Financial Planning is all about keeping an eye on long-term goals by providing for short-term emergencies

Vidyasagar, 35, approached us to plan for his retirement and his daughter’s education.

He works in the hospitality industry. His high income in the early part of his career helped him to buy a property; he has closed the housing loan as well. His wife, aged 32, is a home-maker and his daughter is 4.

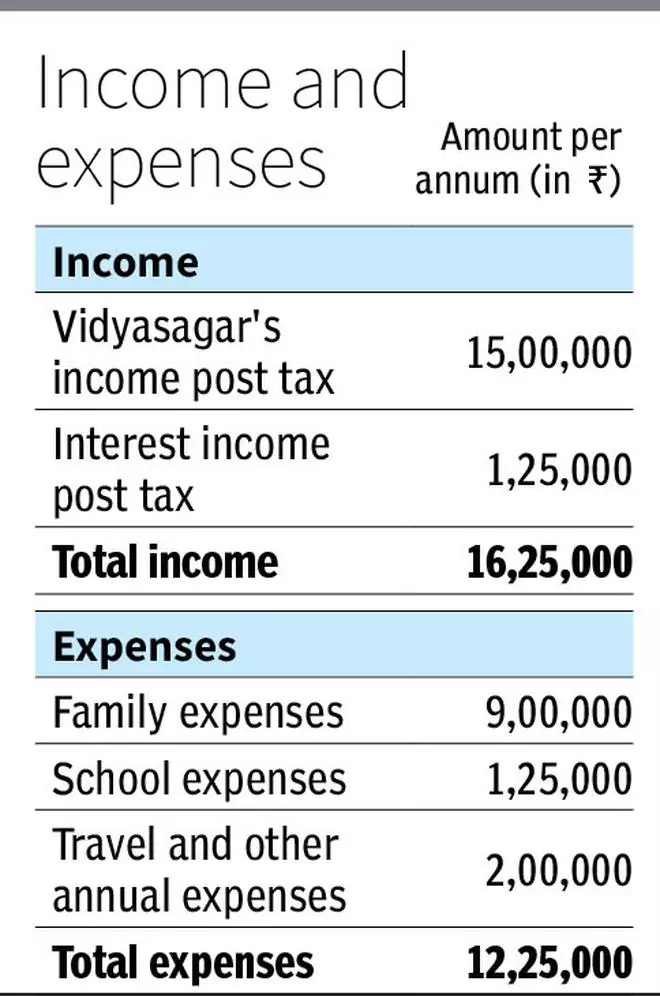

His income got hit during the Covid pandemic and he wants to ensure that his family’s lifestyle and his daughter’s education are not compromised in future. His mother lives with him, and all family members are reasonably healthy. His mother gets an interest income of ₹3 lakh per year, which is sufficient for her expenses.

His goals are prioritised as below:

1. Emergency fund of ₹13.25 lakh to cover one year’s expenses

2. Current cost of his daughter’s college education at ₹30 lakh to cover majority of courses in India.

3. Retirement at the age of 65 at current cost of ₹50,000 per month. He is willing to work till 70 if needed

4. He wants to build a medical emergency fund for ₹10 lakh

5. He wishes to opt for right insurance cover

We assessed his risk profile to be ‘Balanced’. He was not aware of many financial products. He was focused on closing his housing loan over the past six years. When his father expired in 2020, he received ₹70 lakh as part of his share from his father’s assets. He settled his housing loan balance and invested the rest in fixed deposits and mutual funds. He had selected mutual fund schemes based on advice from friends. He was not very confident about his investments. He was also unaware of his risk profile. He sought professional consultancy to get better clarity on his goal-based investing.

1. His fixed deposit of ₹25 lakh to be retained towards his emergency fund and medical fund.

2. As he needed to accumulate a corpus of ₹88 lakh towards his daughter’s education in the next 14 years adjusted for inflation of 8 per cent, he was advised to invest ₹24,000 per month in a balanced portfolio of mutual funds, not exceeding 50 per cent in equity mutual funds.

3. Retirement corpus of ₹10.18 crore needed to be accumulated to manage his retirement expenses of ₹50,000 per month at current cost. His expenses would be ₹3.8 lakh per month adjusted for 7 per cent inflation when he retires at his age of 65.

4. As he does not have EPF as part of his salary component, it was suggested to look at a combination of PPF and NPS towards his fixed income portfolio allocation. He can accumulate ₹1.44 crore in PPF in the next 30 years by investing ₹1.5 lakh per annum for the next 30 years. NPS can be used to build ₹56.67 lakh in the next 30 years with an expected return of 8 per cent from an annual contribution of ₹50,000 for the next 30 years. His current investment in mutual fund is also mapped towards his long-term retirement goal.

5. It is very much essential to opt for long-term fixed income investments while building retirement corpus with tax efficiency and lock-in periods. Fixed income products provide stability to the portfolio and bring in discipline as well, to the savings habit.

6. He needs to invest ₹10,000 per month in equity mutual funds to fund the deficit in retirement corpus. Initially this may be difficult to manage, considering the cash flow. An early start will definitely give an edge in generating long-term compounded returns and in managing the risk of the portfolio. Alternatively, he can start investing ₹2,000 per month in mid-cap mutual funds and move to large-cap when he can afford to increase his monthly contribution to retirement savings.

7. He was advised to opt for pure term insurance for a sum assured of ₹2.05 crore to protect the family lifestyle and his daughter’s education in line with a need-based approach. He was also advised to opt for basic health cover for sum insured of ₹5 lakh and increase it by another ₹20 lakh by super top-up in the next 3-5 years’ time frame.

8. He needs to use his income growth to save towards enhancing lifestyle, daughter’s higher education and marriage goals and other important retirement-related goals in future.

Not compromising on the current style of living is very important to convince family members about long-term savings and investments. Financial planning provides a step in the right direction to reach one’s goals comfortably. Initial days of saving could put a family to a relatively tight budget compared to the days of “no savings”. But when the whole family is taken into confidence on the need to save for future goals by providing the numbers, the environment at home would be conducive to start the journey and move along. Financial Planning is all about creating good habits and keeping an eye on long-term goals by providing for short-term emergencies. Financial security doesn’t happen accidentally; it has to be planned carefully considering one’s own resources and constraints!

Published on December 17, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.