost of college education is assumed to be ₹18 lakh at 10 per cent inflation he would need ₹33 lakh in the next 6 years’ time. This is goal can be achieved by continuing ₹4,500 per month SIP. Similarly, he was investing ₹7,500 per month for his second son’s education for the past seven years and accumulated ₹10 lakh. By continuing the same investment of ₹7,500 per month, he was likely to achieve the target of ₹56 lakh when his second son turns 18. This will be for his college education.

His accumulated EPF of ₹34 lakh with regular contribution of ₹16,750 per month will fetch him ₹2.17 crore when he retires at 60. Based on his past history of prudent living, retirement expenses at current cost of ₹40,000 per month seemed practical. Assuming inflation of 6 per cent per annum and expected return of 7.5 per cent per annum with safe investments post his retirement, he needed ₹3.18 crore at his retirement. We assumed 30 years of living, post his retirement. To fund the deficit, he started investing few years back in midcap mutual funds through systematic investments of ₹8,500 per month. He had accumulated ₹6 lakh as on date towards this goal. By continuing the same investments, the chance of reaching his goal was found to be very bright or highly probable.

In addition, he was investing ₹50,000 per year in NPS and ₹1.5 lakh in PPF. These savings would come in handy and help him to manage his other needs post retirement.

He could save more in the last two years as the expenses were low due to covid. His savings surplus was approximately ₹10 lakh which can be used towards house purchase.

If he opted for housing loan of ₹60 lakh at current interest rate of 7.15 per cent per annum for him, his monthly loan commitment would be ₹54,500 for a period of 15 years. We also informed his family that moving to a bigger house may increase their expenses as well by another ₹5,000-7,000 per month. This was affordable at this moment by sacrificing his additional savings of ₹11,000 per month.

If the rate increased by 100 bps, his monthly outflow will increase by ₹3,500. If the rate increased to 9.15 per cent in the next 2 years, his EMI may increase by ₹7,000. With single earning, he might not be able to continue his savings in PPF. He will depend on his increase in his income to build additional savings or investments. Post the discussion with him and his wife, they understood the risk at this age. His wife decided to explore part time employment opportunities to increase the family income. This could help them to close the housing loan prior to 15 years.

6. He had enough emergency fund in fixed deposits and adequate life and health cover for the entire family. He was advised to opt for additional life cover when he goes for new housing loan. He was also advised to opt for home insurance to protect against any natural calamities and fire.

7. We appreciated their disciplined savings and investments over the years. We also appreciated the way they maintain their lifestyle expenses and their focus on regular savings. With limited income, buying a house for ₹1.6 crore was a major decision for Srivatsan and he was very much relieved to understand that he could afford it by tweaking some of his low-priority goals.

As the saying goes, “In every single thing you do, you are choosing a direction and your life is a product of your choices”. Financial Planning, as a few believe, is not an exercise to be done once. Every major decision impact one or multiple goals. Getting to know the kind of impact is a better way to get prepared before moving on with key decisions.

The writer, Co-founder of Chamomile Investment Consultants in Chennai, is an investment advisor registered with SEBI

Published on March 19, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.