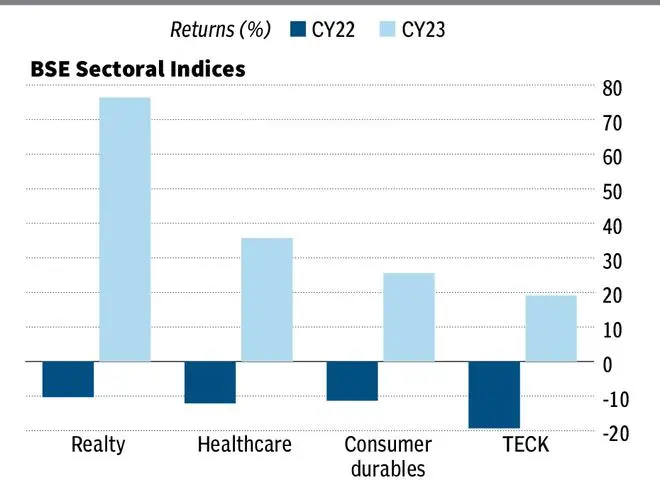

In the year gone by, a notable shift swept through the key sectoral indices of the BSE, marking a significant turnaround for Realty, Healthcare, Consumer Durables, and TECK (Telecom, IT, and Media). Having weathered a steep decline in CY22, these sectors turned the tide in CY23 and were gleaming brighter than the Sensex. Here are some insights on their contrasting performance in the last two years.

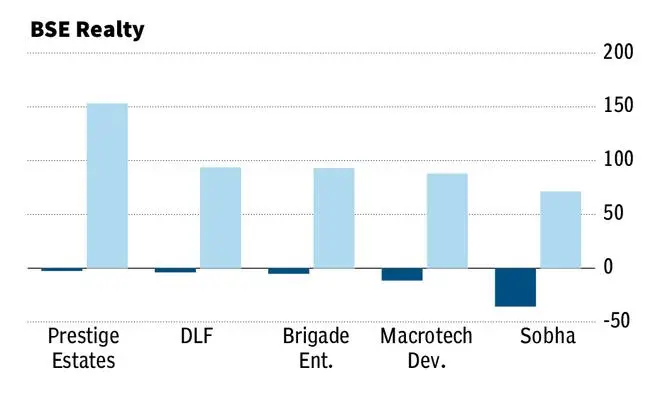

Solid macroeconomic environment, strong demand for luxury retail space, and rising institutional investments in the Indian office sector contributed to a positive outlook for listed real estate developers. Prestige Estate Projects was the best-performing stock within the sector this year, primarily driven by higher quarterly sales from new launches.

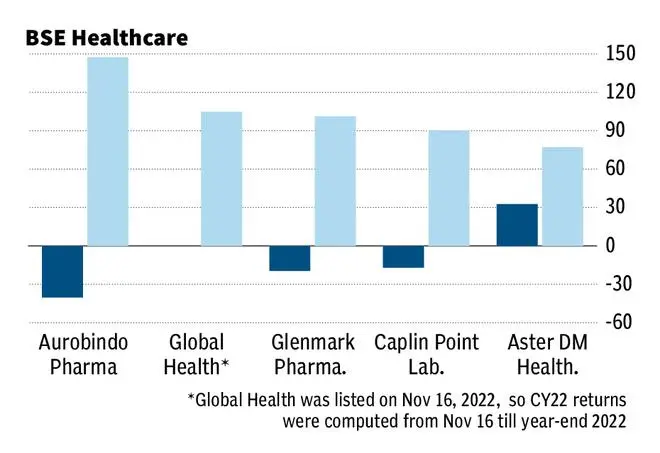

Overall, the healthcare sector, after facing challenges from FDA plant inspections and US price erosion in CY22, demonstrated upbeat performance in CY23 which can be attributed to easing pricing pressures in US markets, big product launches, and lessening pressure on Indian pharma cos from the FDA. Aurobindo Pharma, after experiencing a significant decline in CY22, exhibited good resilience by achieving triple-digit growth during the year.

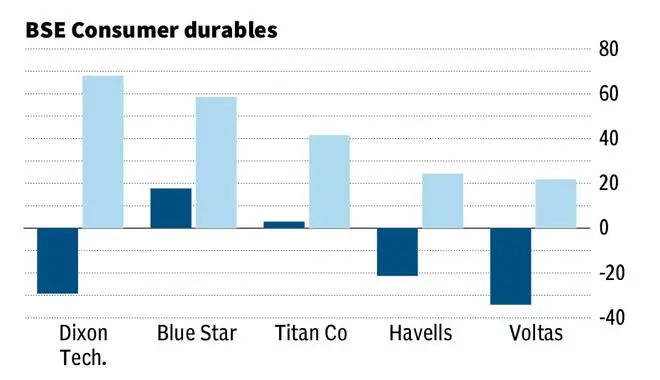

The government’s sustained emphasis on capital expenditure, along with its implementation of incentive programs like the Production-Linked Incentive (PLI) scheme, provides a robust structural tailwind for the consumer durable sector. Following a weaker than expected smartphone market in CY22, EMS player Dixon Technologies’s share price rebounded strongly in CY23 driven by a robust order book from the domestic mobile segment, leading the outperformers in this sector.

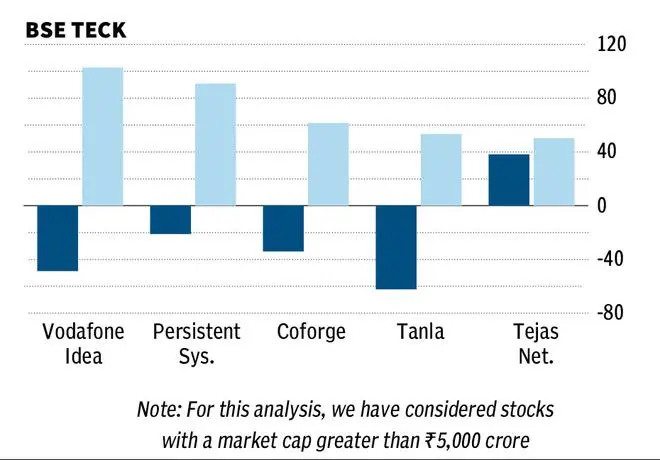

It should be pointed out that the BSE TECK has barely covered up the previous year’s loss but is yet to surpass its high recorded on January 17th, 2022. Among the sector constituents, the share price of Vodafone Idea (Vi) more than doubled in CY23, though it should be noted that Vi has not succeeded in finding new investors and the co’s lenders are also reportedly refusing to extend fresh loans.

Published on January 1, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.