Biocon (₹305.2)

Signs of bullish reversal

Biocon’s long-term downtrend, that began in December 2020, came to an end in April 2023 after it found support at around ₹200. Since then, the stock has been on a recovery. Importantly, before a couple of weeks, Biocon’s stock broke out of a key resistance at ₹290, forming a higher high. Thus, the price action indicates that the stock is likely to appreciate further from here. Nearest notable resistance is at ₹380.

So, we recommend buying the stock of Biocon now at ₹305 and accumulate if it dips to ₹290. Initial stop-loss can be at ₹275. When the stock rises past the possible hurdle at ₹325, alter the stop-loss to ₹300. When the price hits ₹350, tighten the stop-loss further to ₹335. Book profits at ₹375.

Great Eastern Shipping (₹1,035)

Bull flag breakout

The Great Eastern Shipping stock was moving across a sideways band since the beginning of this year. But a fortnight ago, it broke out of the range, opening the door for further rally. The daily chart shows that the stock has confirmed a bull flag pattern, according to which, the price is likely to surge to ₹1,350 in the near term.

That said, the price might see a dip to ₹980 from here before the rally. So, we suggest going long now at ₹1,035 and add more shares in case the price dips to ₹980. Place stop-loss at ₹880 initially. When the stock surpasses ₹1,150, raise the stop-loss to ₹1,090. Further tighten the stop-loss to ₹1,190 when the price touches ₹1,250. Liquidate the longs at ₹1,350.

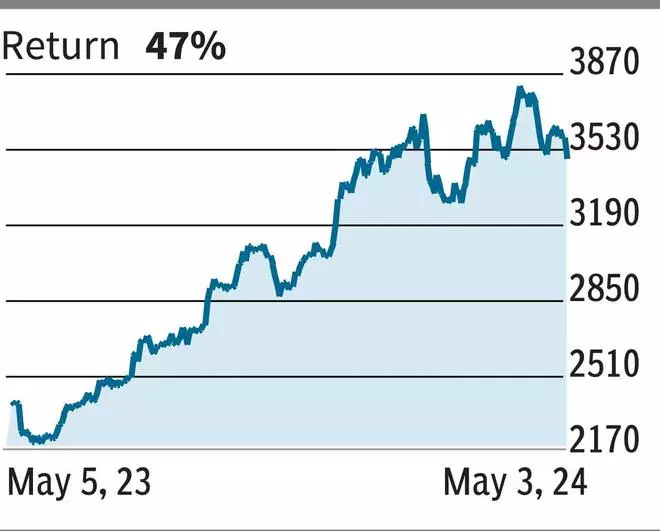

L&T (₹3,499.1)

Head & Shoulder reversal pattern

L&T’s stock, which is on a long-term uptrend, hit a record high of ₹3,860 in early April. But since then, it has been on a descent. While the long-term trend is still positive, there can be some weakness in the near future. The formation of a Head & Shoulder reversal pattern on the daily chart strengthens the case for a short-term decline in price, potentially to ₹3,100. But ₹3,280 is a good base.

Nevertheless, only a breach of the support at ₹3,480 will confirm the pattern. Therefore, traders can stay on the fence and initiate fresh short positions if the stock slips below the support at ₹3,480. Place stop-loss at ₹3,600 initially. When the price moderates below ₹3,380, tighten the stop-loss to ₹3,460. Exit at ₹3,280.

Published on May 4, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.