In line with the government’s target of reaching close to 500 GW of installed generation capacity from renewable energy sources by 2030, power advisory body Central Electricity Authority (CEA) has estimated investments to the tune of ₹2.4-lakh crore in the inter-state power transmission space over the next 7-8 years. Power transmission PSU, Power Grid Corp (PGCIL), appears to be among the best-placed to tap the opportunity in the Indian transmission space.

We gave an Accumulate rating on the stock in the edition dated July 17, 2022, owing to reasonable valuation, strong dividend yield, assured earnings model and the stock being a safe bet given the volatility in the market then. Since then, the stock has returned nearly 62 per cent (including dividends). This has been due to its re-rating as its P/E went up from around 9 times to nearly 14 times.

Investor optimism in the stock is driven by expectations of increased capex, which will support the company’s growth in the medium term. Higher capex incurred in building transmission assets will result in commercialisation of projects once the execution is completed, which can boost the company’s revenues and cash flows, going forward.

Currently, the stock delivers a dividend yield of around 5 per cent and the company benefits from the strong growth visibility on account of its planned capex over the next 7-8 years. Ultimately, investors can continue to ‘Accumulate’ the stock on account of positive industry dynamics, stable business model, strong balance sheet and healthy dividend yield.

PGCIL handles about 50 per cent of India’s total power transmission network and has a near monopoly in handling the country’s inter-state power transmission network. Power transmission is the bulk movement of electrical energy — from power generating plant to an electrical substation. The company generates about 96 per cent of its revenue from the transmission business, while other sources of revenue have been telecom (2 per cent) and consultancy (2 per cent).

A majority of the company’s transmission revenue (95 per cent) comes from the regulated tariffs set by the Central Electricity Regulatory Commission (CERC), which ensures complete pass-through of costs plus 15.5 per cent of pre-tax ROE (Return on Equity) on its completed projects awarded under the regulated tariff mechanism. The components of the annual transmission charges include return on equity, interest on term loan, interest on working capital loan, operations and maintenance expenses and depreciation.

PGCIL needs to ensure technical network availability above the normative level of 98 per cent to recover the annual transmission charges. Ultimately, availability-based tariff means the company’s tariff charge doesn’t depend on the volume of power transmitted.

Along with this, PGCIL earns revenue under TBCB (tariff-based competitive bidding), where it competes with private players such as Adani Energy Solutions and Sterlite Transmission. Here, projects are awarded to those providing cheapest bids, and tariffs are competitive. However, despite the competition, the company has been able to maintain its foothold in TBCB with 40-50 per cent market share in bids.

PGCIL has been able to achieve 99.85 per cent availability during H1FY24 as against the normative level of 98 per cent.

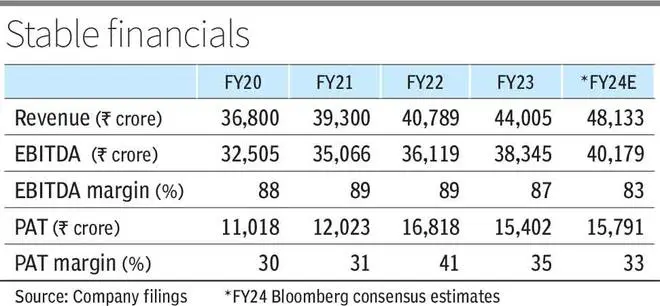

It had a flattish growth of around 1.5 per cent in revenue during H1FY24 from operations of around ₹22,315 crore. Further, EBITDA during the period increased by 5 per cent to around ₹19,591 crore with EBITDA margin expanding from around 85 per cent to 88 per cent, aided by lower transmission costs. Over the years, the company has been able to maintain its EBITDA margins in the 83-88 per cent range owing to its regulatory return model.

Despite being in a capital-intensive business, PGCIL has been able to reduce its leverage over the last five years, resulting in reduction in its D/E from around 2.4 times during FY18 to around 1.4 times as of H1FY24. Further, the company’s ability to access debt at cheaper levels compared to its private peers results in a competitive edge, especially while bidding for TBCB projects. PGCIL provides its investors an attractive dividend yield of around 5 per cent.

The stock is trading at a P/B of 2.7 times.

During FY2011-18, the company’s growth was driven by sharp increase in capex, which reached around ₹25,800 crore in FY18. However, it fell to nearly ₹9,212 crore in FY23 due to increased competition in the space and the majority of the planned inter-regional transmission capacity relating to thermal was completed. With ₹2.4-lakh crore RE related inter-State transmission opportunities over the next 7-8 years, the transmission space appears to have seen revival.

As per the management, there is an expected capex visibility for the company of around ₹1,88,000 crore in total in transmission space by 2032. This includes inter-state projects worth ₹1,16,500 crore, intra-state projects worth ₹37,000 crore, cross-border interconnection projects worth ₹10,000 crore and international projects worth ₹7,500 crore. Thereby management expects the capex to reach more than ₹12,500 crore in FY25 which may gradually increase to annual capex of ₹20,000-25,000 crore by FY27 or FY28.

The company incurred capex of around ₹4,246 crore during H1FY24, while the management has revised its FY24 capex target from around ₹8,800 crore to around ₹10,000 crore split equally between RTM and TBCB projects.

Transmission apart, the company also estimates ₹17,000-crore outlay in other businesses such as solar generation, smart metering and data center over the next 7-8 years. As on September 30, 2023, PGCIL has ₹55,000 crore of works in hand, including ₹16,500 crore of TBCB projects.

Published on January 6, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.