Steel companies and the metals universe have powered Nifty/Sensex earnings turnaround post Covid, owing to higher commodity prices. But owing to recent 180 degrees change in global macro environment including increase in bond yields/ lending rates, inflation, and economic outlook, a closer view of steel stocks may be necessary. We have analysed Tata Steel, JSW Steel, Steel Authority of India Limited (SAIL) and Jindal Steel and Power (JSPL) on the four parameters for a comparison. Tata Steel’s higher spreads (revenue and cost), better access to European markets and lower relative valuation makes it a better stock amongst the lot. On a contrarian view though, SAIL and JSPL have opportunities to improve product mix and realise better valuations going forward. But the bumper earnings of FY22 may only be repeated beyond FY24 in the current commodity situation.

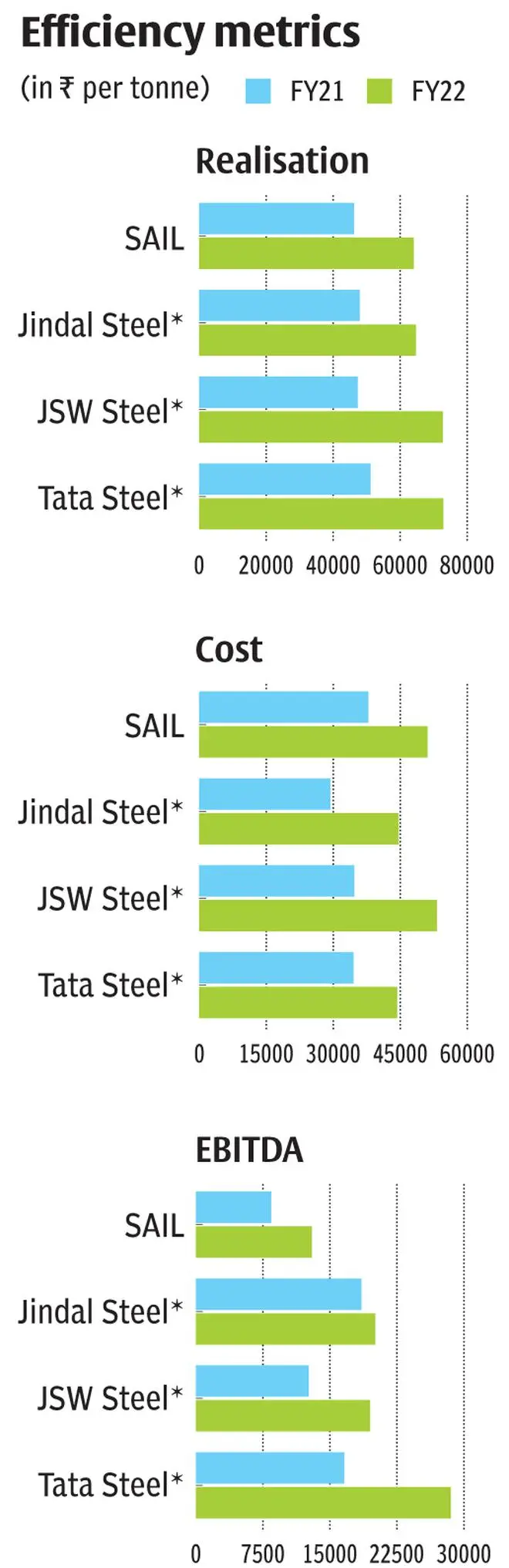

Efficiency measure: spread or EBITDA per tonne, is the difference between realisation (per ton of sales) and cost (operating cost per ton) where operating cost is a function of raw materials (around half), and employee (6-10 per cent) and other related expenses (around 40 per cent).

Standalone operations account for more than 95 per cent of SAIL and JSPL consolidated operations and 82 per cent of JSW Steel operations but only 52 per cent of Tata Steel. We are comparing on a standalone basis to focus on domestic markets operations where , Tata Steel followed by JSW Steel have better realisations (₹70-73,000 per ton as on Q4FY22) compared to SAIL and Jindal steel (₹65-66,000 per ton). A higher mix of value-added products drives better realizations, which SAIL is implementing currently by improving long steel contribution compared to semi-finished product mix. For comparison though, in Q3FY21, the quarter after Covid had struck and companies had recovered their production schedule, the average realisation was around ₹48,000 per ton with very little variation amongst the four companies.

On the cost side, Tata Steel and Jindal Steel operate at lower cost per ton (around 48,000 per tonne in Q4FY22) compared to the other two at ₹56,000 per tonne. Coking coal which accounts for 60-65 per cent of raw material costs have increased drastically. As a result, operating costs have increased by an average 40 per cent from H1FY22 to H2FY22 across the four. Russia Ukraine conflict has added to the higher coking coal prices with import duty reduction offering only a minor cost offset to the companies.

The outlook on spread seems to be narrowing for the companies. With the implementation of export duty on steel, the domestic spot prices have already declined 8 per cent to ₹65,000 per tonne in May for hot rolled coil steel and expectation is for further decline. On the cost side, coking coal imports are expected to be higher even into Q1FY23. With spread narrowing to ₹8,000-9000 for the weakest of the four largest players (SAIL in Q4FY22), export duty implementation by government will have to consider the efficiency of other smaller steel manufacturers as well, which places a clock on the duties timeframe. But overall on the longer term, higher steel prices are expected to be above last cycle considering curtailed Chinese participation in export of steel (environmental concerns) and lower dependence of Europe on Russian coking coal imports.

