The buyback of India’s largest EPC company Larsen and Toubro (L&T) opened on September 18. The record date for the buyback was September 12 i.e. investors who had the shares in their demat account by end of September 12 are eligible to participate. Eligible shareholders can tender their shares for buyback at a price of ₹3,200 per share. The last date for tendering shares is September 25, 2023. The buyback price is at a premium of around 10.5 per cent to the closing price on September 20. The final returns to shareholders will depend on the portion of shares bought back from the shares they tender. The company has notified allotting ₹10,000 crore to buyback or up to 3.125 crore shares, which is 2.2 per cent of the outstanding shares.

Buyback Considerations

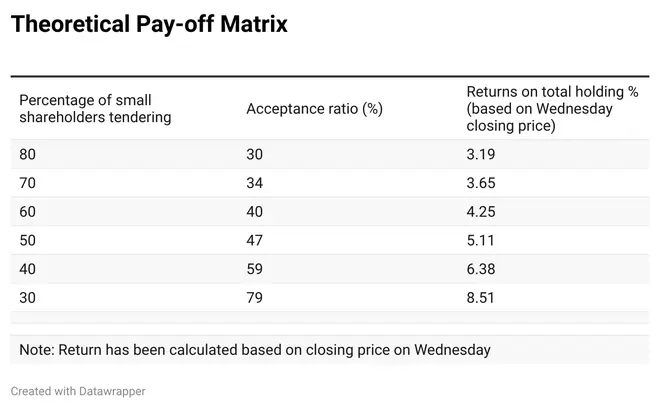

Of up to 3.125 crore shares to be bought back, 15 per cent shall be reserved for small shareholders i.e. the total value of holdings is less than ₹2 lakh as on record date, as per SEBI guidelines. Based on this, small shareholders held 1.97 crore shares as on the record date, while 15 per cent of the buyback authorisation reserved for them represents 0.46 crore shares. Thus, although the company is buying back only 2.2 per cent of outstanding shares, 23.6 per cent (0.46/1.97) of outstanding shares tendered by small shareholders will be bought back. This is assuming all small shareholders tender their shares. However, on a practical basis, it is unlikely that all shareholders will tender all their shares. Hence, we need to make assumptions regarding the acceptance ratio, and, thereby calculate the returns based on the acceptance ratio (portion of shares accepted out of shares tendered). If 30/50/70 per cent shares are tendered, the acceptance ratio comes out to 79/47/34 per cent respectively, resulting in gains of 8.5/5.1/3.6 per cent (premium on shares accepted/ total value of holdings) respectively, considering the buyback premium of around 10.5 per cent.

The L&T stock trades at a one-year forward P/E of around 28 times i.e. about 40 per cent premium to its five-year historical average P/E of around 20 times. Thus, while growth prospects remain good, the premium valuation likely implies the shares are not undervalued. Hence, considering this and the fact that investors can pocket decent gains, investors can tender their shares.

Business prospects

Amid an infrastructure push from the government, L&T has been a major beneficiary of the rise in capex and the stock has given returns of around 52 per cent over the last one year.

The company is present in infrastructure (47 per cent of revenue), energy projects (13 per cent), IT (22 per cent), financial services (7 per cent), majorly, and other segments such as hi-tech manufacturing and developmental projects. Its core infrastructure projects division comprises EPC projects relating to buildings and factories, transport infrastructure, heavy civil infrastructure, power transmission and distribution, water treatment and minerals and metals.

The company has seen an order inflow of around ₹2 lakh crore during FY23, translating into growth of around 19 per cent y-o-y. While revenue increased by around 17 per cent on account of strong execution, the EBITDA margin dipped from around 11.6 per cent to 11.3 per cent on a Y-o-Y basis on account of cost pressures faced in EPC projects. Core EPC margins during the year remained at around 8.6 per cent i.e. lesser than the guided margins of around 9.4 per cent on account of cost pressures in legacy projects. According to the management, margins may start picking up by H2FY24, as by the time, the legacy projects may get executed and have guided for around 9-9.1 per cent core EPC margins for FY24. For FY24, the management has given guidance of order inflow growth of 10-12 per cent and revenue growth of 12-15 per cent. At the current stock price, these trends are well reflected.

Also read: L&T Q1 FY24 review: Margin pressure in core infra segment persists

Published on September 20, 2023

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.