Insecticides India appears to be a good proxy to play the big agri opportunity in the country | Photo Credit: rvimages

Investors with an investment horizon of two to three years can consider the stock of agrochemical maker Insecticides India. The two-decade-old, Delhi-headquartered company is among the country’s leading producers of crop protection chemicals such as insecticides, herbicides, and fungicides. Besides chemicals, the company is building its biological portfolio of pesticides, bio-control agents and other products. Further, it is expanding its technical (raw material) and formulation facility at Chopanki (Rajasthan) and Dahej (Gujarat) at a cost of ₹140 crore, which is expected to come on stream during the October-December 2022 quarter. All these should keep the company in good stead, for the next two years. At the current price, the stock trades about 13 times and 12 times its FY23 and FY24 estimated earnings. The stock trades about 17.7 times its trailing 12-month earnings, compared to 39 times for the industry.

We believe Insecticides India to be a good proxy to play the big agri opportunity in the country. India’s consumption of agrochemicals is still lower than that of peers such as China and Japan, at 0.6 kg per ha, compared to 13.1 per cent for China and 11.8 per cent for Japan and world average of 2.6 per cent. Crop losses in India due to pest infestation are high at 25-30 per cent, which can be mitigated with increasing usage of crop protection chemicals. This reinforces the strong growth potential for the industry in the near to medium term, which is expected to average at excess of 8 per cent over the next 8 years, 2.7 times higher than the global industry growth of about 3 per cent.

Also, companies across the world are looking to reduce dependence on China for crop protection supplies. India’s strength in research and manufacturing provides it an edge over others, which should bode well for the industry, and specifically for companies that are investing in capacity expansion and backward integration, such as Insecticides India.

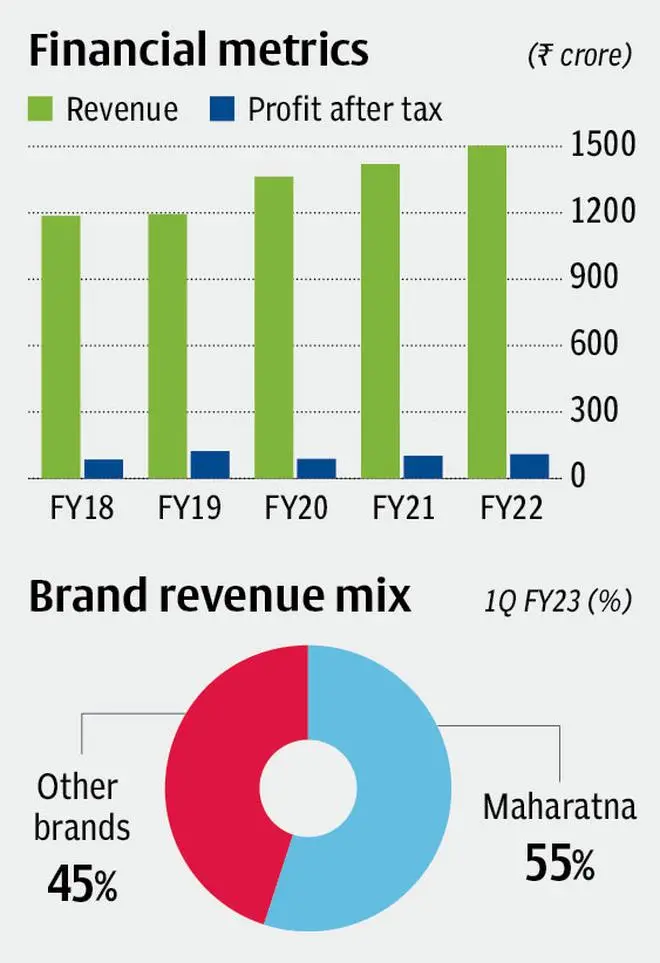

The focus on building brands over the last several years has been Insecticides India’s biggest strength. Currently there are 11 focus Maharatna products that typically enjoy high margins compared to other products. The company, besides investing on growing the Maharatna brands, is also building a strong generics pipeline, with at least 6 new launches planned in FY23.

In Q1FY23, the company unveiled three products, including herbicide Torry for maize crop, launched in India for the first time. Interestingly the growth is being driven by these new products, which is suggestive of the good response to and acceptance of the company’s products by the farming community. For instance, in 1QFY23, the products launched in FY22 accounted for over a third of the revenue.

Besides generic products, the company is focussed on novel research for which it has a joint venture with OAT Agrio Co, Japan, with a research and development unit in Chopanki (Rajasthan). The company also operates a GLP (Good laboratory practices)-certified lab in Chopanki. The JV has already been granted patents and the company expects the first novel product to be commercialised by 2025.

The company’s foray into biologics through its subsidiary IIL Biologics and traction in this segment with a current portfolio of 10 products, will also drive the medium to long-term prospects.

New launches across generic formulations, biologics and novel products will also bolster medium to long-term growth.

The company is investing about ₹150 crore in expanding its technical synthesis unit and formulation manufacturing at Dahej and Chopanki. The incremental capacity is expected to come on stream by December 2022. With an historical average assets-to-turnover ratio of about 4 times, we expect this investment about 2-3 years from now, at peak, to add about ₹600 crore to the company’s revenue, which is a 40 per cent increase from the current sales of ₹1,504 crore, in FY22.

Besides, we believe the technical synthesis expansion is in line with the company’s larger plan to reduce import dependency for raw material through backward integration. This will not only help the company during such times, when there are supply disruptions across the globe, but also offer better margins and pricing flexibility.

Over the last few years, the company has steadily reduced its debt, and is currently almost debt free. As of March 2022, secured debt was ₹49 crore, from ₹305 crore in FY19. Also, the return ratios, which had bottomed out in FY20, are now showing signs of improvement. The return on capital employed is stabilising and improving from about 14 times in FY20 to 16 times by FY22.

In the June quarter, the company managed to grow revenue by 19 per cent to ₹560 crore, compared to the same period last year. However, higher raw material and fuel costs, on the back of record crude prices, impacted the company’s operating profit margin, which declined from 11.3 per cent the previous year to 10.4 per cent. Net profit for the period grew about 10 per cent to ₹39.6 crore.

Over the next two years, the company expects to achieve double-digit revenue growth. Insecticides India expects operating profit margin to improve by 100 basis points and this will be on the back of product mix and backward integration, besides cost optimisation efforts.

The ongoing supply disruptions and geopolitical crisis and resultant fluctuation in crude and gas price can impact the company’s margins. Also, climate change and its repercussions on agriculture globally will negatively affect demand for agrochemical globally, and Insecticides India’s export and domestic sales. The company has already revised downward its export sales forecast for FY23, from ₹150 crore. However, with exports accounting for under 8 per cent of the total sales, the company’s strength in the home market should help negate the slowdown in export sales.

Published on September 10, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.