During the week ending March 15, the Indian equity benchmark indices BSE Sensex and NSE Nifty experienced a decline of 2 per cent attributed to selling pressure. The fall stems from weakened US macroeconomic data and concerns regarding potential delays in interest rate cuts. The spillover of the nervousness in the mid- and small-cap segments, following SEBI’s concerns on a building up of froth in this space could also be another reason.

Majority of sectoral indices concluded in negative territory, with the BSE Realty experiencing the steepest decline at -9.3 per cent, followed by the BSE PSU at -8.5 per cent, BSE Metal at -7.7 per cent, and BSE Power at -6.7 per cent. BSE Teck and BSE IT exhibited some marginal positive performance, closing with gains of 0.8 per cent and 0.5 per cent, respectively.

Although certain stocks saw upward movement lacking substantial support from notable news or underlying fundamentals, Solar Industries, RVNL, and Computer Age Management Services Limited (CAMS) emerged as the top gainers within the BSE 500 index, driven by fundamental developments during the preceding week.

The shares of Solar Industries witnessed an increase of 17.7 per cent in the preceding week, attributed to securing of export orders.

The company specialises in the production of a comprehensive array of industrial explosives and explosive initiation devices. Furthermore, it has expanded its operations into the manufacture of ammunition for military purposes.

In a recent disclosure to the exchanges, Solar Industries announced procurement of export orders totalling ₹455 crore for the supply of defence-related products, to be fulfilled over the course of the next two years.

The stock is currently trading at a trailing P/E ratio of 106 times.

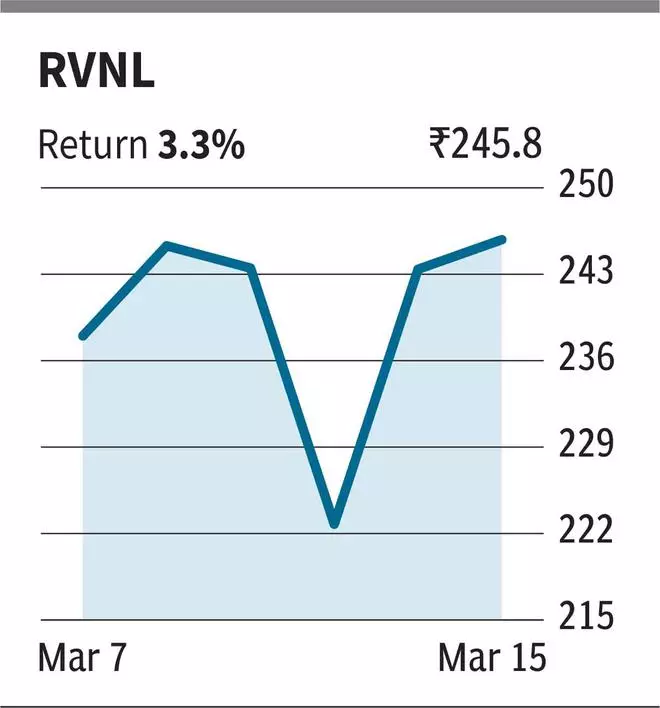

The stock of RVNL jumped by over 3 per cent last week, on account of bagging multiple contracts.

Rail Vikas Nigam Ltd (RVNL) is a public sector undertaking (PSU) specializing in the development of rail infrastructure.

In its recent disclosure to the exchanges, RVNL announced receiving two contracts from Madhya Pradesh Poorv Kshetra Vidyut Vitaran Co. Ltd. for the supply, installation, testing, and commissioning of 11 KV Line associated works in Jabalpur and Jhabua. These projects, to be completed over 24 months, are valued at over ₹251 crore and ₹106 crore, respectively.

Additionally, RVNL secured two contracts from Himachal Pradesh State Electricity Board Ltd for the enhancement of distribution infrastructure in the South and North zones of Himachal Pradesh, with total costs around ₹888 crore and ₹410 crore, respectively.

Moreover, the company secured orders from Rajasthan Rajya Vidyut Prasaran Nigam Ltd and Madhya Pradesh Power Transmission Co Ltd for the construction of 132 kV grid substations and transmission lines, with contract values of ₹193 crore and ₹174 crore, deliverable over 24 and 18 months, respectively.

In another development, RVNL received Letters of Acceptance (LoA) from Madhya Pradesh Metro Rail Corporation Limited (in joint venture with URC) and Maharashtra Metro Rail Corporation Limited for the design and construction of elevated viaducts valued at over ₹339 crore and ₹543 crore, respectively.

The stock is currently trading at a trailing P/E ratio of 36 times.

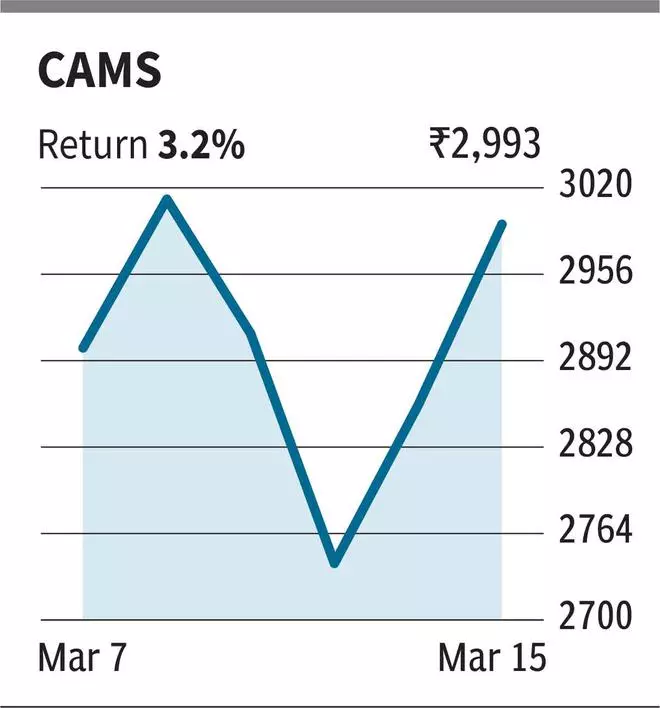

The stock of CAMS surged by 3.2 per cent last week, attributed to a target price revision by a brokerage firm.

Computer Age Management Services Ltd (CAMS) operates as a mutual fund registrar and transfer agency, overseeing more than 69 per cent of assets within the Indian mutual fund industry.

In the previous week, brokerage house Motilal Oswal revised the target price for CAMS upwards from ₹2,950 to ₹3,450. This revision was prompted by the company’s expansion into non-mutual fund (MF) businesses, expected to drive higher growth rates compared to the MF segment over the coming years.

In Q3 FY24, CAMS reported a 20 per cent y-o-y increase in net profit, amounting to ₹89 crore, driven by improved margins. Furthermore, the contribution from non-MF business activities increased by 300 basis points y-o-y, contributing 13 per cent of total revenue.

The stock is trading at a trailing P/E ratio of 51 times.

Published on March 18, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.