Higher export demand and prices have aided companies in the last one year, which has been dampened by the duty imposition. Jindal Steel has had the highest exposure to export market, averaging around 33-35 per cent in the last two years. The company has indicated that its export mix may continue similarly by focusing on pockets of products without export duty. Similarly, JSW Steel expects to maintain exports at 15-20 per cent despite the duty. But companies, having to bear the export duty, will take a call on the export-domestic mix depending prices emerging in the next few periods. Tata Steel with strong European presence (with Corus Steel) with standalone operations contributing to only 52 per cent of consolidated top line and SAIL with low 9 per cent export revenue contribution are placed well with regard to export duty imposition.

But tepid domestic demand and its capacity to accommodate higher allocation, even with lower pricing, seems to be major headwind for all producers till export duties are lifted. Auto, OEM manufacturers and infrastructure companies are the largest consumers of steel.

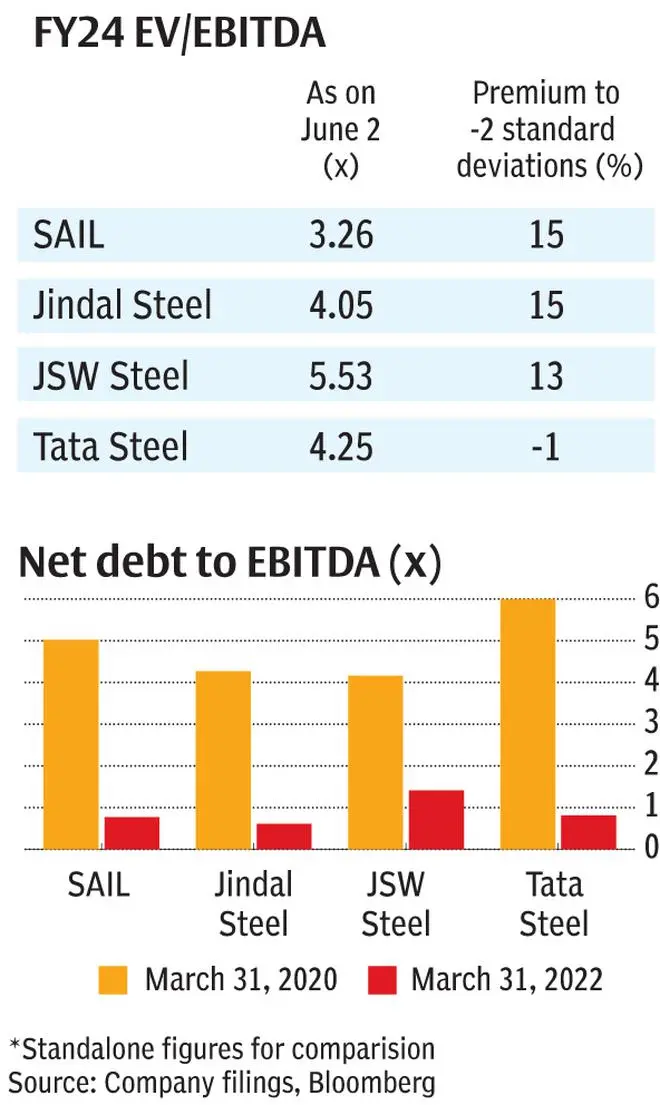

Steel companies have deleveraged significantly from an average net-debt/EBITDA of 4.8 times on March-2020 to 0.9x on March-2022. While the quantum of debt is lower, the increasing cost of debt and lower spreads from operations can lead to interest costs taking 15-18 per cent of EBITDA compared to 10 per cent earlier (when realisations were higher and operating costs were lower), unless companies continue to de-lever consistently. Tata steel with highest spreads is better placed amongst the lot to maintain interest costs at 8-9 per cent of EBITDA. SAIL and Jindal Steel targets to be debt free by FY23 may be complicated by decreasing spreads.

On the other hand, capex plans are at a higher level and few companies have reiterated the plans even after import duty announcement and lower spread outlook. China’s lower participation in steel exports may have encouraged such positioning. SAIL, JSW Steel and Tata Steel have budgeted between ₹8,000 crore and ₹20,000 crore for capex in the next year alone with a significant increase in output by 15-20 per cent. Considering the volatile environment, Jindal Steel with spread out investment schedule over three years (₹18,500 crore) may be better placed amongst the four. If the spreads continue to decline, companies may have to step off the gas on capex considering targets to deleverage.

Companies trade at a discount in steel up-cycles and this cycle is no different with top line growth of 35 per cent across the four companies in Q4FY22. Measured as premium to last five-year average EV/EBITDA less 2 standard deviations, SAIL, JSW Steel and Jindal Steel are trading at 13-15 per cent premium. Only Tata Steel is trading near to two standard deviations below average currently. Also, one should consider the highest input prices witnessed by the industry baked into the lower EBITDA expectations providing further cushion to valuations.

Published on June 4, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.