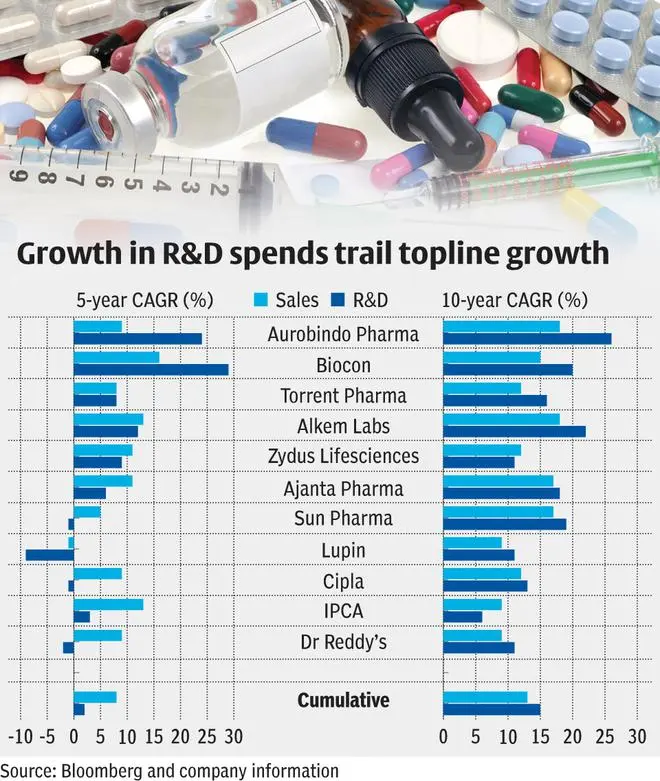

While a differentiated product portfolio can give pharma companies an edge on growth, they seem to be going slow on developing the same, looking at their R&D spends in recent years. Compared to a CAGR of 8 per cent in revenues over the last five years for top pharma players, R&D CAGR has been slower at 2 per cent. This is in sharp contrast to the trend in the last ten years for the same set of companies, where growth in R&D spends are ahead of sales growth.

Some of the slowdown can be attributed to the Covid outbreak. While the pandemic was positive for the topline, big-ticket R&D spending aimed at clinical trials slowed down in the last two years. Secondly, companies have also optimised their R&D spends in this period towards complex products, diversifying away from generics which have a different development timeline. For instance, 20-30 generics filings at a cost of $1-3 million per product can be turned around in 1-2 years; but complex filings on the other hand would cost 5-10 times more and call for 2-3 times more in terms of time period required. For complex filings, major cost is absorbed at the backend of the development timeline and hence, the actual spends may show up in future. Sun Pharma has been waiting for trial participants to return to clinical trial centers as the pandemic restrictions are lifted. Cipla’s second inhalation product has scheduled the study on 1,400 participants in April-2022 and hence can witness a higher R&D spend. After a period of trimming proprietary development, Dr. Reddy’s portfolio of products under development can expand along with R&D allocation from here on.

Even if R&D spends are slowing for companies, investors can assess the flight to value by the number of complex products in a company’s R&D pipeline. Across companies, the common R&D efforts seem to be on complex injectables or biosimilars for US and European markets. Adding further value are the innovator molecules undergoing clinical trials. Respiratory products, depot injections and vaccines are also making inroads into R&D plans for companies.

For example, Sun Pharma is advancing two Phase 3 studies for its Ilumya and two other innovator molecules are in Phase 2 study.

Cipla and Lupin have made a strong start in respiratory products (2 approved) and are preparing the next set with generic Advair and generic Symbicort for Cipla. Lupin has two respiratory products under review and 6 more are in early stages of development.

Biocon has launched three biosimilars, three more are in review from the first wave and two from the second wave are in development. Aurobindo, Dr Reddy, Lupin and Zydus Lifesciences are also developing their own biosimilars targeted for developed and other markets. Under complex injectables Cipla, Lupin, Zydus Lifesciences’ and Aurobindo are developing peptides, long acting injectables (depot) and transdermals.

Aurobindo’s pneumococcal vaccine is at advanced stages of study and filing. Zydus’ indigenous DNA vaccine for Covid and Dr. Reddy’s Sputnik light (booster dose under study) are eyeing to get some

traction from follow up sales after missing the initial opportunity in Covid vaccines. All companies also develop regulatory wise complex products (505 B(2) filings) which involve both technological and regulatory innovation, in challenging existing patents.

That said, companies must speed up R&D investments for better growth. The last five years of slower R&D growth was also the period when Nifty Pharma index underperformed the Nifty returned 26 per cent compared to Nifty 50’s 62 per cent returns. Innovation is the only fall back for pharmaceutical industry which otherwise faces pricing pressure in almost every geography.

Published on July 16, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.