India’s power sector is marking a major shift with the government’s proposed target of 50 per cent of installed power capacity from non-fossil fuel based energy resources by 2030, a significant part of which will be from renewable energy. Indian power major NTPC (National Thermal Power Corporation) is eyeing 60 GW of renewable energy capacity and 130 GW of total installed capacity by 2032. At a group level, NTPC is the country’s leading power generating company with an installed capacity of about 69,134 MW.

At the current market price (CMP) of ₹158 level, the stock of NTPC trades at a trailing P/E of 9.4 times against its three-year average P/E of 9.8 times; and P/B of 1.11 times compared to three-year average of 0.9 times. Based on expected earnings, the stock trades at a one year forward P/E of 8.2 times. The company also trades with a decent dividend yield of around 4.5 per cent at CMP. Hence, in the currently environment of market volatility, the long-term investors can look forward to accumulating the shares of NTPC on account of its assured return model from regulated projects, reasonable valuation along with a good dividend yield and consistent payout.

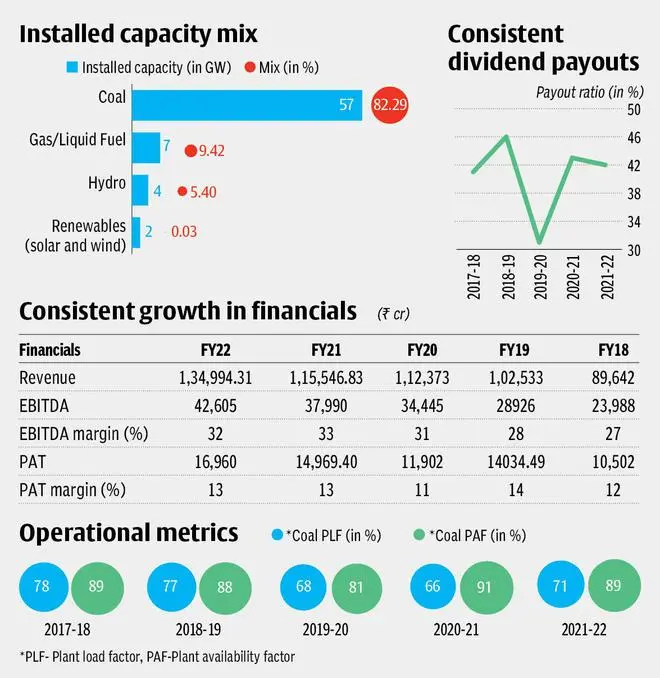

NTPC, a PSU with Maharatna status, generates 24 per cent of India’s electricity with a share of 17 per cent of the country’s installed capacity. The company is majorly involved in the business of electricity generation along with other businesses such as consultancy, project management, power trading and supervision services. A majority of the electricity generated by the company is through coal while other sources being gas, hydro, wind and solar. The company earns bulk of its revenue from regulated projects through the sale of thermal power to distribution companies under long term PPA (Power Purchase Agreement) wherein tariff structure is such that it ensures complete pass through of costs such as plant capacity charge, supplementary capacity charge (emission control system cost), interest on loan, interest on working capital and energy cost (fuel) and allows ROE (Return on equity) of 15.5 per cent over and above these costs.

The company uses multiple means to source coal. One, company has long term FSA (Fuel Supply Agreement) with CIL (Coal India Ltd) for supply of coal based on ACQ (Annual Contracted Quantity). Two, NTPC has captive coal mines for its own exclusive use. Due to the shortage of coal in the recent times, NTPC also imported coal following government guidelines for power generation companies to import 10 per cent of the coal needed for building stocks and blend it with domestic supply. which proved to be costly affair as global coal prices were five times of CIL notified coal prices . However the issue appears to be behind now, as the government has withdrawn the mandatory blending order on account of adequate stocks at power plants before annual rise in coal demand post monsoon when electricity demand picks up.

In the renewable space, the projects are being awarded on a competitive tariff basis which means that the company will be competing with various private players to win bids. Down the line, i.e. 10 years from now, the company look forward to making renewables a substantial part of its portfolio but currently, the segment accounts for only 2.02 GW of installed capacity against 57 GW of coal based thermal installed capacity.

For the regulated projects, the company’s capacity charges are mainly based on PAF (Plant availability factor), a metric indicating capacity available for generation (ie power that can be supplied at any time). NTPC’s PAF for coal and gas plants for Q1 of FY23 was 90 per cent and 73 per cent which was lower compared to 93 per cent and 97 per cent for coal and gas respectively for Q1 of FY22 due to maintenance led closure of two plants. NTPC scores on the capacity utilisation front, as the company’s coal plants achieved PLF (Plant load factor) of about 80 per cent which is more than that of industry average PLF of 69.5 per cent and it has improved on year-on-year basis backed by higher electricity demand. If the PLF for a generating station is above 85 per cent, the company would earn incentive over and above the capacity charge.

The company with revenue of ₹43,177 crore for Q1 of FY23 clocked a growth of about 47 per cent on y-o-y basis while the same was 17 per cent on a q-o-q basis. Net profit for the period has increased only about 17 per cent on y-o-y basis and decreased 23 per cent on q-o-q basis. Margin pressure has been on account of lower late payment surcharge (interest payable by distribution companies on account of delay in payment) due to Power Ministry scheme recently allowing distribution companies repay overdue in up to 48 monthly instalments and under recovery of fixed costs to the tune of ₹500 crore at two generating stations which can be recovered in the coming quarters. NTPC’s debt-to-equity ratio has remained stable at around 1.55 times.

The debt part has not been a concern for the company as the firm has been able to raise debt at an average cost as low as 5.94 per cent due to its assured return model. Receivables being at around 45 days have been under control. Further, the company has provided investors with a dividend of ₹7 per share resulting in a dividend yield of 4.5 per cent at CMP with payout ratio of around 40 per cent for FY2021-22 which has been consistent over time.

In the renewables energy (RE) space, around 4.09 GW of capacity is under construction and the company has recently won the bids for 2.2 GW. To keep up pace with the target of 60 GW of renewable energy installed capacity in the next ten years, management has guided for commercialisation of around 6 GW of total capacity during FY23 which includes 1.5 GW of solar capacity addition . For RE projects, company is looking for avenues beyond PPAs such as selling power directly to corporates and industrial customers which company believes can give better returns. Further, the company is consolidating its RE assets under the subsidiary NTPC Green Energy Limited and plans for monetisation of these assets during FY23.

While there have been some concerns in the power generation space such as shortage of coal, increase in price of solar modules and competition from private players in renewables space, investors can accumulate the stock with a long term perspective. The risk reward is favourable as given its defensive characteristics such as strong foothold in power generation sector, reasonable valuation, stable dividend payouts and earnings visibility. Renewable energy project pipeline also bodes well for the long term.. Monetisation of renewable assets can act as a catalyst for further upside.

Published on August 13, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.