While Indian markets have started correcting recently, the correction in the technology sector in the US has been more brutal. According to recent report by BofA, 76 per cent of Nasdaq stocks are in a bear market. Many of them are high quality companies that have corrected due to a combination of macro, geopolitical and company specific headwinds, leaving wide open attractive entry points for long term investors even after factoring risks associated with their businesses.

One such company is Nasdaq listed global fintech giant – PayPal, which at its current price of $110.94 has corrected a whopping 64 percent from its all time/52 week high of $310. Trading at a one year forward PE of 23.1 times, EV/EBITDA of 16.2 times and EV/revenue of 4.2 times (Bloomberg consensus), its valuation appears attractive on absolute as well relative basis. On an absolute basis, its valuations is attractive when considering its CY21-23 revenue, EBITDA and EPS expected CAGR of 18, 28 and 28 per cent respectively. A PEG ratio (price to earnings growth) of just 0.82 for a high growth company makes the risk reward very favourable for long term investors. The lower the PEG ratio, more attractive the stock is and vice-versa. On a relative basis also the stock is cheap as compared to its 5 year average PE, EV/EBITDA and EV/revenue of 36.7, 25.6 and 7 times respectively. The company is also relatively attractive when compared with other established global fintech leaders such as Visa (PE of 28.4), Mastercard (34.2) and Block erstwhile Square Inc (77.2).

Further PayPal comes with a clean balance sheet with a marginal net cash position and CY22 free cash flow yield (free cash flows/market cap) at 5 per cent. In simple terms, annual free cash flows is the cashflow left with company post re-investments to sustain/grow business, and can be used to shore up cash buffers for a rainy day, or for capital returns - dividends and buybacks (although dividends/buybacks can be done with borrowed money as well, but doing it with own cash implies stronger financials).

While the valuation is attractive to buy at current levels, investors can look to accumulate over next few months given global macro and geopolitical headwinds which have increased volatility and market uncertainty.

PayPal in its original form was founded by famed entrepreneurs like Elon Musk and Peter Theil during the dotcom boom years. It was acquired by eBay for $1.2 billion in 2002 and later spun off as an independent listed company in 2015 and has a market capitalization of around $125 billion today. It is a leading technology platform that enables digital payments and simplifies commerce experience on behalf of merchants and consumers worldwide.

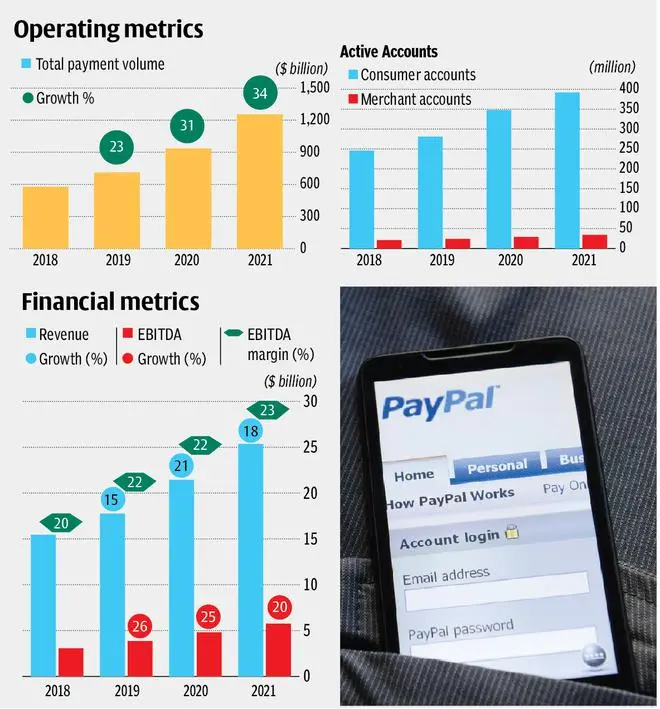

It operates a global two-sided network at scale that connects merchants and consumers and had 426 million active accounts as of December 2021 (consisting of 392 million active consumer accounts and 34 million active merchant accounts), across more than 200 markets (primarily countries, rest being protectorates/independent territories). Company has its own proprietary payments solution that enables completion of payment in its own platform. Besides core payment service via its ‘PayPal brand’, company also houses independent popular fintech brands including Venmo and Braintree. Customer can charge their accounts to make payments or link their accounts to multiple funding sources like bank accounts, credit/debit cards and certain cryptocurrencies to transact.

In using its technology/platform, consumers get the benefits of convenience/flexibility in payments when purchasing goods and services, or in transfer and withdrawal of funds. PayPal is also active in the recently trending fintech theme of ‘buy now pay later’, offering more convenience to consumers. Merchants on the other hand get an end-to-end payments solution that provides authorization and settlement capabilities, as well as instant access to funds and pay-outs. PayPal platform also allows customers to do cross border shopping/ transfer of funds and merchants get the advantage of global reach.

PayPal earns revenue by charging fees (take rate) for completing payment transactions and other payment related services, that are based on the volume of activity processed in its platform (TPV – total payment volume).

PayPal stock has had a rough ride with the stock down 64 per cent from its all time highs of $310 in July 2021. This is driven by two factors. The first being investor frenzy over the accelerated digitization them post onset of the pandemic in March 2020, pushing the stock well above fundamental value. The other factor being company resetting expectations after its 3Q CY21 results and again after 4Q CY21 results – in both instances management lowered CY22 revenue guidance citing weakened consumer confidence driven by factors like lack of stimulus payments, persistent inflation, ecommerce spending surge tapering post re-opening etc. Company is also expecting lower customer net adds in 2022 as it shifts focus on quality versus quantity of customers. While this is a positive as margins will improve offsetting any revenue impact, initial investor reaction was negative. Another factor was adjusting to its erstwhile parent eBay transitioning its sellers to its own payments system. This is however mostly behind with eBay revenues representing only 4 per cent of PayPal revenues now.

Despite the above issues, the underlying fundamentals for PayPal remain strong. In CY21, its user base grew 13 per cent and total payments volume increased a good 33 per cent to $1.25 trillion and gaining share as per its 10k filing. Revenue, EBITDA and EBIT grew 18, 19 and 29 per cent respectively. Further as mentioned above CY21-23 CAGR growth across key metrics is expected to remain strong. EBITDA margin is expected to improve to 26.6 per cent by CY23 from 22.7 per cent in CY21. Take rate is expected to remain largely stable to modestly down from around 1.85 per cent in CY21 to around 1.77 per cent in CY23. Further from a call with the management post Q4 results, JP Morgan in its report noted that management sounded optimistic on higher than 20 percent revenue and EPS growth beyond CY22.

Thus overall all looking past the expectations reset, which in management’s view reflected a measured approach to guidance, the recent severe share price correction is an opportunity to capitalize on for high quality high growth fintech company.

One long term risk that investors may need to look out for is whether cryptos and central bank digital currencies can impact fintech players.

Published on February 26, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.