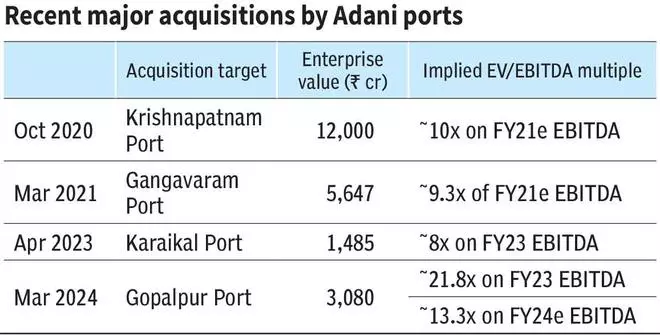

Last week, APSEZ announced the acquisition of Gopalpur Port in Odisha, which will make it the seventh Indian port to be acquired by the company since 2014. It currently has a total capacity to handle around 607 million metric tonnes (MMT) (around 355 MMT on the West coast and around 252MMT on the East coast). The acquisition of Gopalpur (20 MMT) will help APSEZ move a step closer to achieving its vision of East-West parity (share of East in domestic cargo volumes handled by the company increased from nil in FY14 to 43 per cent in 1HFY24)

With cargo volumes of 339 MMT, it is the largest commercial ports operator in India, accounting for nearly one-fourth of the cargo movement in the country. Revenue CAGR for the last five years (FY18-23) was 13 per cent and EBITDA margin for the ports segment of the business is over 70 per cent (overall margin of around 60 per cent). It ticks all the boxes for an equity investment, well almost. The stock has rallied ~65 per cent since December 2023 and is currently trading at ~18.6x NTM EBITDA (Bloomberg consensus), ~38 per cent premium to its five-year average. These valuation levels offer investors a good opportunity to book profits as suppressed return profile and cash conversion may not be viewed favorably when there is a reversal in optimism

APSEZ operates three main business segments: 1) Ports - domestic and international (around 90 per cent of 1HF24 revenue), 2) logistics (around 7.5 per cent), and 3) SEZ and port development ( around 2.5 per cent). APSEZ currently has 14 strategically located ports and terminals in India (seven each on the West and East coast) and the recently acquired Haifa port in Israel. Through its subsidiary Adani Logistics, APSEZ operates three logistics parks (in Haryana, Punjab and Rajasthan) and has the ability to handle 500,000 twenty foot equivalent units (TEUs) annually. It is evolving from a port company to an integrated transport utility providing end-to-end solution but ports continue to be the primary revenue driver.

India’s Maritime Amrit Kaal Vision 2047 aims to significantly improve the country’s maritime capability and efficiency. It has proposed the development of six mega ports by 2047, which will help increase the country’s cargo handling capacity (quadruple from around 2,600 MMT to around 10,000 MMT by 2047) and the traffic volume handled (5x from around 1,400 MMT to around 7,000MMT, a CAGR of 6.8 per cent).

In the past, APSEZ has been able to capture market share and grow ahead of the industry (share rose from around 11.6 per cent in FY14 to an estimated around 26.2 per cent in FY24). Since FY14, cargo volume handled by APSEZ has grown at a CAGR of 13 per cent compared to the industry CAGR of 4.4 per cent. As the clear market leader (share of 26 per cent compared to the second-ranked JSW infra with a share of 6 per cent), APSEZ is best placed to capture a major share of the increased volumes from the 2047 vision.

That said, it is important to consider the cost associated in achieving this growth. Around 94 per cent of the current East capacity (236 out of 252 MMT) has been through inorganic acquisitions.

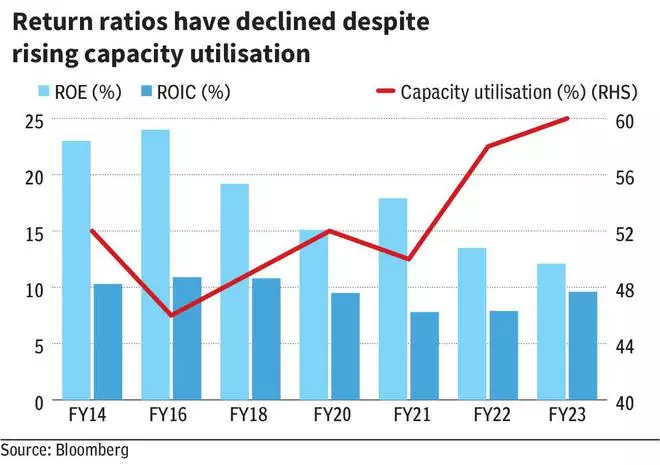

Even though APSEZ has managed to improve the performance of the acquired ports (improved utilisation and profitability), the high cost of acquisition has suppressed return ratios in the last few years. Return on Equity (RoE) and Return of Invested capital (RoIC) have dropped from around 24 per cent and around 11 per cent in FY16 to around 12 per cent and around 9.5 per cent respectively in FY23.

This is despite the overall capacity utilisation for the company’s domestic ports increasing from 46 per cent in FY16 to 60 per cent in FY23. To put that into perspective, major ports achieved utilisation of only 48 per cent in FY23 while the overall industry average was around 55 per cent. EBITDA margin for the ports segment reached around 70 per cent in FY22 and FY23 compared to around 66 per cent in FY21. The company has been targeting reducing ts net debt to EBITDA ratio to ~2.5x by FY24 from 3.1x in FY23. We expect return ratios to remain suppressed in the medium term, which may not be viewed favourably by the market when the tide turns.

Given the capital-intensive nature of the industry, the average capex-to-operating cash flow averaged about 50 per cent during FY19-23. Sales turnover has been in the range of 0.17-0.24x averaging less than 0.2x in the last decade. FCF conversion has largely been muted with FCF-to-sales averaging just 0.16x. The company has an ambitious target to reach cargo volumes from around 340 MMT in FY23 to 1,000 MMT by 2030 (around 17 per cent CAGR). APSEZ’s cash generation will remain under pressure while the company builds its capacity and capabilities over the next few years.

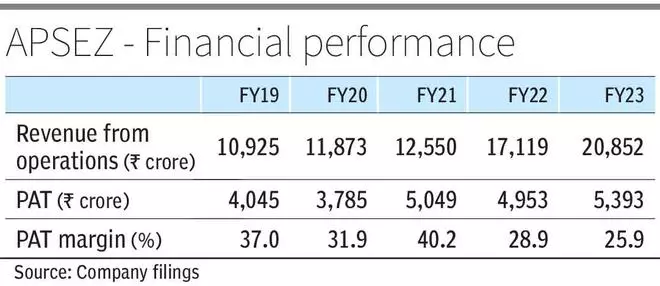

APSEZ reported revenue from operations of ₹20,852 crore in FY23 (22 per cent YoY growth) and ₹19,814 crore in 9MY24 (32 per cent YoY). For the full year FY24, Bloomberg consensus estimates top-line YoY growth of around 26.5 per cent Looking ahead, APSEZ is forecast to achieve revenue/EBITDA YoY growth of 15-17 per cent in FY25. At the current price, the stock is currently trading at 18.6x FY25 EBITDA, ~38 per cent higher than its five-year average of 14x. In addition to suppressed return ratios, the stock is currently trading at a price to book ratio of 6.1x, ~56 per cent higher than its long-term average, indicating that it has fully priced in all the optimism, thereby leaving very little margin of safety. We believe it is a good opportunity for investors holding the stock to book profits at these levels.

Published on April 6, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.