The Indian benchmark indices, the Sensex and Nifty 50, have risen for the third consecutive week. Sensex rose 1.65 per cent and Nifty was up 1.86 per cent last week. Both the indices have surged over 5 per cent in the last three weeks.

All sectoral indices closed in green last week. The BSE Metal index outperformed others by surging 4.72 per cent last week. The BSE Auto and BSE Bankex rose marginally by 0.62 and 0.58 per cent respectively.

The Foreign Portfolio Investors (FPIs) have increased their pace of buying last week. The FPIs bought $2.04 billion in Indian equities last week. The rally in the Sensex and Nifty will get a boost from here if the FPIs continue to buy Indian equities.

As expected, Nifty opened with a wide gap-up above 17,800 at 17,910.2 on Monday last week. The pull-back from the high of 18,178.75 found support around 17,900. The index has bounced back well from the low of 17,899.90 to close the week on a strong note at 18,117.15, up 1.86 per cent.

The week ahead: The close above 18,100 is a positive. The outlook is bullish. Immediate support is at 17,900. As long as the Nifty sustains above this support, a further rise to 18,300 and 18,430 is likely this week.

Graph Source: MetaStock

The near-term outlook will turn negative only if Nifty breaks below 17,900. In that case, a fall to 17,800 can be seen initially. If the sell-off intensifies, then the Nifty can see a steeper fall up to 17,550-17,500 in the short term.

Medium-term outlook: The bigger picture is bullish. The level of 17,500 is a strong support. Below that the 21-Week Moving Average at 17,076 and a trendline at 16,900 are the crucial medium-term supports for the Nifty. The chances are high now for the Nifty to sustain above 17,500 itself.

We retain our broader bullish view of seeing 19,200-19,300 on the upside initially. From a much bigger picture perspective, the Nifty will now have potential to target 20,500 on the upside in the coming months.

Sensex opened with a gap-up and broke above 61,000 initially last week. The index fell sharply from the high of 61,289.73 failing to get a strong follow-through buyers. However, Sensex managed to bounce back from the low of 60,245.96 and close the week at 60,950.36, up 1.65 per cent.

The week ahead: Near-term outlook is bullish. Immediate support is at 60,450. As long as the Sensex sustains above this support, the chances are high for it to see a sustained break above 61,000. Such a break can take the Sensex up to 62,500 in the short term.

Graph Source: MetaStock

The index will come under pressure only if it breaks below 60,450 decisively. In that case, a test of 60,000 is possible initially. A further break below 60,000 will see an extended fall to 59,300-59,000. But such a steeper fall below 60,000 looks less probable now.

Medium-term outlook: The medium-term outlook is bullish. The level of 59,000 is the first important support. Below that the 21-Week Moving Average near 57,350 is the next strong support. We see high chances for the Nifty to hold above 59,000 itself in case it falls below 60,000. We retain our bullish view of seeing 63,500-64,000 on the upside in the coming months.

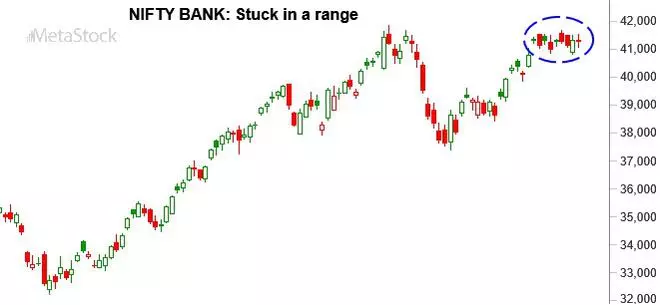

Nifty Bank index has been stuck in a sideways range over the last couple of weeks. The trading range has been 40,820 to 41,680. Within this range, the index has closed at 41,258.40, up 0.65 per cent.

The immediate outlook is not clear. The Nifty Bank index can continue to oscillate in this sideways range for some time. However, from a bigger picture perspective, the bias is bullish to see a breakout above 41,680 in the coming days.

Graph Source: MetaStock

There is a strong support at 40,600. As long as the index stays above this support, the chances are high for it to breach 41,680. Such a break can take it up to 42,000 and 42,500 initially. A further break above 42,500 can then take the Nifty Bank up to 43,000-43,300 eventually in the coming weeks.

The Nifty Bank index will come under pressure only if it breaks below 40,600. In that case, it can fall to 40,250 and 40,000.

As expected, the Dow Jones Industrial Average (32,403.22) witnessed a corrective fall last week. The fall was triggered after the US Federal Reserve reiterated its hawkish stance in its meeting last week.

The Dow tumbled from around 33,000 to make a low of 31,727 on Thursday. It has closed at 32,403.22 for the week, down 1.4 per cent.

Graph Source: MetaStock

Although the Dow has managed to bounce back well on Friday, the outlook is mixed as seen from the weekly chart. Important support is at 31,440 – the 21-Week Moving Average. Strong resistance is in the 33,300-33,400 region. We can expect the Dow to consolidate sideways between 31,400 and 33,400 for a few weeks.

A breakout on either side of 31,400-33,400 will then determine the next leg of move. The bias is bullish to see an upside breakout above 33,400. That break will then open doors for the Dow Jones to target 34,500 and 35,000 on the upside, going forward.

The Dow will come under pressure only if it breaks below 31,400. In that case, it can fall to 31,000.

Published on November 5, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.