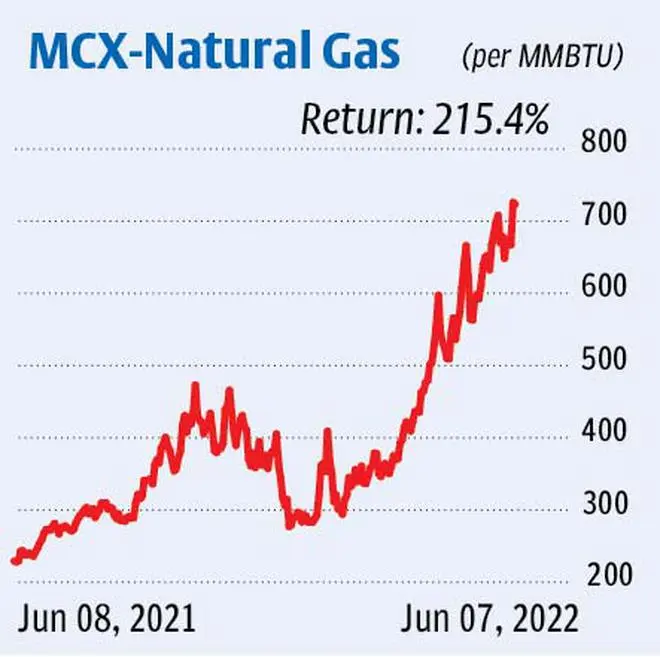

The continuous contract of natural gas on the Multi Commodity Exchange (MCX), which has been on an uptrend since February this year, has begun showing some weakness of late. The chart shows a slowdown in momentum as the difference between the recent highs is dropping.

Moreover, the RSI and the MACD on the daily chart have failed to form new highs in tandem with the price. While these are worrying signs for the bulls, the price remains above both 21- and 50-day moving averages, and the price band of ₹600-625 can offer good support. So, there is no confirmation of a bearish reversal yet.

That said, notwithstanding the recent weakness, we would still recommend longs but with tight and dynamic stop-loss to reduce the risk.

Considering the above factors, traders can plan their longs in three legs. That is, buy for one-third of the total intended amount at the current level of ₹725, another one-third when the price drops to ₹680, and deploy the remaining when the price softens to ₹625. Here, the average buy price would be around ₹677. Place initial stop-loss at ₹590.

When the price rallies above ₹750, start moving your stop-loss upwards at 1.5 times the daily ATR (average true range). For instance, when the price moves to ₹750, alter the stop-loss to ₹690 i.e., 1.5 times the daily ATR. Daily ATR is now 40 and thus the stop-loss should be 60 points (1.5 times of 40) below ₹750. Move the stop-loss with this interval as and when the contract rallies. Do not revise stop-loss when the price falls.

Published on June 8, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.